서론

AI는 빅테크 간 군비경쟁을 촉발했고, 초대형 데이터센터의 계획·건설에 관심이 집중되고 있습니다. 이들 데이터센터는 막대한 전력을 필요로 하며(대형 데이터센터 하나의 에너지 소비량이 중형 도시와 맞먹는 것으로 추정됩니다), 현재는 산발적인 재생에너지와 노후 화력발전에 의존하고 있습니다.

향후 몇 년간 데이터센터 인프라 건설은 계속될 것이고, 전력 수요는 놀라운 속도로 늘어날 것입니다. 그렇다면 궁극적인 해결책이 있을까요?

답은 당연히 핵에너지입니다.

이 글에서 RockFlow 투자 리서치팀은 "AI 에너지의 종착지"로 불리는 핵에너지의 가장 선도적 세부 분야를 심층 분석하고, 핵에너지 콘셉트주 가운데 전통 강자와 신흥 기업의 투자 가치를 정리합니다.

1. 왜 빅테크가 핵에너지 트랙으로 몰리는가?

최근 몇 달 사이 기술공룡들은 핵에너지 관련 계획을 속속 발표했습니다.

- 구글: 카이로스 파워(Kairos Power)와 협력해 소형 모듈형 원자로(SMR) 개발

- 아마존: 에너지 노스웨스트와 협약, 에너지 수요 충족을 위해 SMR 4기 개발 자금 지원

- 마이크로소프트: 컨스텔레이션 에너지와 20년 전력 구매 계약 체결, 사고로 폐쇄됐던 스리마일섬(Three Mile Island) 원전 재가동 추진

- 오라클: 데이터센터 전력 공급에 SMR 활용 계획

또한 칼라일 그룹, 브룩필드 애셋 매니지먼트, 아폴로 글로벌 매니지먼트 등 글로벌 사모펀드도 핵에너지 분야 투자를 모색하고 있습니다.

거의 모든 이가 핵에너지가 궁극적 에너지 해법의 중요한 축이 될 것이라 믿습니다. 다만 AI가 요구하는 빠른 에너지 수요를 제때 충족시키기 어렵다는 우려가 일부 존재합니다.

예를 들어 스리마일섬 원전의 경우, 장기간 가동 중단 시설을 재가동하려면 규제 장벽을 넘고 노후 설비 문제를 해결해야 합니다. 가장 빨라도 2028년이 되어야 재가동이 가능할 것으로 추정됩니다.

마이크로소프트의 원전 재가동 계획이 시간이 걸린다 해도, 최소한 검증된 기술을 바탕으로 한다는 점에 의미가 있습니다. 그러나 핵에너지 분야에서 가장 주목받는 신기술이자 상용화가 진행 중인 SMR은 다릅니다.

기존 원전은 건설 비용이 엄청나고, 완공까지 수십 년이 걸립니다. 체르노빌, 스리마일섬, 후쿠시마 등의 사고 이후, 대중은 원전에 대한 거부감을 키워 왔습니다. 반면 간소화된 핵전력 생산 솔루션인 SMR은 유연성, 낮은 초기 비용, 모듈형 배치 등 여러 장점을 지녔습니다.

간단히 말해 SMR은 전통 원자로의 소형 버전입니다. 설비를 현장이 아닌 공장에서 모듈화로 제작할 수 있어 조립과 품질 관리가 수월하며, 공급망과 건설 품질을 예측하기 쉽습니다. 조립 후 현장에 운반해 적층하면 하나의 원자력 발전소가 됩니다.

SMR의 전력 생산량은 50~300MW 수준으로(전통 원전은 1GW) 적지만, 건설 편의성이 이 단점을 상쇄합니다. 많은 설계가 증기발생기·터보차저·주 냉각재 펌프를 원자로 압력 용기 내부에 배치하는 통합 구성을 채택합니다. 현대의 전산유체역학(CFD)은 냉각 거동을 정밀하게 시뮬레이션할 수 있게 해주고, 사고 내성 연료와 첨단 신소재는 안전 여유와 운전 효율을 개선합니다. 덕분에 설치·유지보수 난도가 크게 낮아지고, 배관과 잠재적 누출 지점을 줄여 안전성이 강화됩니다.

현재 상업적으로 배치된 SMR은 러시아의 부유식 원전 아카데믹 로모노소프(Akademik Lomonosov)가 유일합니다. 중국도 초기 단계에서 기술을 시범 적용하고 있습니다. 미국에서는 누스케일(NuScale)이 유일하게 NRC(원자력규제위원회) 설계 인증을 받았지만, 상업성 부족으로 수년 전 핵심 프로젝트를 취소해야 했습니다.

IAEA(국제원자력기구)에 따르면 전 세계 25개국 이상이 SMR에 투자하고 있습니다. 우드맥킨지(Wood Mackenzie)는 2024년 전 세계 SMR 프로젝트 가치가 1,760억 달러를 넘어설 것으로 추정하며, 2050년까지 SMR이 전 세계 원전의 30%를 차지할 것으로 예상합니다.

빅테크가 이 시장에 뛰어든 것은, 소형 시설을 통한 대규모 저가 핵에너지 공급이 더 빠른 시일 내 현실화될 수 있음을 시사합니다.

2. 전망은 밝지만, SMR은 여러 장애물을 안고 있다

어떤 원자력 시설에서든 가장 중요한 것은 안전입니다. 원전 설계의 핵심 과제는 발전소가 갑자기 정지했을 때 원자로 코어를 어떻게 냉각시키느냐입니다. 냉각재가 순환을 멈추면 연료 열이 급격히 상승해 녹아내리고 방사성 물질이 누출될 수 있습니다. 2011년 후쿠시마 원전 사고가 대표적입니다. 쓰나미가 냉각을 위한 백업 발전기를 파괴하면서 대규모 재앙으로 이어졌습니다.

다행히 많은 SMR 설계는 수동적이고 자율적인 안전 시스템을 탑재해 외부 전력이나 인력에 의존하지 않습니다. 일부 SMR은 외부 물 없이도 자연대류 등 고급 냉각 방식을 통해 원자로를 냉각할 수 있다고 주장합니다.

보안성 외에도 SMR은 기존 원전 대비 빠른 건설 속도, 낮은 단위 비용, 더 작은 부지를 필요로 하는 등 장점이 있습니다.

그러나 진정한 상용화까지는 여러 난관이 존재합니다.

가장 큰 단점은 규모가 너무 작다는 것입니다. 같은 전력을 생산하더라도 기존 원전보다 더 비싸 경제성을 확보하기 어렵습니다. 그동안 진행된 몇몇 사업을 보면, 초기 비용이 예상을 훨씬 웃돌고(예산 대비 3~7배 초과) 완공까지 시간이 오래 걸리는 경우가 많습니다. 이는 여러 나라에서 반복되는 현상으로, 비용 추정과 건설 과정에 시스템적인 문제가 있음을 시사합니다.

예를 들어 누스케일은 높은 비용과 낮은 고객 관심으로 미국 최초 SMR 프로젝트를 취소했습니다. 반면 중국과 러시아는 통합 공급망, 통제 가능한 비용 구조, 보장된 수익원을 바탕으로 더 큰 진전을 보였지만, 이들 역시 초기 추정보다 높은 비용을 부담했습니다.

그럼에도 SMR 설계·건설 과정은 기존 원전 구매(또는 건설)보다 확실히 빠릅니다. 입지 선택도 유연하고, 24시간 중단 없는 안정 운전이 가능하다는 장점이 있습니다.

이는 에너지 수요가 급하고 비용 탄력성이 큰(소프트웨어 서비스 마진이 높은) 빅테크와 데이터센터 운영자에게 특히 중요합니다. 따라서 이들은 태양광 등 일정량의 청정에너지를 확보하는 것과 더불어 SMR 도입을 필수 경로로 삼고 있습니다.

3. 핵에너지 산업에서 다음 10배 성장주는 누구인가?

현재 핵에너지 산업에는 누스케일·옥로(Oklo) 같은 신생 기업과, 웨스팅하우스처럼 업력이 깊은 전통 기업이 공존합니다. 유명 자동차 브랜드로 알려진 롤스로이스조차 2021년부터 소형 원자로 개발을 착수했고, 영국 우주청과 협력해 우주 탐사용 원자력 활용을 연구하고 있습니다.

마이크로소프트의 스리마일섬 재가동 계획, 구글과 아마존의 핵에너지 파트너십 발표 이후 누스케일, 옥로 등은 주가 급등락을 여러 차례 겪었습니다.

NANO는 소형 원자로 기술의 대표 주자로서 유연성과 높은 배치 효율을 갖춰 에너지 부족 지역의 빠른 전력 공급에 적합합니다. 옥로는 오픈AI 창업자 샘 올트먼의 초기 투자를 받아 주목을 받았습니다. 누스케일은 확장성과 낮은 비용을 강점으로 내세워 탄소중립 목표 하에서 뜨거운 관심을 받고 있습니다.

이제 RockFlow 투자 리서치팀이 가장 유망한 미국 핵에너지 콘셉트주를 분석합니다.

NuScale Power(SMR)

핵에너지 신흥 기업인 누스케일(주식 코드 역시 SMR)은 미국에서 유일하게 NRC 설계 인증을 획득(2022년 7월 승인)한 SMR 기업입니다. 다른 기업들도 인허가를 추진 중이지만, 선두 주자인 누스케일은 이 우위를 바탕으로 향후에도 리더십을 유지할 가능성이 큽니다.

가장 큰 문제는 첫 SMR 프로젝트(규제 승인을 받은 탄소중립 발전 프로젝트) 취소였습니다. 2015년 시작된 해당 프로젝트는 비용 추정치가 42억 달러에서 93억 달러로 치솟았고, 2023년 11월 고객(전력 구매자) 확보 실패로 취소되었습니다. 이 소식은 당시 주가에 큰 충격을 주었습니다.

다행히 2024년 새로운 핵발전 붐이 일면서, 누스케일은 스탠다드 파워(Standard Power)와 데이터센터 전력 공급을 위한 프로젝트를 추진하기로 합의했습니다. 2029년 가동과 매출 창출이 목표입니다.

기술 측면에서 누스케일 SMR은 비용 경쟁력, 안전성, 확장성을 갖춘 우수한 솔루션입니다. 모듈이 공장에서 완전 제작되고, 현장 건설이 필요 없으며, 규제가 정비된 상용 핵연료를 사용합니다. 덕분에 비용 예측이 쉬우며 운영·유지보수 비용도 기존 원전보다 낮습니다.

RockFlow는 누스케일이 비교적 성숙한 기술을 보유하고 있고, 미국에서 원전 건설 승인을 받은 유일한 기업이라는 점에 주목합니다. 재무 상태는 아직 미흡하지만 공장 가동 본격화와 함께 개선될 전망입니다. 아직 작은 기업이지만 성장 여지가 큽니다.

다만 프로젝트가 실제 생산·수익 창출 단계에 들어가기까지 수년이 걸릴 수 있어, 이는 투자자가 고려해야 할 주요 리스크입니다.

OKLO

옥로는 낙관할 요소가 많은 신예 기업입니다.

먼저 소형 모듈형 원자로 기술은 완전히 새로운 개념이 아니어서 "제로 베이스" 리스크가 상대적으로 낮습니다. 옥로는 첫 발전소 건설을 추진 중이며, NRC와 협력해 새로운 라이선스 신청 방식을 시범 적용하고 있어 허가 과정이 단순화될 것으로 기대됩니다. 또한 원자로를 판매하는 대신 전력을 판매하는 모델을 채택해, 장애 요소가 적습니다.

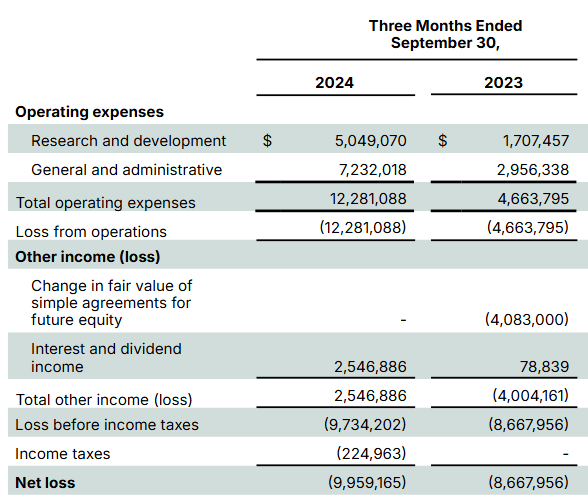

둘째, 재무 측면에서 현금 보유고가 많고 소모 속도도 안정적입니다. 아직 의미 있는 매출은 없지만 분기 손실이 1,200만 달러 수준이며, 유동자산이 2억 3천만 달러 이상이라 유동성이 충분합니다.

셋째, 핵심 제품 설계와 기획 외에도 판매·사업 개발을 시작해, 2GW 이상의 잠재 전력구매계약(PPA)을 확보했습니다. 고객사는 Equinix, Diamondback Energy, 미 국방물류국(DLA) 등을 포함합니다.

마지막으로 경제성도 훌륭합니다. 옥로는 15MW 발전소 건설 비용을 7천만 달러로 추정하고 있으며, 규모가 확대되면 6천만 달러까지 낮출 수 있다고 봅니다. 최근 데이터센터 PPA 가격(100달러/MWh)에 적용하면 15MW 발전소는 하루 3만6천 달러, 연간 1,310만 달러의 매출을 올릴 수 있고, 안정 운전 시 영업이익률은 60%에 이를 것으로 추정합니다. 원전 폐기물 재활용 솔루션이 가동되면 초기 투자비 회수에 도움이 되는 현금 흐름도 기대할 수 있습니다.

RockFlow는 옥로가 원자로 제품, 시장 수요 적합성, 단위 경제성 측면에서 높은 매력을 지닌다고 평가합니다. 낙관적 시나리오에서는 2028년 2~7기, 2029년 5~12기의 발전소가 가동될 수 있습니다. 글로벌 에너지 뉴노멀을 이끌 잠재력을 고려하면 현재 30억 달러 수준의 시가총액은 비싸지 않습니다.

NANO Nuclear(NNE)

NNE는 마이크로 원자로 개발 기업입니다. 2024년 5월 IPO 이후 주가는 3.25달러에서 23달러 안팎까지 상승했습니다. 7배 오른 상태지만, 마이크로 원자로 상용화까지는 아직 갈 길이 멉니다.

최근 NNE는 2030~2031년 사이에 Zeus와 Odin이라는 수익화 가능한 마이크로 원자로를 출시할 계획이라고 밝혔습니다. 동시에 연료 제조·운송·컨설팅 등 사업을 병행해 단기 수익원을 확보하고, 주요 사업의 개발·허가를 지원할 계획입니다.

재무 보고에 따르면 Zeus와 Odin은 △원격 발전이 필요한 광산 △선박 동력 △전기차 충전 인프라 △데이터센터·AI 컴퓨팅 시설 등 4대 핵심 시장을 겨냥합니다. 이 중 가장 수요가 큰 곳은 데이터센터와 AI 컴퓨팅 시설입니다.

주의할 점은 2022년 2월 설립 이후 아직 매출을 내지 못한 채 누적 순손실이 1,494만 달러라는 것입니다. 2024년 6월 말 기준 현금·현금성 자산은 1,380만 달러였으나, 이후 여러 차례 지분 조달을 통해 1억 2,500만 달러까지 늘어났습니다. 현재까지 분기 현금 소모가 254만 달러 수준이라 당분간 현금은 충분하지만, 2025년에는 컨설팅·연료 운송·신규 연료 생산 설비·마이크로 원자로 R&D에 투자하면서 소모가 크게 늘어날 전망입니다.

NANO의 기술 로드맵은 2025~2026년 데모 단계에 돌입해 원자로 테스트베드를 구축할 계획이라 밝힙니다. 마이크로 원자로의 기술적 타당성을 입증하면 시장 신뢰가 높아지고 투기 자금 유입을 기대할 수 있습니다.

다만 이후 일정은 원자력규제위원회 허가 절차에 따라 2031년 사업 개시를 예상하고 있는데, 이는 상당히 낙관적인 가정입니다.

BWXT

소형 모듈형 기술이 미래가 될 수 있지만, 핵에너지 트랙에는 저위험 대안도 존재합니다. 그 대표가 BWXT입니다.

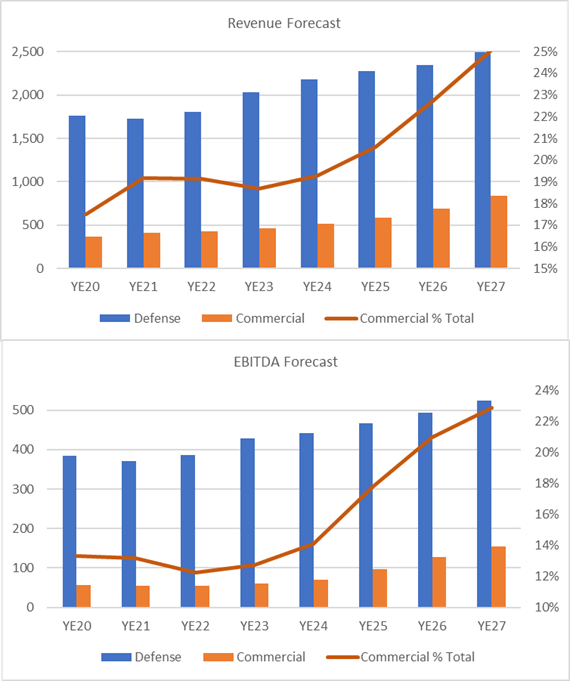

BWXT는 미국 해군의 원자로를 제작·유지하는 국방 계약업체입니다. 동시에 미국·캐나다 핵에너지 기업에 핵연료와 부품을 공급합니다. 해군과의 장기 계약과 높은 안전 등급 덕분에 현금 흐름이 안정적입니다.

현재 해군용 원자로 기술로도 소형(20~300MW) 혹은 마이크로(1~20MW) 원자로를 제작할 수 있습니다. 다만 핵심은 비용과 상용화 시기입니다. 회사는 연료 제조를 포함한 기술·공급망을 강력한 경쟁력으로 꼽지만, 군사 기술의 상용화에 필요한 안전 허가가 잠재적 장애 요소가 될 수 있습니다.

BWXT의 상업 부문 매출 비중은 19%로 방산 부문보다 마진이 낮습니다. 회사는 캐나다 CANDU 원자로 계약과 광산·우주·해운·데이터센터 원자로 프로젝트 덕분에 내년 매출이 전년 대비 5~10% 성장할 것으로 기대합니다.

누스케일 등과 비교하면 BWXT의 밸류에이션은 훨씬 저렴합니다. RockFlow는 BWXT가 방위산업 독점 기업이면서 상업용 핵에너지 기회를 가지는 기업이라고 봅니다. 상업 부문 매출·현금 흐름이 늘어나면 방산 업체 대비 프리미엄이 부각될 것입니다. SMR, OKLO 등이 고급 기술을 보유했다고 하지만 아직 수익화되거나 완전히 검증된 것은 아닙니다. BWXT는 성숙한 기술과 제조 역량을 지닌 믿을 만한 선택입니다.

물론 국가 안보 이슈로 인해 소형·마이크로 원자로 기술의 상용화가 제한될 위험은 있습니다. 이 경우 회사의 성장 잠재력이 줄어들고, 관련 사업이 다른 업체에 분할 발주될 수 있습니다.

4. 결론

RockFlow 투자 리서치팀은 AI 데이터센터의 전력 수요가 기하급수적으로 늘어나는 상황에서, 전통 에너지가 부족해지는 지금 핵에너지 트랙의 투자 가치가 빠르게 부각되고 있다고 봅니다.

구글부터 마이크로소프트까지, 빅테크는 이미 이 1조 달러 규모 시장을 주목하고 있습니다. 이는 에너지 혁명의 바로미터이자 새로운 투자 블루오션이 탄생하고 있음을 뜻합니다. AI가 촉발한 기술 파도 속에서 핵에너지는 에너지 판도를 재정의하고 있으며, SMR은 핵에너지 상용화의 새 시대를 열고 있습니다. 전통 핵에너지 강자부터 SMR 신생 기업까지, 앞으로 10년간 막대한 투자 기회가 예상됩니다.

저자 소개:

RockFlow 연구팀은 미국 주식 시장의 우량 기업뿐만 아니라 라틴 아메리카·동남아시아 등 신흥시장, 암호화폐·바이오테크 등 잠재력 있는 산업을 장기적으로 분석합니다. 팀의 핵심 구성원은 Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, CITIC Securities 등 주요 기술 기업 및 금융 기관 출신이며, MIT, UC 버클리, 난양공대, 칭화대, 푸단대 등 세계 유수 대학을 졸업했습니다.

또한 다음 플랫폼에서도 저희를 만나보실 수 있습니다: