Introduction:

In the previous article, the RockFlow research team conducted an in-depth analysis of the business evolution process, latest business overview, and future stock price catalysts of AI advertising company AppLovin, which ranked first in the Nasdaq 100 Constituent Stock Index in 2024 (with an annual increase of 713%).

From being in deep trouble to later making a comeback, AppLovin's success was inseparable from the strategic transformation of acquiring multiple game studios, as well as the subsequent acquisitions and business integration of Adjust (a mobile data monitoring platform) and MoPub (an advertising trading platform that used to belong to Twitter). However, in fact, at that time, AppLovin most wanted to acquire a well-known game engine company - Unity.

In August 2022, AppLovin proposed to acquire Unity for $20 billion (a premium of up to 18%). Unfortunately, fate played a trick and Unity's shareowner rejected the proposal. Since then, Unity has made extremely bad decisions (especially trying to introduce a new pricing model), which not only successfully aroused the anger of most developers, but also led to the resignation of the initiator and former CEO John Riccitiello.

Today, two years later, the fate has reversed: AppLovin, which failed to acquire, became the annual stock king with a market value of over 100 billion US dollars, while Unity continued to decline with a market value of less than 10 billion US dollars; if it had accepted the transaction two years ago, its current value would exceed 50 billion US dollars.

In this article, the RockFlow investment research team will take you to explore the legendary game engine company Unity in depth. What is its growth history? What is the current business situation? Why did it take a completely different path from AppLovin? What is its future investment value?

1. Unity's growth history, business model, and money-making rules

Unity was founded in Denmark in 2004 by David Helgason (right), Nicholas Francis (left), and Joachim Ante (center). The company failed when it released its first video game in 2005, but they saw the value of building game power builders. So it adjusted its direction and revised its vision to make game development more "democratic" by making 2D and 3D interactive content development easier for various creators (not just professional developers) to use.

Its early success relied heavily on the launch of iPhone 2007, when a large number of mobile game creators emerged one after another. The mobile game ecosystem gradually flourished.

Similar to Apple's idea of launching the App Store, in 2010, Unity launched the Asset Store, a trading platform for developers to sell project assets on. A few years later, the company began to expand from the gaming industry to industries such as movies and TV.

In 2014, Unity acquired Applifier (mobile ad platform), which was later renamed Unity Ads. In the same year, the company acquired two more companies: Playnomics (later Unity Analytics) and Tsugi (later Unity Cloud Build). In October of the same year, Helgason stepped down as CEO (but remained in the company as Executive Vice President) and was taken over by former Electronic Arts CEO John Riccitiello.

Facebook has also used Unity game engine many times to assist in the development of its VR projects. Due to the smooth progress of its own business, good relationships with large companies, and the intermittent heat of the VR industry, Unity successfully completed multiple rounds of financing, with a valuation of $3 billion in 2016. Since 2017, Unity has begun to cooperate with Google to carry out risk investment related to AR and VR.

In September 2020, Unity went public with an initial market capitalization of $13.70 billion.

As a game engine giant, Unity allows creators to create and manipulate interactive, real-time 2D and 3D content. There are four keywords in this sentence:

- Creators. They are direct users of Unity and use its software to develop content. Creators include game developers, artists, architects, car designers, filmmakers, etc. Creators have different levels of professional knowledge, and people without development backgrounds can also learn to use Unity. This is consistent with Unity's original vision: to promote the democratization of game development.

- Interactive. Game plugins developed based on the Unity game engine allow end users (i.e. gamers) to connect with content and each other. In multiplayer games, one user's behavior immediately affects another user's experience.

- Real-time. The Unity game engine can adapt to user behavior and feedback in near real-time, and the image rendering speed is very fast, enough to create realistic experiences.

- 3D. The Unity game engine supports 3D graphics scenes, which enables the company to play a role in the AR and VR fields, thereby enhancing its value in multiple other industries.

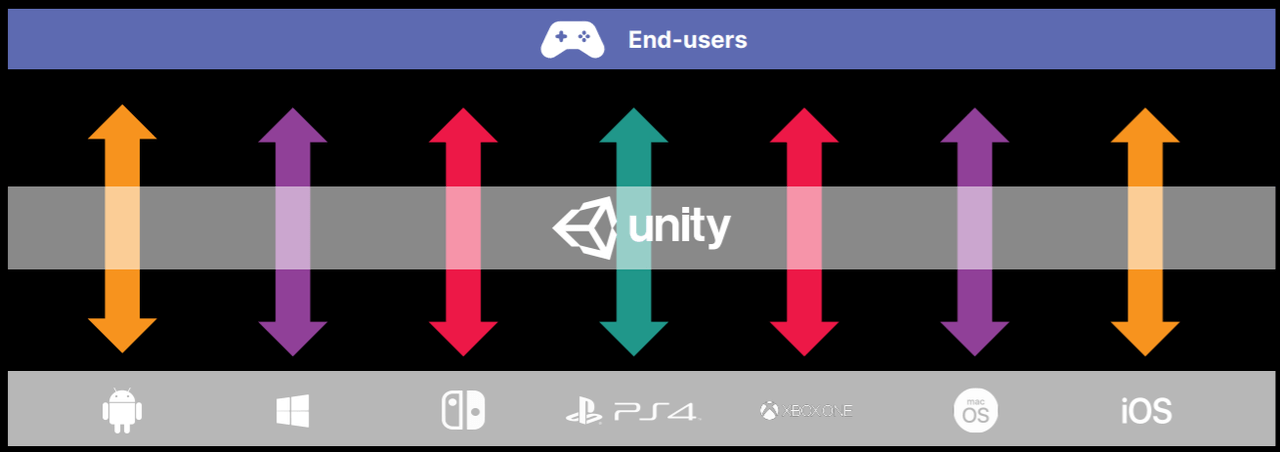

Unity's game engine not only allows developers to visualize and iterate in real time, but also to collaborate with each other to edit content simultaneously. The presentation and display speed of these contents is very fast, and the development experience is seamless and efficient enough. More importantly, it allows creators to deploy on many platforms without additional development.

Unity provides many products through two complementary solutions: Create Solutions and Operate Solutions. In addition, it earns money through partnerships with multiple technology providers and sales revenue from asset stores.

Create Solutions enables creators to create, edit, run, and deploy real-time 2D and 3D content through a development engine. Creating once can be deployed on more than 20 platforms, including Windows, Mac, iOS, Android, PlayStation, etc. Unity provides a Modularization platform where creators can freely call up what they need, so they can achieve "personalization" according to their needs.

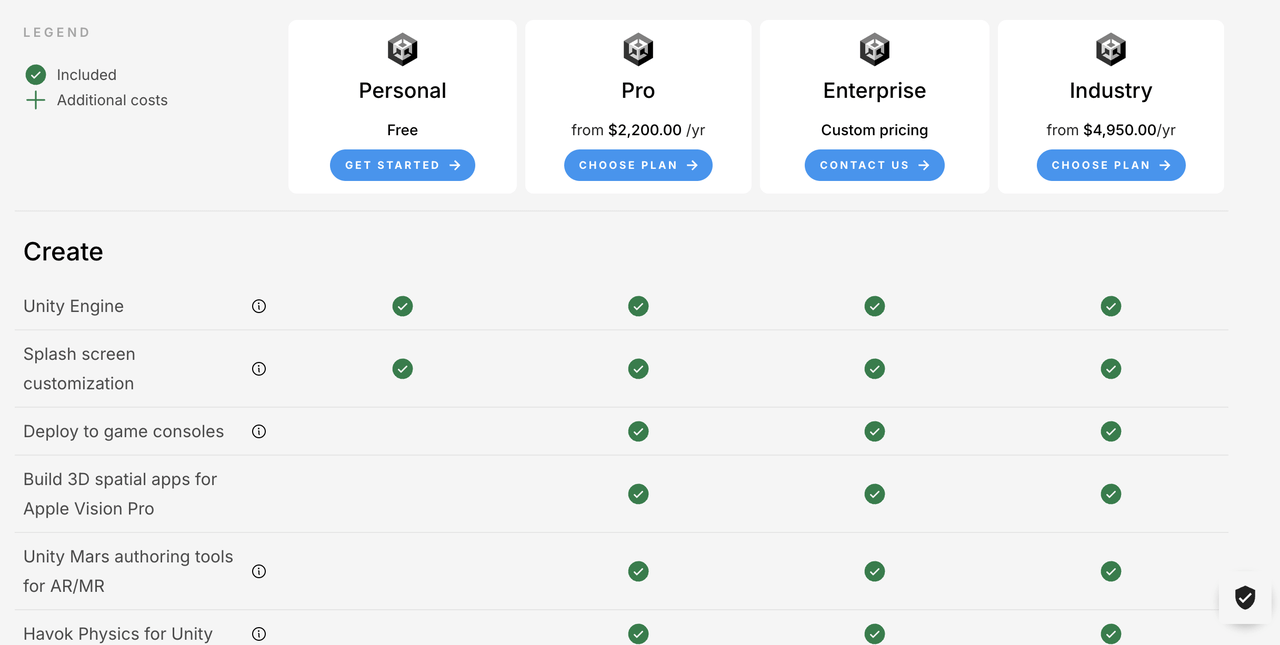

How does Unity specifically profit? The company's Create Solutions is mainly based on a subscription revenue model. Previously, creators with income below $100,000 were allowed to use it for free. This means that Unity only charges large companies and is very friendly to smaller creators. The following figure outlines the core plan.

Operate Solutions belongs to another business module. After creating and deploying content, Unity will continue to help creators grow, operate, monetize, and provide other services to their end-user base.

To this end, Unity has developed various products, such as Unity Ads, Unity In-App Purchase (IAP), Delta DNA, and Vivox. Not only can games be connected to the AD Network to help creators monetize, but it can also allow creators to directly sell various items in the game, provide analysis of player behavior, and even help enable text or voice chat functions in the game. Unity has not disclosed the revenue contribution of different products, but it is estimated that Unity Ads accounts for the majority.

The operational solution enables Unity to generate revenue from the continuous management and success of content developed by creators, whether created on Unity or using third-party software. This is a long-term business that helps Unity profit from the growing gaming industry.

The above two businesses account for more than 90% of Unity's revenue, while the rest mainly comes from partners and other sources of revenue. "Partners" are actually Unity's customers, including hardware, operating system, and console game developers who pay fees to Unity so that games developed on the Unity platform are compatible with their own platforms. For example, Microsoft, Sony, and others pay Unity so that content created on the Unity engine can be immediately used on their own platforms.

Other income is mainly generated through the Asset Store. Unity charges a 30% commission for each sale of the Asset Store. This is also an important part of Unity, which simplifies the development of many inexperienced creators and helps Unity achieve its ultimate goal of democratizing game development.

2. Different choices between Unity and Applovin as ad platforms

Historically, although Unity's business has developed well, its profitability has always been poor. As its business involves game advertising and marketing, it directly competes with the dominant Applovin. Unfortunately, Applovin can achieve unprecedented advertising accuracy by integrating massive data from AD Network, game users, and MAX platform, thereby driving advertising revenue to regain high-speed growth in 2023, while Unity's advertising business has basically stagnated in the past two years.

The core of the game ad platform is to help paying customers achieve higher ROI goals, which is largely driven by data and algorithms. The more data and algorithm matching, the higher the advertising placement efficiency and profit margin of the platform.

As for Unity, they do have a large amount of data and acquired IronSource at a great cost (about 74% premium) in 2022, but the business integration process was too slow. The CEO of Unity introduced the progress of competition with Applovin in Q1 2024 as follows:

"Frankly speaking, we have two data departments that are not fully integrated with each other. This year, we will complete the integration of the two, fully utilize more data, and use it to train our models.

We will launch these products on a larger scale and expect the situation to improve by the second half of 2024. We have already had some large customers of Max (Applovin's intermediary platform) switch to LevelPlay. We believe we are narrowing the gap with AppLovin.

No one wants to have only one partner, customers want to see competition. They still expect us to catch up. "

Looking at Applovin, it not only has a strong development momentum, but also continuously improves its AI advertising engine AXON. The company's CEO stated during the Q1 2024 financial report conference call:

"With the development of our business, there are two key points that need to be understood. Firstly, a key driver of our growth is the continuous improvement of AXON. Our model is still in the early stages and will continue to self-improve. Our team is still looking for ways to substantially improve the algorithm. Although these benefits may be unpredictable, they may bring performance far beyond expectations.

Secondly, our algorithm and advertising engine are not limited to games. By expanding to web-based marketing and e-commerce advertising, we expect the AXON model to further improve as demand diversity increases. "

By comparison, the difference is clear. Applovin understood the value of data and AI early on. Therefore, in the trend of the gaming industry turning into a recession in 2022, not only did it efficiently integrate the MoPub platform, but it also continued to focus on optimizing and training the AI model AXON. This is also an important reliance on it to continuously achieve better-than-expected performance in 2023 and 2024.

As for Unity, after enjoying the rapid growth of the gaming industry in 2021, it thought its prospects were unlimited. However, with the industry downturn in 2022, it has experienced many difficulties and a long journey of transformation.

3. After ups and downs, Unity's long transformation has finally paid off

In 2022, with the suspension of the epidemic and the reopening of the economy, the gaming industry is no longer prosperous. With the number of layoffs in the gaming industry reaching a historic high, some analysts believe that the industry's downturn is the most severe since the Atari crash in 1983. Almost every month, there are reports of large-scale layoffs or complete closures of a large studio.

However, the reason why Unity's stock price plummeted more than 90% from its peak in 2021 to its lowest point in 2024 is mainly due to the company's own problems.

The most notorious of these was in September 2023, when under the leadership of former CEO John Riccitiello, Unity attempted to significantly increase developer fees (the new policy required charging based on the number of downloads of Unity games or applications). This move sparked public anger, and developers turned to competing development engines such as Unreal and Godot in large numbers. In the end, Unity had no choice but to withdraw the policy update, and Riccitiello was forced to leave Unity.

In addition, under the leadership of the former CEO, Unity conducted multiple mergers and acquisitions over a period of 9 years, acquiring companies such as Weta Digital and IronSource, most of which were later proven to be major mistakes. Taking Weta as an example, Unity paid $1.60 billion for this digital special effects company, but shut it down completely a few years later.

Frankly speaking, Unity at this stage is a bit like Google, investing a lot of resources in other projects far from the core business. This is feasible for Google because its search business has a very strong cash flow. But Unity simply does not have enough resources to waste.

Fortunately, under the new CEO in 2024, Unity has taken several necessary measures to get back on track, including a 25% layoff in 2024. This is considered necessary because Unity's workforce has expanded rapidly since its IPO, recruiting heavily for various non-core projects and absorbing a large number of personnel due to multiple mergers and acquisitions.

Although Unity, which has significantly reduced non-essential business, is expected to see a decrease of about 18% in full-year revenue in 2024 compared to 2023, its core business revenue unexpectedly increased and improved in the third quarter of 2024. At the same time, the company will get rid of cost burdens in 2025, and its revenue situation will become clearer.

Meanwhile, the entire gaming industry has experienced the turbulence of the past few years and is expected to start stabilizing. The global gaming market revenue in 2023 is about $184 billion, and analysts predict that this number will grow to about $500 billion by 2033. Therefore, Unity may once again enjoy a favorable situation in the industry.

The RockFlow research team believes that Unity still has the potential to become the dominant player in the gaming industry, just as Spotify and Netflix have captured most of the market share in music and video streaming media.

In addition, considering that there are currently only two main independent game engines, Unity and Unreal. Although Unreal is most suitable for high-end games, its drawback is that it is not easy for developers to use and does not run well on low-end game consoles and PCs. Rivals such as Godot engine are good for smaller game projects, but difficult to meet the needs of high-cost games. Overall, Unity has achieved a good balance between producing a good enough graphical interface and making it easy for novice developers to master.

Moreover, reviewing the previous fee policy controversy, Unity still has a strong competitive advantage. At that time, developers generally resisted or gave up Unity, choosing Godot or other solutions, but ultimately returned to Unity due to ease of use, asset store, and platform interoperability. Although Unity's measures were very unwise, this negative event still highlights the potential value and irreplaceability of Unity game development engine.

RockFlow's research team believes that Unity and its main competitor Unreal will gain a larger market share in the future. Due to the decline of the gaming industry in the past, many large game studios have integrated their businesses and reduced their staff, and practitioners' interest in continuing to develop proprietary game engines has decreased. Developers are increasingly aware that employers may fire them at any time, so they are less willing to work in proprietary engines. This is undoubtedly good news for Unity, which supports development on all major platforms.

In summary, in the future, a portion of game development will still shift from proprietary engines to Unity or Unreal, which will enable Unity to occupy a larger share in the continuously expanding market.

4. Conclusion

According to the latest financial report, Unity's Q3 2024 performance exceeded expectations and has raised its future performance guidance. The RockFlow research team believes that Unity's worst period may have passed.

On the battlefield of game development engines, Unity has played a legendary role. It went public in 2020 and was once regarded as a pioneer of game development democratization. However, the cogs of fate are always unexpected: in 2022, Unity, which rejected AppLovin's $20 billion acquisition offer, now has a market value of only $9.20 billion, while its pursuer AppLovin has risen to a technology giant with a market value of hundreds of billions of dollars.

In this essentially data integration and AI application competition, Unity is indeed lagging behind. However, despite the subsequent pricing turmoil and management turmoil, with its profound technical accumulation and industry status, Unity's story is far from over in the fertile land of game development engines.

Author Profile:

The RockFlow research team has a long-term focus on high-quality companies in the US stock market, emerging markets such as Latin America and Southeast Asia, and high potential industries such as encryption and biotechnology. The core members of the team come from top technology companies and financial institutions such as Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, CITIC Securities, etc. Most of them graduated from top universities such as Massachusetts Institute of Technology, University of California, Berkeley, Nanyang Technological Institute, Tsinghua University, and Fudan University.

Additionally, you can also find us on these platforms: