1. What happend in the history of Apple?

As a company focusing on the research, development and sales of electronic devices, Apple initially gained a large number of users with extremely user-friendly mobile phones and computer devices. Subsequently, Apple continued to improve its technological capabilities and launched a variety of technological innovations such as full-screen, facial recognition and self-developed chips. In addition to technological research and development of electronic devices, Apple is also actively exploring new growth drivers:

- Developing a variety of applications and creating value-added service systems to improve cash efficiency and user loyalty;

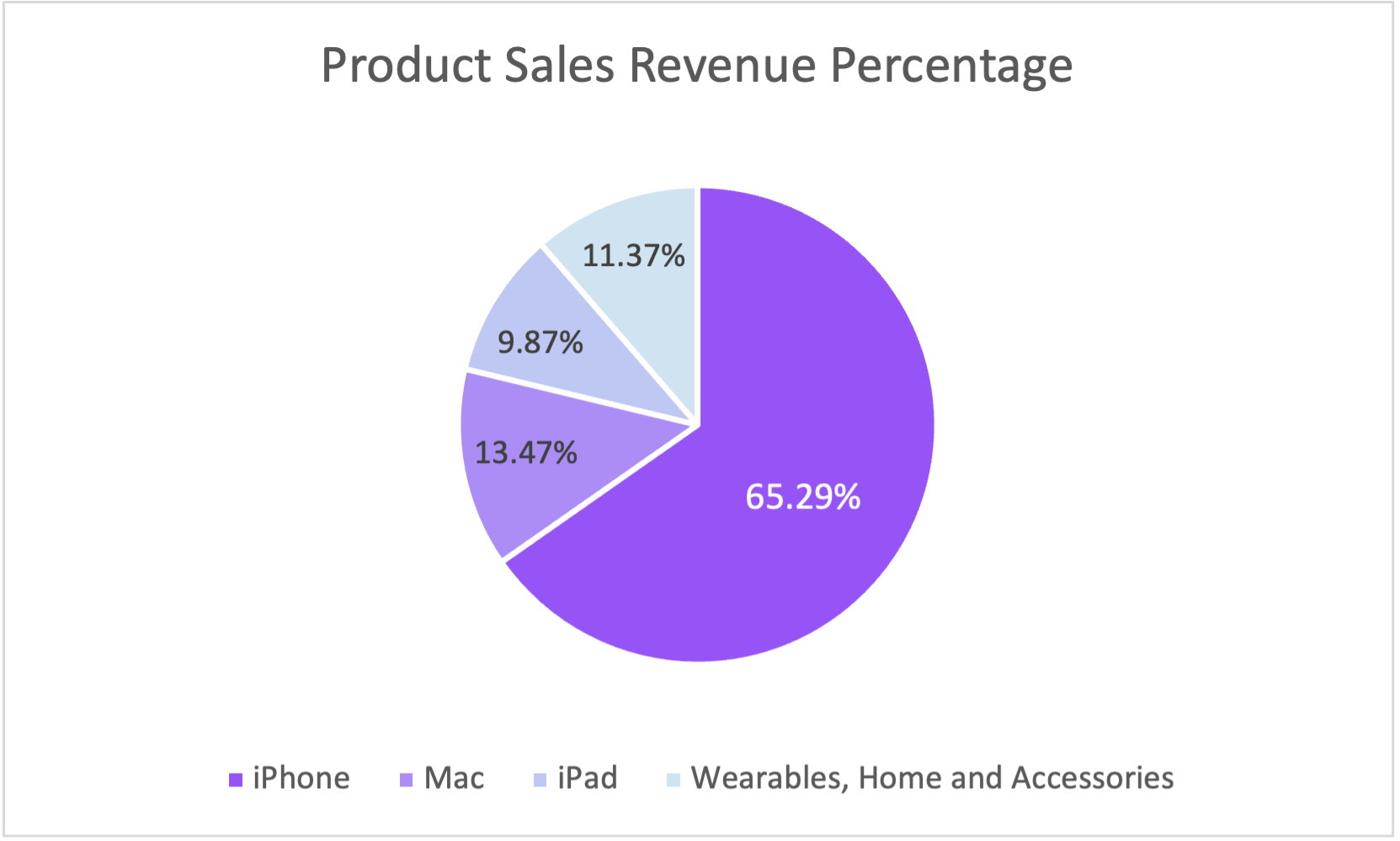

- Develop wearable, home and accessory product systems, expand revenue channels, acquire non-Apple users and increase sales volume, so as to promote revenue growth. In 2021Q4, this part of revenue has surpassed Mac series and iPad series, becoming the second growth curve after the iPhone; In the future, with Apple's technological innovation continuously promoting product iteration, and the development of new device categories to increase the number of SKUs and build Apple's ecosystem, The number of Apple users, user loyalty and re-purchase rate will continue to maintain a steady growth. At the same time, with the growth of users, the flow and the enrichment of value-added service system, Apple's liquidity will also be rapidly improved, which promotes its revenue and stock price increase rapidly.

2. How does Apple make Money?

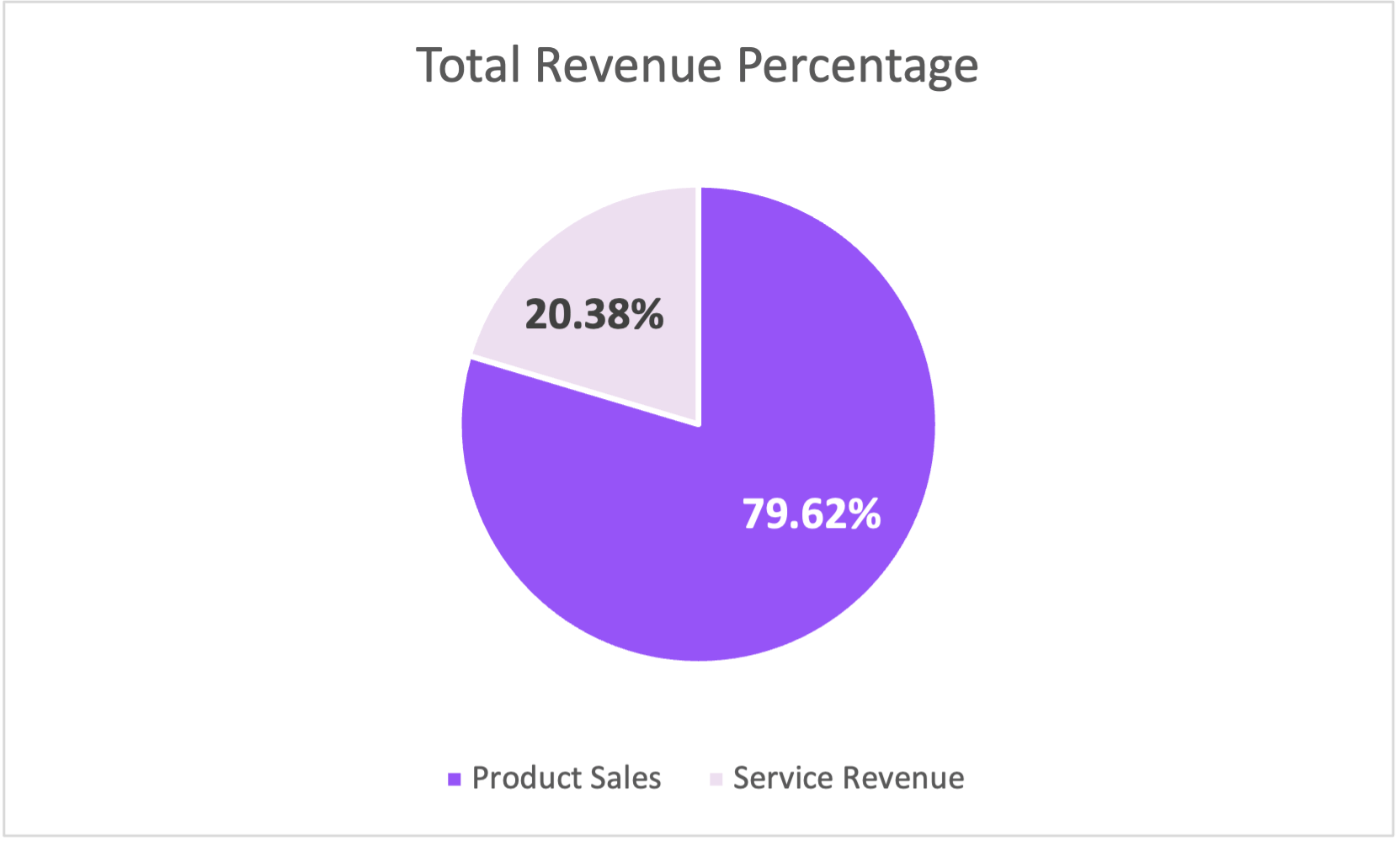

Apple Inc., headquartered in California, is one of the largest information technology companies in the United States. Its main business is designing, developing and selling electronic products, applications and value-added services. There are three main sources of revenue for Apple: 1) Product sales revenue: mainly from hardware devices such as iPhone and Macbook; 2) Service fees: mainly from Apple Pay and AppStore, and subscription fees from Apple Care, Apple Music and advertising etc.

- Product Sales Revenue = Product sales Average price of product = Number of users User purchase frequency *Average price of product

- Service Fee Revenue = GPV * Top-up commission rate

- Subscription Fee Revenue = Number of users * Average subscription fee

3. How changes in key indicators affect stock prices?

The market focuses more on the company's profitability, namely its product sales and service fee revenue from the App Store. The factors that affect the composition of Apple's revenue, and thus influence its stock price, are:

- Product sales revenue

- Product sales

- User purchase frequency

- Average price of products

- Service fee income

- GPV

- Commission rate

- Amount of users

- Average subscription fee

Observable indicators that affect the above factors include:

- Amount of SKUs

The amount of SKUs is one of the important core indicators of Consumable Industry companies. Apple, as a company whose main business is electronic product consumption, is no exception. The increase in the number of SKUs means that Apple continues to develop market segments, broaden usage scenarios, and increase user purchase frequency; For example, the launch of Homepod has expanded Apple's home audio usage scenarios, and the launch of Airpods has broadened the user market of Apple products, so that the purchase of additional products is no longer limited to users in Apple systems. Therefore, the number of SKUs increases, then the company has opened up new segments. The market effect is higher than expected, the number of customers would increase significantly, and the CAC will decrease, the repurchase rate increase, the growth rate of net operating income is accelerated, and the stock price will increase

- Technical Update

Major technical improvements will bring significant improvements to Apple's product functions and user experience, thereby increasing the repurchase rate and sales of products, and giving product prices ample space for price growth. For example, Apple recently launched its self-developed M1 chip, which is installed on its own devices. In terms of products, the functions of Mac and other devices have been greatly improved. As of the first quarter of Apple's fiscal year 2022, Mac's quarterly revenue reached 10.9 billion US dollars, and the revenue was the best record in past 6 quaters. Therefore, excellent technological innovation will greatly improve Apple's products sales, repurchase rates, which drive up revenue and stock prices.

- Number of Value-Added Services

Service fees and subscription fees for value-added services are businesses with relatively high gross profit margins in Apple's revenue composition. The expansion of value-added services can increase Apple's monetization channels and improve Apple's monetization ability for users with existing devices. At the same time, Apple Care, Apple Music, Value-added services such as iCloud can also increase user loyalty, increase the repurchase rate and the number of hardware device purchasers, and give subscription fees sufficient space for increasing, thereby driving the growth of total revenue;

- Amount of Users

In addition to directly affecting the company's product sales revenue, the number of purchased users will also affect the revenue generated from value-added services and the level of advertising fees Apple charges in the software system. ApplePay and other service fees charged to merchants based on GPV, with the growth of the number of users, take rate will also have more space to rise, which will promote the rise of revenue and stock price