Highlight:

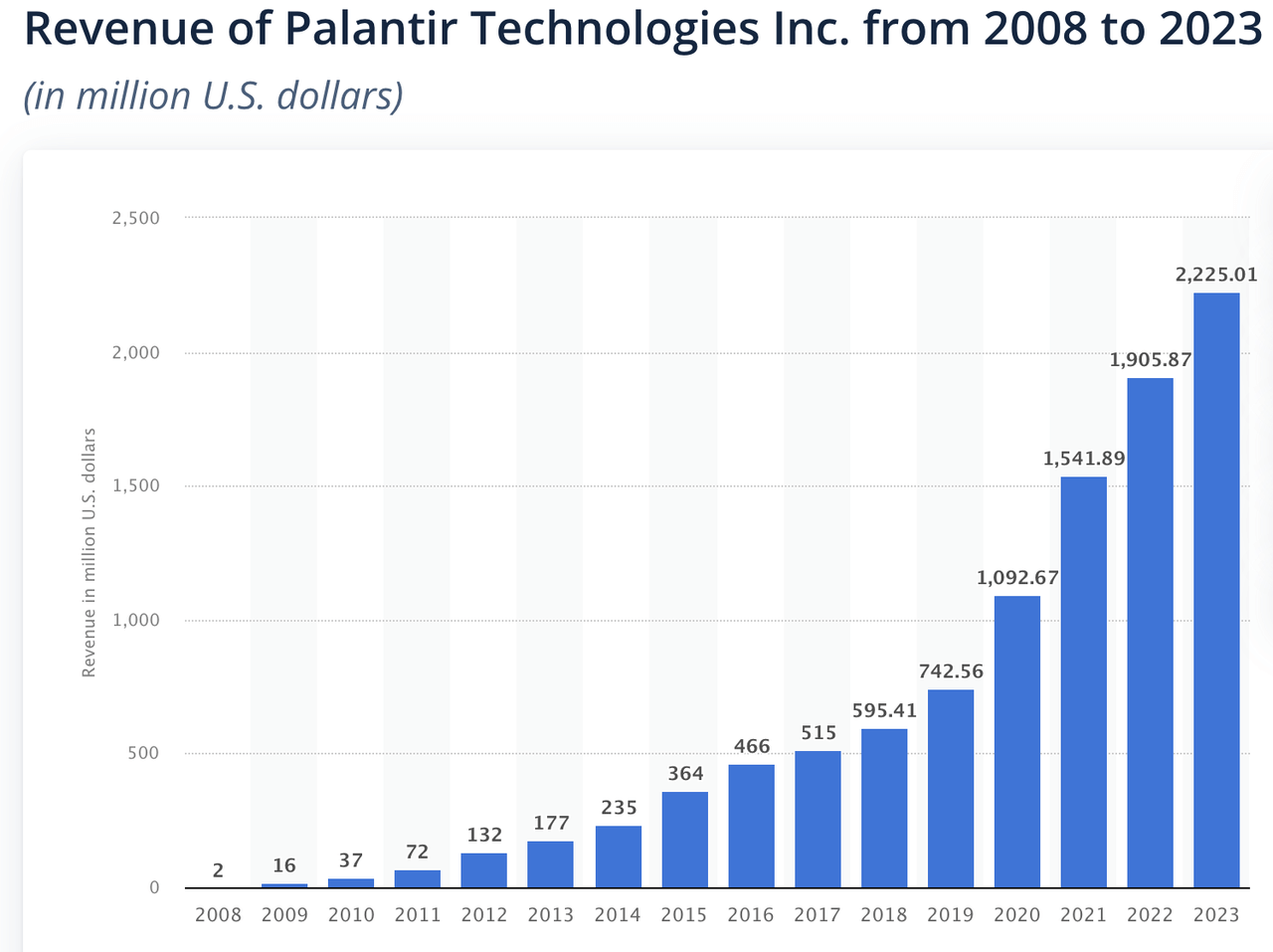

1)The name Palantir comes from the "Crystal of Truth" (Palantiri) in "The Lord of the Rings" - seeing the deep value behind the data. It once helped the US government kill bin Laden with its powerful Data Analysis capabilities, and has since successfully expanded into non-governmental businesses, with layouts in AI, finance, insurance, healthcare, and other fields. Its revenue has grown at a very high compound annual growth rate in the past 16 years.

2)Palantir's artificial intelligence platform (AI Platform) truly takes into account both large language model capabilities and data security needs. In order to bring it to the market, it abandons the traditional and outdated sales team and chooses to hold a large number of AIP beginner training camp activities, significantly shortening the sales cycle and accelerating the efficiency of acquiring new customers, achieving an effect similar to "exponential growth".

3)Palantir's financial report in the previous quarter was quite impressive, and it achieved annual profitability for the first time in 2023, which prompted many investment banks to upgrade their ratings. The Wood Sister ARK Fund also chose to decisively increase its position by nearly $43 million. With the intensification of geopolitical tensions and more companies eager for AI transformation, Palantir is becoming one of the earliest and most direct beneficiaries of this AI boom.

The concept of AI has been popular in US stock market investment for a long time. The huge success of ChatGPT has sparked excitement, and the transformative potential of large language models has sparked crazy investment from technology companies, venture capital funds, and stock investors.

We believe that the changes brought by AI will be real. In this wave of AI sweeping the world, which companies will benefit more from the trend earlier and more? Investors have different judgments. We hope to pay closer attention to the long-term impact of AI and why and how different technology companies benefit from the AI revolution.

Therefore, the RockFlow investment research team has successively analyzed the latest views of well-known VCs in Silicon Valley on the potential new stars in the generative AI track, the many interesting changes in the Fintech industry due to the emergence of AI, different investment cycles in the AI wave, and high-quality investment research targets in various sub-fields. This article will focus on Palantir, deeply analyze its past development history, current AI business progress and high-growth performance, as well as the stock price catalyst in the future.

In addition, the RockFlow investment research team has recently released in-depth investment research articles on Coinbase, Duolingo, Adobe, and other companies. Coincidentally, some of these companies are entering a new round of financial reporting season. If you want to quickly understand their business development and investment value, please click:

How did Palantir become the king of Data Analysis?

Palantir is a software and services company engaged in big data analysis, which went public on the New York Stock Exchange in 2020. In 2003, PayPal co-founder Peter Thiel and three other engineers officially founded Palantir. Its name comes from the "Palantiri" in "The Lord of the Rings", which means seeing the deep value behind the data.

Possibly influenced by the 9/11 incident, in the early days of its establishment, Palantir specialized in the development of anti-terrorism software.

In 2005, the US CIA became its first customer, and Palantir developed a custom Data Analysis system for it.

In 2006, the CIA's venture capital arm, In-Q-Tel, invested $2 million in Palantir.

In 2008, the US government officially signed a contract with Palantir, and Gotham was released in the same year, making Palantir's ability to process and analyze complex data well known to the outside world.

In the following years, the successive success of government projects inspired Palantir to explore non-governmental businesses, and it began to enter the commercial field.

In 2010, JPMorgan became Palantir's first commercial client.

In the same year, Palantir announced a partnership with Thomson Reuters.

In 2011, Palantir helped the US government kill bin Laden with its powerful Data Analysis capabilities.

Since then, Palantir has become famous and its business scope has continued to expand, with business layout in AI, finance, insurance, medical and other fields.

The story doesn't end here. Palantir is still continuously improving its software development capabilities and launching a heavyweight commercial platform and multiple features.

In 2016, Palantir released the Foundry commercial platform, which seamlessly connects the databases of core business and operation teams as well as external data of the company, promoting real-time collaboration among various departments.

In 2018, Apollo was released to manage Gotham and Foundry, coordinate software updates, and enable customers to use its software platform without environmental restrictions.

In 2020, Palantir went public on the NYSE.

In 2023, Palantir will release the AIP platform, integrating AI large models with customer software platforms, thus opening a new chapter in the AI era.

Currently, Palantir provides three platforms for customers to fully tap the potential of data: Gotham, mainly used by government entities; Metropolis, suitable for banks, Financial Services companies, and hedge funds; and Foundry, for other enterprise customers. Among them, the Foundry platform can connect Structured Data between customer departments and eliminate information barriers; the Gotham platform can fully utilize non-Structured Data.

It is worth noting that because Palantir often customizes software based on specific customer needs, the project completion time is greatly extended. Therefore, it will take some time for Palantir to generate revenue after winning the contract.

Fortunately, it has still generated a super high compound annual growth rate of revenue in the past 16 years.

And all of this is due to the particularity of its business model. In short, Palantir's business model is to solve problems for customers through its own investment in the early stage, demonstrate its own value, and firmly attract users, ultimately promoting the large-scale deployment of the Palantir platform by customer companies to achieve profitability. According to the prospectus, Palantir's monetization is divided into three stages: acquisition - expansion - scale. The evaluation criteria are mainly based on the contribution of annual revenue.

Acquisition phase, contributing less than $100,000 in annual revenue. Palantir conducts short-term pilot deployments for customers to prove the value of its platform. During this period, Palantir operates at a loss and is supplemented by long-term investments.

During the expansion phase, Palantir contributed more than $100,000 in annual revenue but negative profit margins. Palantir continued to lose money to understand customer issues and customize features to create value for customers.

At the scale stage, the contribution to annual revenue is higher than $100,000 and the contribution profit margin is positive. At this time, customers can basically use the software platform independently. The services and value provided by Palantir to customers have significantly increased, and revenue has begun to increase. The customer contribution profit margin returns positive, and Palantir achieves profitability.

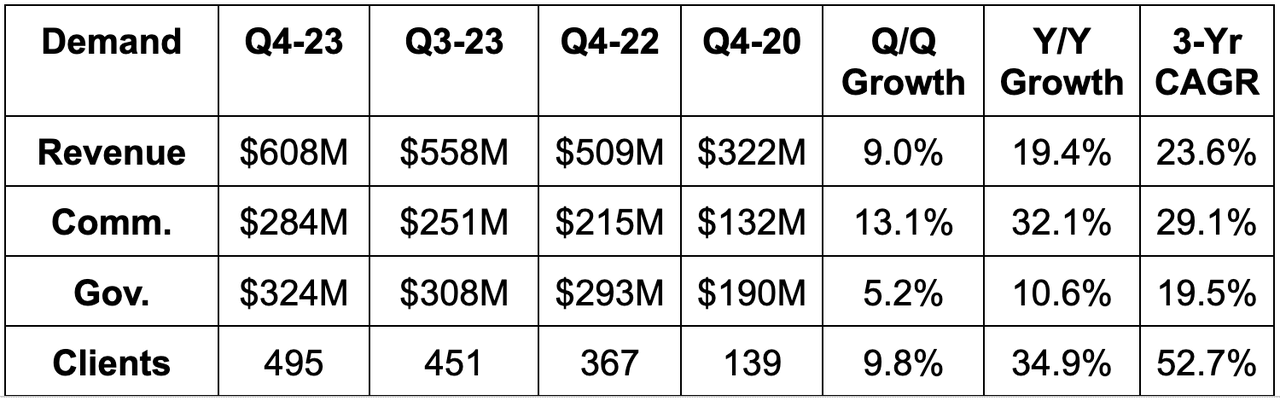

As shown in the above figure, since its IPO in 2020, Palantir's revenue has grown significantly, especially during the COVID-19 pandemic. Although the year-on-year growth rate gradually decreased in the following quarters, it still maintained a good momentum. Although it started with government projects, it also actively expanded its commercial customers, so it can achieve simultaneous revenue growth for both government and commercial customer groups (with quarterly year-on-year growth rates exceeding 10%). Today, the proportion of commercial customer revenue has exceeded 40%.

The same is true for development potential - according to the prospectus, companies with annual revenue of more than $500 million are defined as potential customers. Currently, there are nearly 10,000 companies worldwide that meet the requirements, so the addressable market for commercial customers is huge. As for government customers, Palantir targets the software budget expenditures of the US and its ally countries, and the addressable market is worth nearly $100 billion.

Overall, Palantir has a broad target market prospect. Combined with its advantages in Data Analysis and decision assistance, the RockFlow research team believes that Palantir's performance is promising in the future.

Palantir's core AI weapon - AIP

Normally, it takes a lot of preparation and sales work for companies to purchase, install, and use the new generation of AI-driven software platforms, especially the enterprise version of military products that government entities used to have. However, Palantir did not simply follow the past approach of establishing and maintaining customer relationships through sales teams, but adopted a novel method: AIP beginner training camp.

What is AIP? It is an artificial intelligence platform (AI Platform) launched by Palantir. While integrating AI large models into users' private platforms to help achieve intelligent decision-making, it also attaches great importance to user data security and operational compliance. It can better adapt to various confidential scenarios and truly balance the capabilities of large models and data security needs.

Palantir's AIP beginner training camp mainly consists of three types of activities: hackathons, on-site conferences, and parties. Generally lasting from one to five days, the content includes engineer demonstrations, actual interviews with participants, and demonstrations of existing customers. Once it is proven that the software can really help with work, there are many new customers who are convinced or even converted on the spot, and a considerable proportion of old customers have almost become unofficial sales.

In fact, from the beginning, Palantir was hostile to Wall Street and traditional sales methods. In 2017, the company's CEO declared, "Almost everyone in the company is an engineer, we don't have salespeople." It wasn't until the peak of the IPO trend in 2019 that Palantir began to establish a large-scale sales team.

As for why they are not optimistic about the sales strategy, Palantir's response is quite arrogant - the company does not aim for linear growth, they see demand growing exponentially.

Palantir did find an opportunity for "exponential growth" later on - by frequently holding AIP beginner training camps, not only could it convert new customers in batches, but it could also persuade a considerable number of old customers to organize similar activities freely. In this way, Palantir's product promotion could theoretically quickly spread exponentially.

It has repeatedly highlighted the AIP newbie training camp to investors - mentioned 21 times in the last earnings call, and Palantir described it as the most important way to sell its artificial intelligence platform.

Last October, the management set a goal of holding 500 AIP training camps in 12 months. However, in the fourth quarter alone, Palantir completed over 560 training camps for 465 organizations.

This year, Palantir expects to hold an average of five events per day. Most will be in the US. Given the huge demand, the company has even chosen to bring in engineers from Europe to help with the activities. Palantir has told investors why boot camps are so attractive? Because customers themselves are tired of regular steak dinners and golf - they want to see truly effective artificial intelligence products.

Currently, Palantir's AIP platform is receiving widespread attention and has been used by over 100 organizations, including healthcare and automotive industries. It is also in talks with over 300 companies. Palantir has seen evidence that the AIP beginner training camp can significantly shorten sales cycles and accelerate the efficiency of acquiring new customers.

In the previous quarter, its new customer acquisition rate in the US commercial sector rose to 22% quarter-on-quarter, compared to 12% and 4% in the third and second quarters, respectively. From Q4 2022 to 2023, the number of TCVs (total contract value) in the US commercial sector reaching $1 million has more than doubled.

How did Palantir perform in the latest quarter?

As mentioned earlier, Palantir's revenue is divided into two parts - government and commercial. Government customers mainly use the Gotham platform, while commercial customers mainly use the Foundry platform. Gotham is mainly responsible for regularly building custom use cases for government customers, while Foundry is more flexible and can provide more pre-built application integrations.

Palantir's financial report in the previous quarter was quite impressive, with both quarterly revenue and next quarter guidance exceeding expectations. It also achieved annual profit for the first time in 2023, prompting many investment banks to raise stock ratings and target prices. Even Mu Jie's ARK fund chose to significantly increase its holdings of nearly $43 million of stocks on the same day.

In this quarter, the revenue growth of the commercial department was the most important highlight, with a year-on-year increase of 70% in revenue, a year-on-year increase of 55% in customer numbers, and a year-on-year increase of 107% in TCV, indicating very strong growth. Moreover, the guidance for 2024 indicates that the performance of subsequent quarters will be even better.

Government revenue has also been rising steadily, with US government revenue increasing by 6% YoY in Q4 2323 and international government revenue increasing by 27% YoY. International growth is mainly due to the Eastern European market. Palantir stated that the geopolitical tensions in the region are expected to drive demand for Palantir products from other governments and US allies.

Conclusion

The RockFlow research team believes that, in addition to solid fundamentals and impressive recent quarterly financial reports, there are two long-term catalysts that can push Palantir to new highs.

First, the company's partnerships with several Enterprise Services giants can further drive business demand: in the past year, it has established or expanded global partnerships with Microsoft, Oracle, IBM, and other giants that provide large enterprise infrastructure.

Secondly, the intensification of geopolitical tensions may mean that Palantir's government business will experience further growth recovery. In the past three years, the growth of this field has gradually slowed down, but as global conflicts intensify, the US and its allies may have stronger demand for Palantir's Data Analysis and AI software service platform.

Palantir is proving that it will be one of the earliest and most direct beneficiaries of the AI boom, and AIP is the product that enables it to ensure this position. Coupled with the impact of these upcoming catalysts, Palantir deserves close attention.