Highlight:

The development trajectories of AI and mobile internet are very similar. Initially, the value flowed to hardware companies, but as the technology matured, market attention gradually shifted to the software field. Recently, the monetization of AI software companies has made significant progress, and their stock prices have risen sharply, reflecting the strong demand and confidence in AI in the market.

Companies such as Palantir and SoundHound AI have shown strong growth potential in revenue, customer expansion, and market performance. They not only attract new customers through AI functions, products, or platforms, but also gain more business from existing customers, indicating that related AI products and services have strong market competitiveness and application value.

RockFlow research team believes that AI software companies have broad development space in the future. With the deep application of AI in various industries, these companies are expected to further increase their market share and commercial value.

Introduction:

History doesn't repeat itself, but it does rhyme.

In the early days of mobile internet development, hardware companies such as Qualcomm and ARM were the first to be popular. As technology continues to mature, software giants such as Google and Amazon occupy the largest share of long-term growth.

The development trajectory of AI is similar. With the improvement of large language model capabilities and the continuous improvement of AI infrastructure, the market's focus is shifting from chips and infrastructure to software. In recent months, US AI software companies have blossomed in multiple places. Taking AppLovin, a US AI marketing company, as an example, after releasing impressive Q3 performance, its stock price continued to soar, rising 7 times this year, and its market value exceeded 100 billion US dollars.

In addition, AI + Data Analysis company Palantir and AI + Voice company SoundHound AI have both achieved several-fold increases. AI software companies have made rapid progress in monetization capabilities, stimulating the market's FOMO sentiment. Coupled with the arrival of the peak season in the fourth quarter, active user demand and many large corporate customers are preparing budgets for AI software, a series of catalysts have jointly pushed up the surge in this sector.

Behind the strong stock prices of AI software companies, there is continuous business and financial data as support, which indicates that the outbreak of AI software is not simply speculation. In this article, the RockFlow research team will sort out several AI software vertical giants that are most worth looking at recently, and explore their performance progress and current investment value in depth.

1. Palantir, backed by the government, is the most important company in AI + Data Analysis

Palantir's stock price has risen 350% this year, far higher than Nvidia's 188% level.

Nvidia has become the most important supplier of cutting-edge AI chips, but Palantir is also the most important company helping enterprises and governments put AI models into production and actual business. More importantly, the adoption rate of Palantir's artificial intelligence platform (AIP) is rapidly increasing. This platform allows enterprises to integrate large language models and generative AI into their operations, which has led to a sharp acceleration in the company's business and revenue channels.

In the third quarter of 2024, the company's revenue increased by 30% to $726 million compared to the same period last year. In contrast, Palantir's revenue growth in 2023 is much slower, only 17%. As time goes by, the company's revenue growth continues to accelerate. While setting a new quarterly profit record in Q3, the company also raised its full-year revenue and profit guidance, which exceeded expectations.

Palantir management pointed out during the earnings call that "we continue to see strong momentum driven by AIP in both business expansion and new customer acquisition."

The company not only attracted new customers for its AI software platform, but also won more business from existing customers. Palantir's net dollar Retention Rate in the third quarter was 118%, compared to 107% in the same period last year, indicating that existing customers are increasing their adoption and willingness to pay for its platform.

In addition, Palantir has a broad future, as evidenced by the company's residual transaction value (RDV) of $4.50 billion, which increased by 22% year-over-year in the previous quarter. This amazing growth is a good sign for Palantir, which means that Palantir can still maintain rapid growth in the future.

Palantir management stated that its revenue is expected to grow at a rate of over 20% in the next few years. Thanks to the huge opportunities of the AIP platform and AI market, it is expected that the annual growth rate of this business will approach 41% by 2028.

Therefore, the RockFlow research team believes that Palantir has the potential to maintain its position as an AI giant for a long time to come. If you want to learn more about Palantir's development history and current business, click to view: After NVIDIA, who will be the next early AI beneficiary?

2. SoundHound AI, the new giant that sets off the AI voice revolution

SOUN focuses on providing cutting-edge voice AI solutions to enhance customer experience in various industries. Due to its unparalleled speed and accuracy in multiple languages, it has empowered millions of products and services in multiple fields such as automotive, Financial Services, catering, and healthcare.

Since the company's SPAC listing in 2022, its monetization performance and application have fallen short of expectations, and its stock price once fell below $2. Until this year, the overall trend of AI companies in the US stock market has gradually strengthened, and expectations for the application prospects of AI Agents and financial performance have reached a turning point. SOUN's stock price has been rising all the way, with an increase of 85% in November.

RockFlow's research team believes that SOUN's support from NVIDIA is one of its important competitive advantages. NVIDIA is not only SOUN's shareowner, but also its partner. Earlier this year, SOUN announced an in-car voice assistant that uses a large language model and operates on NVIDIA's DRIVE technology.

Recently, the company's stock price has risen continuously, mainly due to two important catalysts. The financial performance is impressive: the company's revenue in the third quarter reached $25.09 million, a year-on-year increase of 89%, exceeding market expectations; in terms of customer concentration, the proportion of revenue contributed by the largest customer decreased significantly from 72% last year, indicating that the customer base is more diversified, and the industry structure has expanded from the previous reliance on automobiles to multiple fields such as finance, insurance, and retail. New market expansion and multilingual development: On November 14th, the company announced that it will expand its advanced voice AI technology to Kia cars in India, and specifically integrate Hindi as the main language. The technology has been applied to multiple car models, providing seamless voice experience for more than 500 million Hindi speakers in the Indian market. In the future, it will gradually integrate 10 regional languages including Bengali and Punjabi.

RockFlow research team believes that given the rapid progress of SOUN's AI business, not only has it launched a new generation of automatic speech recognition engine and developed a multilingual real-time translation system, but its AI assistant has also been used to handle complex conversations. In the future, it will continue to expand vertical industry applications, thereby bringing more revenue conversion.

For a deeper understanding of SOUN's development history and current business, click to view: NVIDIA concept stock: 6 major AI tracks, who will bring the next tenfold return?

3. Rubrik, a new generation AI + data security service provider

Cyber security is receiving high attention from many countries and companies, who have invested a lot of time and effort in cyber warfare. According to a survey analysis, it is expected that by 2029, cybercrime will cause losses of up to $15.63 trillion to global companies. Therefore, the same scale of protection measures is crucial, which means that Rubrik has a huge addressable market opportunity.

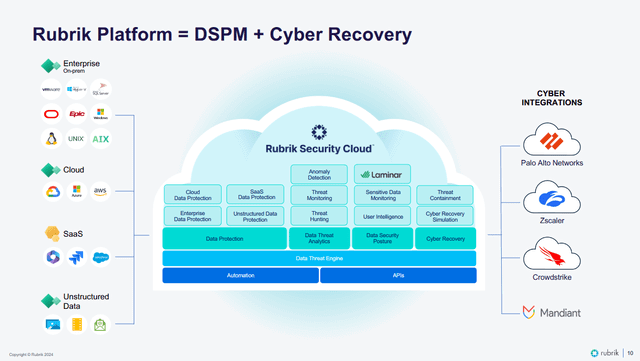

Rubrik provides an innovative and flexible way to effectively protect data, combining data recovery capabilities with AI technology to improve user friendliness. The platform can be implemented locally or as a SaaS solution in the cloud, seamlessly integrating with Cloud as a Service providers such as Google Cloud, Amazon AWS, and Microsoft Azure, while also supporting local enterprise customers.

On the other hand, Rubrik can ensure the security of customer data during attacks and bypass firewalls provided by traditional cyber security companies such as CrowdStrike, Zscaler, and Palo Alto. Rubrik's product range is also broad enough to cover DSPM (identification and backup of sensitive data) and recovery functions, which can quickly restore the system to its pre-attack state, while providing a series of AI-based generation functions to improve its functionality and user-friendliness.

Rubrik's latest artificial intelligence initiative, Rubrik Annapurna, has attracted much attention. Generative AI requires data for training and inference, and this data may be stored in multiple systems. With Rubrik's new solution, Rubrik Annapurna enterprise customers can use a single API to access data controlled in the Rubrik ecosystem. The product was launched in partnership with Amazon, providing Rubrik with a new source of revenue. This is an important step for Rubrik in diversifying its products and expanding its AI market influence.

RockFlow research team believes that Rubrik not only fills the gap in the cyber security field and has a huge addressable market, but also the industry will benefit from the current global geopolitical tensions. In the next few years, the market demand for cyber security solutions will be huge, so the development prospects of Rubrik are still very broad.

4. DocuSign, the global leader in AI + cloud electronic signatures

DocuSign provides cloud-based electronic signature solutions. Its cloud-based electronic signature platform helps companies and individuals securely collect information and automate data workflows. The company automates paper-based manual processes, enabling users to manage all aspects of recorded business transactions, including identity management, authentication, digital signatures, form and data collection, collaboration, workflow automation, and storage.

Due to strong performance in the second and third quarters, DocuSign's stock price has risen by more than 80% since early August. An important factor driving this growth is that the market is beginning to see the value of the company in AI contracts. AI contract management is a huge industry, and DocuSign is continuing to pave the way for it.

DocuSign's AI feature has played an important role in helping enterprises review and simplify long-term contract agreements. As a breakthrough product, DocuSign AI can help users review, manage, create, negotiate, and summarize contracts, which would be costly if analyzed by lawyers.

From the perspective of performance, the company's earnings per share have exceeded expectations in the past two years (8 quarters). In the past three years (12 quarters), the company's earnings per share have exceeded expectations in 11 quarters.

In addition, a series of cooperation agreements signed by the company in the past few months should help drive future growth. Taking the recent cooperation with Legitify, a leading online notary solution in Europe, as an example, notarization is a painful and often in-person process, usually used for key documents in estate planning or large commercial transactions. With DocuSign helping to digitize notary seals online, this cooperation will help expand DocuSign's influence in Europe and other regions.

DocuSign also recently launched a new platform called "DocuSign Transactions" to make it easier for agents and clients buying and selling real estate to complete transactions. The company said DocuSign Transactions are designed for brokerage firms and agents to provide convenient services for real estate professionals. This new initiative helps to enter the US 132 trillion dollar real estate market.

RockFlow's investment research team believes that DocuSign has a bright future and will continue to benefit from extensive partnerships. Its Price-To-Earnings Ratio is currently significantly lower than the industry median. These factors are expected to become catalysts for stock price growth.

5. C3.AI, the 2B AI giant that helps enterprises transform

In this wave of AI craze, in addition to the large model itself attracting most of the attention, the landing of AI, the improvement of enterprise processes, and the improvement of efficiency and decision-making ability are also worth looking forward to. The RockFlow investment research team believes that in addition to the previously introduced Palantir, the C3.AI that focuses on developing AI applications and services for enterprises is also a promising target.

As a relatively important but not well-known company in the AI industry, C3.AI initially focused on collecting and analyzing large amounts of energy data to help utility companies optimize power distribution and reduce energy waste. As the technology becomes more mature and market demand changes, it gradually expands to manufacturing, finance, healthcare, and defense. Currently, C3.AI focuses on developing AI products, providing AI transformation solutions and services for enterprises.

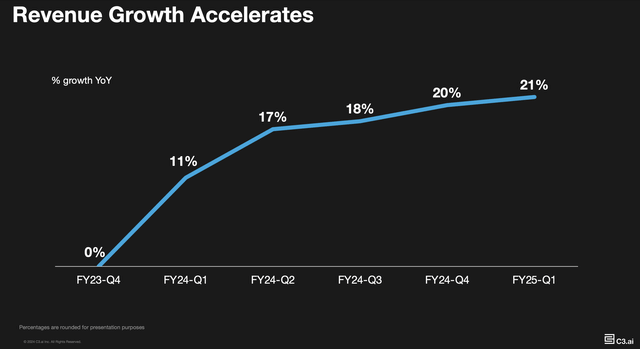

C3.AI recently released its latest financial report, with revenue growth of up to 21% in the latest quarter. The company continued to sign a large number of pilot agreements to drive growth in the next fiscal year, but its stock price did not really rise until Microsoft issued a cooperation press release.

The AI enterprise software company announced an expanded strategic partnership with Microsoft. Although C3.AI was already a partner of Microsoft, the news still pushed the company's stock price up 25%.

The new agreement involves positioning Microsoft Azure as the preferred cloud provider for C3.AI and establishing its AI enterprise solutions as the preferred AI application software provider on the Cloud Computing Platform. Recently, C3.AI announced 40 agreements with Google Cloud, thanks to an event promoting C3.AI state and local government application suites.

C3.AI added 52 AI pilot projects in the latest quarter alone, an increase of 117% year-on-year. The revenue generated by these pilot projects is limited, but it may become a considerable source of revenue in a few years, and most of the expenses are paid in advance through sales and product development to launch pilot projects.

The RockFlow research team believes that with C3.AI's revenue growth, guidance and profit margins continuing to grow steadily, as well as more extensive partnerships, the company still has broad room for growth.

For an overview of C3.AI business, competitive advantages and potential catalysts for share prices, please see:When will C3.AI return to the uptrend?

6. Innodata, an AI data management platform for service giants

Innodata is committed to providing AI software platforms and management services. It operates through the following business units: Digital Data Solutions (DDS), Synodex, and Agility. In short, it provides digital content and Data solutions and serves large technology companies.

The most concerning issue in the current market is the increase in Innodata's stock price. Since the release of its third-quarter financial report on November 7th, its stock price has risen by about 60%, and it has risen by 365% so far this year, which is quite astonishing.

How impressive was Innodata's Q3 performance? Revenue was $52.20 million, up 136% YoY and 44% higher than analyst expectations. Gross margin was 40.8% compared to 37% last year; operating margin was 22% compared to 3.4% last year. Adjusted EBITDA increased 337% YoY to $13.90 million.

In addition, the company further raised its 2024 fiscal year guidance, raising its full-year revenue forecast for 2024 to a year-on-year growth of 88% to 92%. The previous expectation was for a full-year growth of 60%. It is worth noting that the previous forecast has been raised from 40% in Quarter 1.

Innodata's current performance surge is due to its ability to obtain large contracts, and its important customer is Meta. Therefore, its future development depends on whether the company can continue to obtain such large contracts, but based on recent performance, its future sales will further grow strongly. Its customer base already has five of the seven giants.

RockFlow's investment research team believes that Innodata is expected to win more contracts that can generate considerable revenue, and focuses on providing tools for large technology companies to further develop AI. It is expected that both revenue and stock prices will experience considerable growth.

7. AppLovin, a rising star in AI + advertising

Game and mobile advertising company AppLovin has performed well recently, with its stock price surging more than 700% in the past 12 months. In contrast, Nvidia's return rate during the same period was "only" 200%.

The company provides AI advertising and marketing solutions for enterprises, covering advertising and marketing ecology including user reach, traffic monetization, advertising creative design, marketing data detection and other functions. Due to the company's stable financial performance in recent quarters and bright prospects under the AI wave, the market is extremely optimistic about this rising star. After in-depth research by the RockFlow investment research team, it still has good investment value.

The ecosystem built by AppLovin can help developers monetize their games so that they can focus on creating and improving game content. In addition to the software business, AppLovin also has over 200 free mobile games operated by its 11 global studios. These games not only provide a good source of revenue, but also provide a large and growing amount of data that helps drive AppLovin's ad platform. Similarly, these games can also use AppLovin's ad platform to distribute and monetize their content.

AppLovin's rapid growth in Net Profit over the past few years proves the steady improvement of its business over the years, and this trend has continued to strengthen in recent quarters. Against the backdrop of revenue growth of 39% to $1.20 billion in Q3, its Net Profit soared from $109 million in Q3 2023 to $434 million in Q3 2024.

Although there are multiple reasons behind its improvement, the use (and continuous improvement) of AppLovin's AI software AXON is a key driving factor. By utilizing its AXON algorithm, AppLovin helps match advertisers with users who are most likely to download its app, improves advertisers' efficiency through automation, and ultimately helps them achieve better return on investment.

With the continuous advancement of AI technology, AppLovin can continue to add new features to help customers achieve more goals with fewer resources. In addition, AppLovin can also apply its AI capabilities to other parts of the business to help provide better results for customers.

8. Okta, a new generation AI identity management platform

Okta's business includes providing identity access management, consumer identity and access management (CIAM), single sign-on (SSO), multi-factor authentication (MFA), and other identity management solutions. It targets both B2B and B2C customers, providing relevant Software Development Kits, APIs, and identity management services for their application developers.

RockFlow's investment research team believes that Okta will continue to benefit from industry tailwinds, which stem from the ongoing trend of digitalization (which requires enterprises to have more demand for cyber security). New products and a restructured sales model should help drive growth acceleration in the short term.

Last October, OKTA's stock price suffered a heavy blow due to a security incident. People were worried about whether customers would continue to subscribe to OKTA once the contract expired. Recent financial report data proves that negative events have become a thing of the past for OKTA. Customers are willing to maintain long-term commitments with OKTA, especially large enterprises, which were not affected by this security incident.

In addition, there are two obvious growth catalysts that should drive growth in the short term.

Firstly, OKTA's Spera (acquired in December 2023) solution. This acquisition is very timely, and given the increasing trend of hackers using stolen credentials, it is expected to be widely adopted in the future. Moreover, customers have shown great interest in this product.

Secondly, OKTA's sales efficiency will be improved due to the restructuring of its sales team. The management is targeting small and medium-sized enterprises, while hiring new executives for listing work. In order to achieve better results among new and old customers, I believe it is necessary to separate customer upselling from new customer acquisition. Therefore, I expect sales efficiency to improve throughout the year, which will help the company's growth accelerate and recover.

OKTA has also made great progress in its partner ecosystem. All of OKTA's top ten transactions (ACV worth over $1 million USD) this quarter were contributed by its partners. Half of the top ten transactions involved the US federal government, which is an achievement worth emphasizing. It not only demonstrates that OKTA's partners can bring transactions, but also provides a bridge for OKTA to obtain demand from larger and more well-known customers.

Given that OKTA's partners have greatly expanded their distribution scope, OKTA can meet the needs of more end point markets without hiring direct sales representatives (saving costs and operational complexity). Using these saved funds, OKTA can improve its GTM and make it more specialized in certain end point markets.

9. Asana, a cloud-based AI task management platform

Asana is a cloud-based task management solution mainly aimed at workplaces. Since reporting third-quarter earnings and productivity improvements brought by AI Studio, Asana's stock price has risen by more than 43%. The RockFlow research team believes that Asana still has huge growth potential.

Firstly, the company reported revenue of nearly $184 million, exceeding its expectations of $180 million to $181 million, with earnings per share of -0.02, also exceeding market expectations. For the fourth quarter, the company expects revenue to increase by 10%, reaching $187.50 million to $188.50 million, and revenue for fiscal year 2025 will be $723 million to $724 million, a year-on-year increase of 11%, also exceeding expectations. Management pointed out that they expect AI Studio to generate long-term revenue.

The company launched AI Studio at the end of October, which is worth mentioning. The management said that the development momentum of the first 100 customers is strong. The CEO of the company, who co-founded Facebook with Mark Zuckerberg, described AI Studio as "an AI-driven workflow builder that enables teams to design any workflow, embed AI agents without code, and deploy these workflows on multiple platforms."

Asana is repositioning itself as a multi-product company, enabling it to leverage AI to expand growth into multiple verticals. This quarter, non-tech verticals grew 15% year-over-year, faster than overall growth, accounting for two-thirds of total business. Management mentioned during the earnings call that "diversification beyond technology is one of our main areas of focus."

In addition, the number of core custom customers grew 11% this quarter, and customers 100,000 dollars and above grew 18%. These are important signals that Asana's performance continues to improve.

10. Doximity, the spark of medical services colliding with AI

Medical network provider Doximity is steadily moving towards a leadership position in the digital health field, and its stock price has risen nearly 88% this year.

This increase reflects its rapid performance development. Currently, Doximity dominates the digital healthcare field, with over 80% of US doctors using the platform, surpassing the entire US Medical Association (AMA). More and more doctors, nurses, and assistant physicians are joining the platform. In other words, Doximity already has a strong Network Effect and competitive advantage.

The company's financial situation is very good. The latest financial report shows that all data are higher than expected. The Balance Sheet is strong and the cash reserve exceeds $800 million. This quarter's revenue increased by 20% year-on-year, and the gross profit margin reached 90%, far exceeding the industry's average profit margin of 75%. In addition, the operating profit margin of over 45% dwarfs the average level of 30% among peers, indicating the high Operational Efficiency of management and team.

Following the epidemic a few years ago, the healthcare industry has naturally turned to more and more digital solutions in the past few years. Industry research from the US Centers for Disease Control and Prevention shows that most doctors now conduct online consultations every week, and nearly 15% of primary care professionals use this technology to complete more than 50% of their appointments every day. And this is exactly the market Doximity is targeting.

In addition, the company has integrated with multiple systems and health records. This has made great progress in simplifying clinic workflows and improving daily management. This is crucial for any size medical institution, especially as the number of patients increases and budgets may shrink.

The Doximity platform is handling more clinical needs. The release of multiple AI-enabled products also helps accelerate the clinical workflow. In addition, AI-assisted clinical tools can also assist in decision-making to verify and ensure that all patients can receive the best treatment plan.

RockFlow's investment research team believes that the healthcare industry where Doximity is located will benefit from the huge growth potential brought by digital automation, research and development, and operational leverage in the long term. Coupled with the potential development space in international and cross-industry markets, Doximity will continue to be a winner in the foreseeable future.

11. Tempus AI, AI + health technology has great potential

Tempus AI is one of the largest AI health technology companies in the US, with more than 200 biopharmaceutical partners, more than half of US oncologists are connected through partnerships, and its total addressable market size is nearly $200 billion.

The company's business covers the world and has developed multiple international expansion plans. It is currently preparing to enter the Japanese healthcare market through a joint venture supported by its major shareholder SoftBank, which is the starting point for larger-scale regional expansion. In addition, the company has a strong economic competitive edge related to pricing power, an important intellectual property portfolio (271 patents), and a huge database. The RockFlow research team believes that the company's potential development prospects are very broad.

According to the latest financial report, the revenue of the genomics department, the main source of Tempus AI's revenue, increased by 20% in the third quarter of 2024. Considering the untapped market opportunities of Tempus AI and recent acquisitions (including Ambry), the company will achieve greater growth when the synergy effect of the acquisitions plays a role.

On the other hand, in the third quarter of 2024, the non-GAAP gross profit margin of its genomics department was 49%, while the gross profit margin of its data and services department was as high as 78%. As its share of total revenue continues to grow, data and services will make Tempus AI another important business.

In addition, the company has over 200 PB of data that can be deployed in its AI products. Currently, no other similar company can compete with Tempus AI's huge database. It is expected that the compound annual growth rate of the AI health technology industry will reach 43% between 2024 and 2032. Tempus AI is expected to benefit from this market trend and opportunity.

The RockFlow research team believes that Tempus AI's innovative approach to oncology and data services, expanding partnerships, and focus on healthcare data-driven analytics (with over 200 petabytes of data) are all driving factors behind its strong growth prospects.

12. Conclusion

RockFlow's investment research team is quite optimistic about the prospects of current AI software companies. We believe that these companies not only lead in technology, but also demonstrate strong growth potential driven by market demand. With the deep application of AI in various industries, these companies are expected to further increase their market share and commercial value. As investment opportunities in the AI field gradually mature, we will continue to track the performance dynamics of these companies and bring you more forward-looking and reference investment research content.

Author Profile:

The RockFlow research team has a long-term focus on high-quality companies in the US stock market, emerging markets such as Latin America and Southeast Asia, and high potential industries such as encryption and biotechnology. The core members of the team come from top technology companies and financial institutions such as Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, CITIC Securities, etc. Most of them graduated from top universities such as Massachusetts Institute of Technology, University of California, Berkeley, Nanyang Technological Institute, Tsinghua University, and Fudan University.

Additionally, you can also find us on these platforms:

- [https://36kr.com/p/2740242308032772]

- https://panewslab.com/zh/articledetails/7b0pwx2eFt.html

- https://foresightnews.pro/article/detail/58470