|

BlackRock, Fidelity, and ARK are the most likely to succeed, but the real winners are the investors themselves.

Highlight:

Effective dialogue between the SEC and potential publishers is an important reason for the final approval of the Bitcoin spot ETF. 11 Bitcoin spot ETFs (including GBTC) have been approved at the same time, thanks to the SEC learning from the lesson that one ETF in the Bitcoin futures ETF market can eat up the vast majority of the market share just by leading by three days. Allowing all prepared publishers to compete in the same field is more fair and beneficial to investors.

How should investors choose the right ETF for themselves? Three indicators: fees, liquidity, and trading costs. Investors who buy and hold should focus on fees, active traders should pay special attention to liquidity, and all relevant parties should pay attention to how the publisher's own trading costs ultimately affect ETF performance.

On July 1st, 2013, Cameron and Tyler Winklevoss applied to establish the Winklevoss Bitcoin Trust Fund. At that time, it was considered a landmark financial innovation product, but the US SEC was not ready to approve ETFs that invest in unregulated assets in unregulated markets.

Today, more than a decade later, the original vision of the Winklevoss brothers has become a reality, and the SEC has finally agreed to approve the launch of a Bitcoin spot ETF.

History of Bitcoin Spot ETF

Although the Winklevoss Bitcoin Trust initially applied in 2013, it was not officially rejected by the SEC until 2017. Over the past decade, the SEC has repeatedly expressed dissatisfaction with the unregulated and potential fraudulent behavior of cryptocurrency, but this has not stopped relevant publishers from trying to push Bitcoin spot ETFs into the market.

Grayscale launched the canary release Bitcoin Trust (GBTC) as early as 2013, which was initially only open to Accredited Investors. After its listing in 2015, retail investors could only trade it. Why was GBTC able to be successfully launched? Because it is essentially traded in the over-the-counter market and does not require SEC approval (but FINRA approval is required).

As a closed trust product, its drawback is that the market price may deviate significantly from the underlying Net Asset Value. Although technically buying it is equivalent to buying Bitcoin (because this trust product directly holds Bitcoin), its price always has a premium/discount to the Bitcoin Net Asset Value (the maximum discount in 2021 was close to 50%). This means that investing in Bitcoin through GBTC is not very effective.

As a result, publishers, including Bitwise and VanEck, have repeatedly tried to launch their own Bitcoin spot ETFs over the past few years.

At the end of 2017, when CBOE listed the first batch of Bitcoin futures contracts and began trading, the situation began to change. Now that these contracts can be successfully launched, investors will look forward to related financial derivatives. In October 2021, the SEC finally approved the Bitcoin futures ETF.

But then, the bitcoin futures ETF faced its first embarrassing problem: at the time, one ETF, ProShares Bitcoin Strategy ETF (BITO), was published three days ahead of the second ETF, Valkyrie Bitcoin Strategy ETF (BTF).

In the ETF field, the first-mover advantage is huge, and the three-day difference makes BITO attract the attention of most investors. At present, the total investment amount of crypto ETF 2.30 billion dollars, among which more than 1.80 billion choose BITO (rather than BTF), and the time advantage helps ProShares become a big winner.

The second problem with Bitcoin futures ETFs is that they cannot perfectly track the true performance of Bitcoin.

Due to the fact that the underlying asset of the Bitcoin Futures ETF is a futures contract, switching to the next contract after the current contract expires will incur rollover costs. Therefore, the return rate of the Bitcoin Futures ETF has always lagged behind that of Bitcoin itself. Just last year, the price of Bitcoin rose by 171%, while the return of BITO was "only" 151%. The 20% difference is not a small number.

The following chart compares the price fluctuations of BITO and Bitcoin (red represents BITO, green represents Bitcoin).

|

This is why Bitcoin spot ETFs are very important. If investors are optimistic about Bitcoin, the best choice is, of course, Bitcoin itself, not derivatives.

In fact, Bitcoin spot ETFs already exist in Canada and Europe, and there are no technical trading issues. Therefore, it is inevitable that the US SEC allows them to be listed on the world's largest Capital Markets, the US.

New changes in the past six months

The usual path for Bitcoin spot ETF filing before the second half of 2023 is as follows:

Publisher submits Bitcoin spot ETF application

Patiently wait

SEC delays decision on whether to approve

Continue to wait

SEC delays decision again

Continue to wait

SEC refused

The US SEC has always insisted that there is too much fraud and manipulation in the cryptocurrency market, so they choose to remain silent and indefinitely suspend the publisher's application. Although some investors believe that "postponing rather than directly rejecting" is not entirely a bad thing, after experiencing too much waiting, many people are beginning to be disappointed.

It wasn't until the second half of 2023 that the situation truly changed. The SEC began soliciting opinions from publishers, investors, and other relevant parties, and invited publishers to resubmit materials based on feedback. This is an important breakthrough, representing that the SEC is actually willing to discuss rather than ignore it.

In the past month, the US SEC and publishers have repeatedly debated and requested revisions to relevant documents, basically solving all the concerns of the US SEC - the biggest challenge is supervision (how publishers monitor/solve manipulation and fraud issues) and custody (how Bitcoin is stored).

Effective dialogue between the SEC and potential publishers clearly became an important reason for the approval of the Bitcoin spot ETF.

Why is January 10th so important?

It's simple, this is the approval deadline for the ARK 21Shares Bitcoin ETF (ARKB). ARK is one of the important applicants for the Bitcoin spot ETF, and the US SEC needs to decide whether to approve or reject it before January 10th.

Why were 11 Bitcoin spot ETFs (including GBTC) approved at the same time on the 10th? Because the SEC learned the lesson that a single ETF in the Bitcoin futures ETF market can eat up the vast majority of shares just by leading the market by three days. After all, it is fairer and more beneficial for investors to have all prepared publishers compete on the same field.

Prospects and advantages and disadvantages analysis of Bitcoin spot ETF

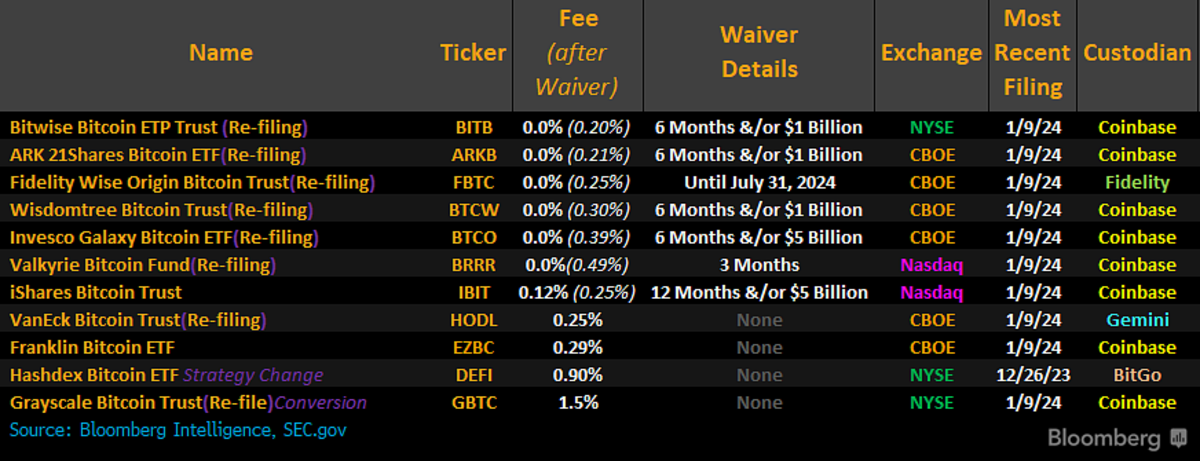

The underlying layers of 11 ETFs are all Bitcoin. What are their differentiating factors? Which publishing companies can ultimately come out on top? How should investors choose the right ETF for themselves?

Three important indicators: fees, liquidity, and transaction costs. Investors who buy and hold should focus on fees, active traders should pay special attention to liquidity, and all relevant parties should pay attention to how the publisher's own transaction costs ultimately affect ETF performance.

The specific targets and analysis are as follows:

|

iShares Bitcoin Trust (IBIT), fee rate: 0.25% (waiver period is 0.12%), with excellent prospects

It is the most promising Bitcoin spot ETF. Considering BlackRock's huge asset size and customer advantage, it is hard to imagine IBIT not being successful. Moreover, from the perspective of market sentiment, it seems unlikely that the Bitcoin spot ETF will be approved by the SEC before BlackRock announced its participation in the competition. It is BlackRock's participation that greatly encourages market confidence (other relevant parties even speculate that they know some "secrets"). In terms of news and attention, BlackRock has always been the most watched one.

Fidelity Bitcoin Trust (FBTC), fee rate: 0.25% (0% waiver period), excellent prospects

If nothing unexpected happens, Fidelity's scale advantage is extremely strong. Although the company is not the absolute leader in the ETF field, it has trillions of dollars in assets and will definitely recommend crypto investments to existing clients. As an asset management giant, Fidelity's appeal cannot be underestimated. Therefore, FBTC is expected to eventually become a leading Bitcoin spot ETF product.

ARK 21Shares Bitcoin ETF (ARKB), fee rate: 0.21% (0% discount period), good prospects Cathie Wood has been involved in the crypto field for many years and holds GBTC through multiple ARK funds. Currently, the position is about 80 million USD and may soon be fully transferred to ARKB. The Bitcoin ETF undoubtedly fits ARK's disruptive innovation theme, and the 0.21% fee is also very low. Given that ARK usually charges a 0.75% fee for its actively managed funds, it can be seen that ARK is working hard to win the market. However, after experiencing a dismal performance in 2022, ARK's reputation is far less prominent than its peak in 2021. How many investors are willing to regain trust in Cathie Wood remains to be seen.

Canary releases Bitcoin Trust (GBTC) with rate: 1.50%, good prospects

GBTC was originally a trust with $27 billion in assets and is transitioning from a closed trust. It used to be the "only" investment channel for Bitcoin. The Bitcoin futures ETF did not pose a real threat, but the spot Bitcoin ETF did, especially from companies like BlackRock and Fidelity. Now it hopes to maintain a fee rate of 1.5% (2% before conversion) on the basis of $27 billion in assets. GBTC should find it difficult to continue attracting a large amount of new funds. The question is how long they can maintain their current scale. They may lose scale due to other funds, but there is no doubt that they will bring huge income for a considerable period of time.

Bitwise Bitcoin ETF Trust (BITB), fee rate: 0.20% (0% waiver period), good prospects

When competing with companies like BlackRock and Fidelity, Bitwise doesn't seem like a potential winner, but BITB could be a dark horse. As of now, their rate is 0.20%, the lowest in the same category, and there is also a fee reduction. There is a small detail in their recent submission. As a crypto-native investment company, Bitwise has received a nine-figure investment commitment from Pantera, which has about $3.60 billion in assets. There may be more companies interested in working with it.

WisdomTree Bitcoin Trust (BTCW), rate: 0.30% (0% waiver period), good prospects

WisdomTree is an established company in the ETF market (ranked 9th in total assets). The company has ETFs covering cyber security, Cloud Services, and artificial intelligence, but its foundation lies in traditional company stocks and bonds. BTCW may attract the attention of established investors.

Invesco Galaxy Bitcoin ETF (BTCO), fee rate: 0.39% (0% exemption period), good prospects

Invesco has a larger scale than WisdomTree Asset Management, is well-known, and their NASDAQ 100 index and related ETFs are attractive, which may have some spillover effects. However, its advantages are not very obvious. The fee waiver is a good start, but the 0.39% rate thereafter is completely uncompetitive.

VanEck Bitcoin Trust (HODL) rate: 0.25%, good prospects

VanEck's asset management scale is not small, but it is not enough to become one of the leaders. Considering that VanEck was one of the first publishers to try to push the Bitcoin spot ETF to the market, it has some popularity, but there is basically no advantage in terms of fees.

Valkyrie Bitcoin ETF (BRRR), fee rate: 0.49% (0% waiver period), average outlook

Valkyrie is a veteran player in cryptocurrency ETFs. Their Bitcoin futures ETF ranks fourth in size. It is understandable that they did not catch up with BITO, but VanEck and ProShares' Bitcoin futures ETFs were launched later than it, but their current size surpasses it. This means that their competitive advantage is average and it will be difficult to surpass BlackRock, Fidelity, and ARK in the future. In addition, their post-exemption fees are one of the highest.

Franklin Bitcoin ETF (EZBC), rate: 0.29%, average outlook

Franklin, as an old-fashioned asset management company, is more famous for its mutual funds than ETFs. Among Bitcoin spot ETFs, EZBC may have the lowest recognition. In 2017, Franklin launched a series of index ETFs in different markets, all with fees set at 0.09%, aiming to overtake by relying on low-price strategies. Some have achieved some success, but most are still less than $100 million, indicating that Franklin failed to break through with low costs. Coupled with no fee reductions, there is no reason to be optimistic about EZBC.

Hashdex Bitcoin ETF (DEFI), fee rate: 0.90%, average outlook

Like Bitwise, Hashdex is a native crypto company, which should give them some advantages, but the high cost is a fatal weakness. Moreover, they are not well-known among ordinary investors.

Conclusion

We'll soon find out who wins the publisher race. But obviously, investors are the big winners.

Previously, the top Bitcoin futures ETF, BITO, had a fee rate of 0.95%, so many people expected the spot ETF fee rate to be at least 0.50%. Now, fierce competition has led to a fee rate as low as 0.20%, and there are even short-term zero fees. The influx of billions of dollars of new funds into the relevant market is just around the corner.

RockFlow investment research team has summarized all the above ETFs to form a "Bitcoin Spot ETF" stock list, which is convenient for everyone to invest in the cryptocurrency market with one click.