하이라이트:

펠로시의 미국 주식 보유는 최근 반년 동안 거의 100%의 수익률을 기록했습니다. 2023년 한 해에만 4,300만 달러의 수익을 올렸으며, 2024년 첫 세 달 동안 투자 포트폴리오의 평가이익은 약 900만 달러에 달합니다. 대부분은 기술주, 특히 엔비디아에 대한 대규모 투자에서 나왔습니다.

의원들의 거래 흐름을 추적하는 간단한 방법은 관련 ETF를 매수하는 것입니다. 민주당 의원 거래를 추종하는 NANC와 공화당 의원 거래를 추종하는 KRUZ가 대표적입니다. 전자는 지난 1년 동안 30% 수익을 기록해 S&P 500 지수를 웃돌았고, 후자는 약 20%의 수익률을 보였습니다. 민주당이 기술주(2023년 급등) 비중이 높고, 공화당은 은행·석유 비중이 높다는 점이 주요 이유입니다.

펠로시의 거래에서는 옵션이 자주 등장하며, 위험 관리와 레버리지 수익 확대라는 두 마리 토끼를 잡고 있습니다. 전략적인 옵션 활용을 통해 높은 수익을 추구하면서도 투자 리스크를 효과적으로 분산하는 모습을 보여줍니다.

서론

최근 레딧(Reddit)의 미국 개인투자자들 사이에서 가장 뜨거운 화두는 바로 의원 펠로시의 미국 주식 보유 수익률입니다. 불과 6개월 만에 100%에 가까운 수익률을 올렸기 때문입니다.

펠로시가 미국 주식 시장에서 화제가 된 것은 지난해 말 가족이 공개한 거래 내역에서 비롯되었습니다. 11월 중순 엔비디아 콜옵션에 약 200만 달러를 투자했는데, 불과 6개월 만에 그 옵션은 400만 달러 이상으로 불어났습니다.

매수 타이밍은 놀랄 만큼 정확하고 수익은 엄청납니다. 엔비디아의 가치를 잘 이해해서일까요, AI를 믿어서일까요, 기술주 자체에 대한 확신 때문일까요? 꼭 그렇지만은 않습니다. RockFlow 투자 리서치팀은 이전에도 펠로시와 가족이 벌인 여러 미세한 거래 사례를 정리한 적이 있습니다.

2020년 12월, 펠로시의 남편 폴 펠로시는 테슬라 콜옵션을 매수했습니다. 몇 주 후 미국 대통령은 연방정부 차량을 전기차로 전환하겠다는 계획을 발표했습니다.

2021년 3월 폴은 마이크로소프트에 대규모 투자했습니다. 곧이어 마이크로소프트가 미 국방부로부터 220억 달러 규모의 AR 전투헬멧 계약을 수주했다는 보도가 나오면서 주가가 급등했습니다.

같은 해 7월, 미국의 주요 빅테크 기업들이 반독점 조사를 받으며 시장이 불안해졌을 때, 폴은 구글을 매수했습니다. 예상대로 구글은 별다른 타격을 받지 않았고 주가는 20% 상승했습니다.

2022년 12월 그는 구글 주식 3만 주를 대규모로 매도했는데, 한 달 뒤 구글은 반독점 위반 혐의로 소송을 당했습니다.

이처럼 유연한 매수·매도 전략은 정책 흐름을 정확히 읽고 있다는 인상을 줍니다. 일부 언론은 미국의 진정한 "주식의 신"은 월가가 아니라 캐피톨 힐에 있다고 농담하기도 했습니다. 레딧의 유명 투자 커뮤니티 WallStreetBets에서는 폴의 포트폴리오를 아예 "인사이더 투자 포트폴리오"라 부르며 "우리는 특정 의원처럼 투자하는 법을 배워야 한다"고 풍자했습니다.

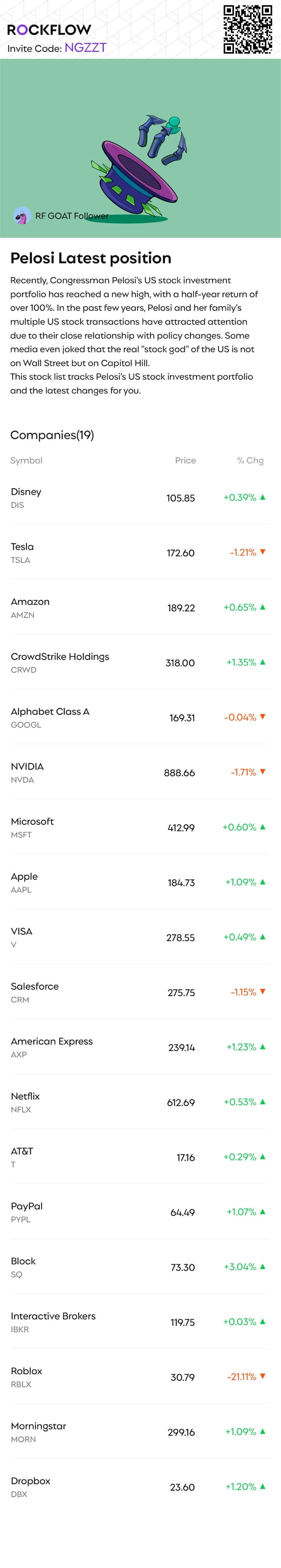

RockFlow는 최근 캐피톨 힐과 월스트리트의 유명 투자자들이 보유한 종목을 추적할 수 있는 리스트를 출시했습니다. 아래 QR 코드를 스캔하면 펠로시의 최신 보유 현황과 동향을 확인할 수 있습니다.

그렇다면 왜 펠로시와 남편 폴(전 하원의장, 민주당 중진 의원)을 "캐피톨 힐의 주식신"이라고 부를까요? 이러한 의원들의 주식 거래는 미국 투자 커뮤니티에서 어떤 파장을 일으켰을까요? 일반 투자자가 그들의 거래를 추적하는 것 외에 더 간단한 방법은 없을까요? 이 글에서 답을 찾아보겠습니다.

또한 RockFlow 투자 리서치팀은 팔란티어, 어도비, 코인베이스 등 여러 종목의 비즈니스와 투자 가치를 심층 분석했습니다. 아래 링크를 참고하세요.

“캐피톨 힐 주식신”이라는 별칭은 어디서 비롯되었나?

보도에 따르면 지난해 미국 의원들이 관여한 주식 옵션 거래 규모는 1억 6천만 달러로 역대 최고치를 기록했습니다. 2022년의 3천만 달러에 비해 크게 늘었습니다. 미국 언론 추산에 따르면 상위 50명의 부유한 의원들의 자산은 48억 달러 이상인데, 의원의 평균 연봉(17만4천 달러)을 기준으로 계산하면 2만 7,500년 동안 일해야 모을 수 있는 규모입니다.

미 의원들처럼 빈번하게 주식과 옵션을 거래하며 엄청난 수익을 올리는 이들은 과연 월가 헤지펀드보다 뛰어난 투자 감각을 가진 걸까요? 아니면 단지 "너무 많은 정보를 알고 있기" 때문일까요?

관련 공시 자료에 따르면 펠로시는 캐피톨 힐에서 가장 우수한 투자 실적을 가진 의원 중 한 명입니다.

2023년 펠로시의 미국 주식 보유 수익은 무려 4,300만 달러였습니다. 2024년 첫 세 달 동안에는 약 900만 달러의 수익을 올린 것으로, 데이터 분석 기업 Quiver Quantitative가 추정했습니다. 대부분은 기술주, 특히 엔비디아에 대한 대규모 투자 덕분입니다.

미국 민주당의 중진 정치인인 펠로시는 오랫동안 당의 핵심 리더 역할을 수행해 왔습니다. 정치 가문 출신으로, 아버지는 볼티모어 시장을 지냈습니다. 펠로시는 1987년 처음 하원의원으로 당선된 후 줄곧 캘리포니아를 대표해 왔으며, 2007년에는 미국 역사상 최초의 여성 하원의장에 올랐습니다.

정치적 성과 외에도 기술주에 초점을 맞춘 펠로시와 남편 폴의 정교한 주식 거래는 그들에게 "캐피톨 힐 주식신"이라는 별명을 안겨줬습니다.

예를 들어 폴은 2023년 11월 15일, 행사가 120달러, 만기 2024년 12월 20일의 엔비디아 콜옵션 50건을 매수했으며, 이 거래로 200만 달러 이상의 수익을 거뒀습니다. 최근 공개된 거래는 팔로알토 네트웍스와 관련된 것으로, 2024년 2월 12일 행사가 200달러, 만기 2025년 1월 17일의 콜옵션 50건을 약 125만 달러에 매수했습니다.

이러한 옵션 거래는 펠로시 가족이 기술주 선택과 타이밍뿐만 아니라, 합리적인 레버리지 상품을 활용해 수익을 극대화할 줄 안다는 점을 보여줍니다. 동시에 상대적으로 안전한 행사가와 만기를 선택해 리스크 관리 면에서도 주목할 만한 전략을 보여줍니다.

펠로시의 여러 투자 성공 사례는 내부자 거래 의혹을 불러일으키고 있습니다. 펠로시는 이러한 의혹을 부인하고 있지만, 논란은 쉽게 가라앉지 않습니다.

몇몇 의원과 정치인은 펠로시의 주식 거래에 문제를 제기해 왔습니다. 예를 들어 미주리주 공화당 상원의원 조시 홀리는 2023년 1월 "선출직 지도자의 유가증권 보유 금지법"(일명 "펠로시 법")을 발의하며 대응했습니다. 홀리는 "월가와 빅테크 기업이 선출직 공무원들과 손잡고 부를 축적하는 동안, 성실하게 일하는 미국인들이 대가를 치렀다"며 의원의 주식 거래 전면 금지를 주장했습니다.

또한 Unusual Whales 보고서에 따르면, 펠로시의 2023년 투자 수익률은 2022년과 극명한 대조를 이룹니다. 2022년에는 포트폴리오 평가액이 19.8% 감소하며 S&P 500 지수보다 부진했습니다.

왜 공직자들이 내부자 거래 의혹을 받는가?

우연의 일치처럼 보이지만, 펠로시를 비롯한 민주당 의원들뿐 아니라 공화당 주요 인사들도 "내부자 거래" 의혹에 연루되어 SEC와 CIA 조사 대상이 되기도 했습니다. 대표적인 사례로 공화당 상원의원 리처드 버(Richard Burr)를 들 수 있습니다.

미 방송사와 워싱턴포스트에 따르면, 버 의원은 2020년 2월 13일 코로나19 팬데믹이 본격화되기 직전에 자신과 배우자가 보유한 33개 종목, 약 160만 달러 상당의 주식을 처분했습니다. 여기에는 호텔 체인 등 여행·레저 업종이 포함돼 있었습니다.

버 의원은 노스캐롤라이나를 지역구로 둔 공화당 상원의원으로, 상원 정보위원회 위원장과 보건위원회 위원을 겸임했습니다. 2006년에는 "팬데믹 및 모든 재난 대비법"(PAHPA)을 추진해 코로나 팬데믹 대응의 법적 틀을 마련하기도 했습니다.

2020년 1월 24일, 상원은 모든 의원이 참석한 코로나19 관련 비공개 브리핑을 열었습니다. CDC 국장 로버트 레드필드, 국가알레르기·전염병연구소 소장 앤서니 파우치 등 미 보건 당국 고위 인사들이 현황을 설명했습니다.

2020년 2월 7일, 버 의원은 "지금 미국은 역사상 어느 때보다 공중보건 위기에 대응할 준비가 잘 되어 있다"고 자신감에 찬 글을 기고했습니다. 불과 엿새 뒤, 그는 보유 주식을 대거 처분했습니다.

미국법에 따르면 공직자는 45일 이내에 금융 거래를 공개해야 하므로, 그는 2월 27일 해당 거래를 신고했습니다.

1년 뒤 SEC는 버 의원의 160만 달러 규모 주식 매도가 연방법상 내부자 거래 금지 위반인지 조사했습니다.

2012년 제정된 "의회 지식 이용 금지법"(STOCK Act)은 내부자 거래 금지 규정을 모든 의원, 보좌진, 연방 공무원에게 적용하도록 규정합니다.

아이러니하게도 버 의원은 이 법에 반대한 세 명의 의원 중 한 명입니다.

흥미로운 것은 2월 27일 버 의원이 기업인 모임에 참석해 기자들에게 유출된 녹취 내용입니다. 그는 "이번 바이러스는 최근 역사에서 본 어떤 것보다 전파력이 강하다", "1918년 독감과 비슷할 수 있다"고 말했습니다. 해당 모임은 2015~2016년 그의 선거캠프에 10만 달러 이상 기부한 기업인·엘리트를 대상으로 열렸습니다.

버 의원 측은 시장이 긴장 조짐을 보이기 오래 전에 주식을 매도했다고 해명했습니다. 하지만 당시 미국의 확진자는 15명에 불과했고, 트럼프 대통령은 "코로나는 통제되고 있으며 곧 사라질 것"이라고 말하던 시점이었습니다.

의원 거래 ETF는 새로운 투자 트렌드가 될까?

그들을 이길 수 없다면, 합류하는 방법도 있습니다.

이처럼 많은 의원들이 미리 "특별한 정보를" 접하고 거래를 한다면, 그리고 법에 따라 거래 후 45일 이내에 공시해야 한다면, 다른 투자자들이 의원의 거래를 주시하거나 아예 따라 하는 전략은 효과적일까요? RockFlow는 최근 캐피톨 힐과 월가 주요 기관의 보유 종목을 추적할 수 있는 기능을 선보였습니다. 이를 통해 투자자들은 전문가의 최신 보유 내역과 변화를 빠르게 파악할 수 있습니다.

직접 따라 매매하는 것 외에도, 의원 거래를 추종할 수 있는 간단한 방법이 있습니다. 바로 관련 ETF를 매수하는 것입니다.

지난해 운용사들은 의원 거래 기반 ETF를 선보였습니다. 민주당 의원 거래를 추종하는 ETF는 NANC(하원 의장 낸시 펠로시(Nancy)에게서 이름을 따옴), 공화당 의원 거래를 추종하는 ETF는 KRUZ(상원의원 테드 크루즈(Ted Cruz)를 기리는 이름)로 불립니다. 두 ETF의 목표는 각각 양당 의원들의 거래를 추적해 투자자에게 제공하는 데 있습니다.

이 ETF들은 액티브 운용이기 때문에 지속적인 매매가 필요하며, 연 1%의 운용보수를 부과합니다. 패시브 펀드보다 다소 높은 수수료지만 수익률은 나쁘지 않습니다.

2023년에 출시된 NANC는 줄곧 S&P 500 지수를 앞서 왔고, 지난 1년 동안 30% 수익률을 기록했습니다. 운용 규모도 약 8,000만 달러로 적지 않습니다. NANC의 성과는 대형 기술주에 집중적으로 투자한 덕분입니다. 마이크로소프트, 아마존, 애플, 엔비디아가 상위 4개 보유 종목이며, 마이크로소프트 비중만 약 10%에 달합니다. 세일즈포스와 구글까지 합치면 상위 6개 종목이 전체 자산의 32%를 차지합니다.

반면 공화당 의원 거래를 추종하는 KRUZ는 시장 평균을 다소 밑돌고 있습니다. 출시 이후 수익률은 약 20%입니다. 앞서 언급했듯 민주당은 기술주 비중이 높고, 공화당은 은행 및 석유 산업 비중이 높아 2023년에는 상대적으로 부진했습니다.

다만 앞서 언급했듯 의원과 가족의 주식 거래는 내부자 거래와 이해 상충 문제를 초래할 수 있습니다. STOCK Act에 따라, 의원은 거래 후 45일 이내에 SEC에 거래 내역을 제출해야 합니다.

따라서 직접 따라 사거나 ETF를 매수하는 전략 모두, 일반 투자자 입장에서는 실제 의원의 거래가 이루어진 시점과 공시 시점 사이에 시장이 크게 변할 수 있다는 위험을 감안해야 합니다. 게다가 규정을 어겼을 때 부과되는 벌금은 주식 거래로 얻을 수 있는 이익에 비해 매우 적은 편입니다.

결론

RockFlow 투자 리서치팀이 펠로시 및 다른 의원들의 투자 성과와 거래 전략을 분석한 결과 다음과 같은 통찰을 얻을 수 있었습니다.

첫째, 기술주는 여전히 가치 창출의 핵심 분야입니다. 펠로시는 여러 기술주에 집중 투자하면서 막대한 수익을 거두었고, 이는 현재 미국 주식시장에서 기술 산업의 성장 잠재력을 보여줍니다. 엔비디아가 주도한 AI 붐은 장기적으로도 투자자에게 수익을 가져다줄 가능성이 큽니다.

둘째, 펠로시의 거래에서 옵션이 자주 등장하는데, 이는 리스크 관리와 레버리지 수익이라는 두 가지 목표를 동시에 달성한 사례입니다. 전략적인 옵션 활용을 통해 높은 수익을 추구하면서 투자 리스크를 효과적으로 분산하는 방법을 보여줍니다.

셋째, 시장 통찰력과 전략적 선택이 성공의 핵심입니다. 펠로시의 투자 성공은 단순히 종목 선정의 결과가 아니라, 미국 주식시장의 장기 추세를 읽고 투자 전략을 완벽하게 실행한 결과입니다.

저자 소개

RockFlow 연구팀은 미국 주식시장의 우량 기업뿐 아니라 라틴 아메리카, 동남아 등 신흥시장과 암호화폐, 바이오테크 등 고성장 산업을 장기적으로 분석합니다. 팀의 핵심 멤버는 Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, CITIC Securities 등 주요 기술 기업과 금융 기관 출신이며, MIT, UC 버클리, 난양공대, 칭화대, 푸단대 등 세계 유수 대학 출신으로 구성되어 있습니다.

다음 플랫폼에서도 저희를 만나보실 수 있습니다: