Highlight:

Pelosi's half-year return on US stock holdings is close to 100%. In 2023, her US stock holdings have a high return of $43 million, and her investment portfolio has a floating profit of about $9 million in the first three months of 2024. Most of this comes from her heavy investment in technology stocks, especially in Nvidia.

A simple way to track the trading trends of congressmen is to buy relevant ETFs. NANC and KRUZ track the stock trading of Democratic and Republican congressmen respectively. The former earned 30% in the past year, outperforming the S & P 500 index; the latter returned nearly 20% in the past year. The reason can be basically explained as Democrats invest more in technology stocks (which will soar in 2023), while Republicans invest more in banks and the oil industry.

In Pelosi's operations, options trading frequently appears, obviously achieving the dual purpose of risk management and leverage appreciation: through strategic options trading, Pelosi demonstrated how to effectively manage and diversify investment risks while pursuing high returns.

Introduction

Recently, the most hotly discussed topic among US retail investors on Reddit was Congressman Pelosi's record high in US stock holdings, with a half-year return rate close to 100%.

Pelosi last sparked a heated discussion in the US stock market circle when her family disclosed a transaction to the public at the end of last year, buying Nvidia Bullish options for nearly $2 million in mid-November. Just six months later, these options are now worth more than $4 million.

The timing of the purchase is so precise and the investment return is so rich. Is it because Pelosi deeply understands the value of NVIDIA, believes in AI, or simply believes in technology stocks? Not necessarily. The RockFlow investment research team briefly sorted out multiple subtle transactions of Pelosi and her family before.

In December 2020, Pelosi's husband, Paul Pelosi, bought Tesla Bullish options. A few weeks later, the US president announced a plan to replace federal government vehicles with electric vehicles. In March 2021, Paul heavily invested in Microsoft. Shortly after, it was reported that Microsoft received a $22 billion order for AR combat helmets from the US Department of Defense, and the company's stock price skyrocketed. In July of the same year, several US tech giants were investigated by Anti-Trust, and the market was like a startled bird. At this time, Paul went long on Google, and sure enough, Google was safe and its stock price rose by 20%. In December 2022, Paul sold a large amount of 30,000 shares of Google stock. Just one month later, the tech giant was sued for allegedly violating Anti-Trust practices.

This flexible buying and selling operation, anyone who sees it will admire Paul's "understanding of policy". Some media joked that the real "stock god" of the US is not on Wall Street, but on Capitol Hill. Someone in the well-known investment section WallStreetBets on Reddit simply named Paul's investment portfolio "insider investment portfolio" and mocked Pelosi: "Capitol Hill has gathered the best investment experts of our generation. We need to learn how to invest like a certain congressman."

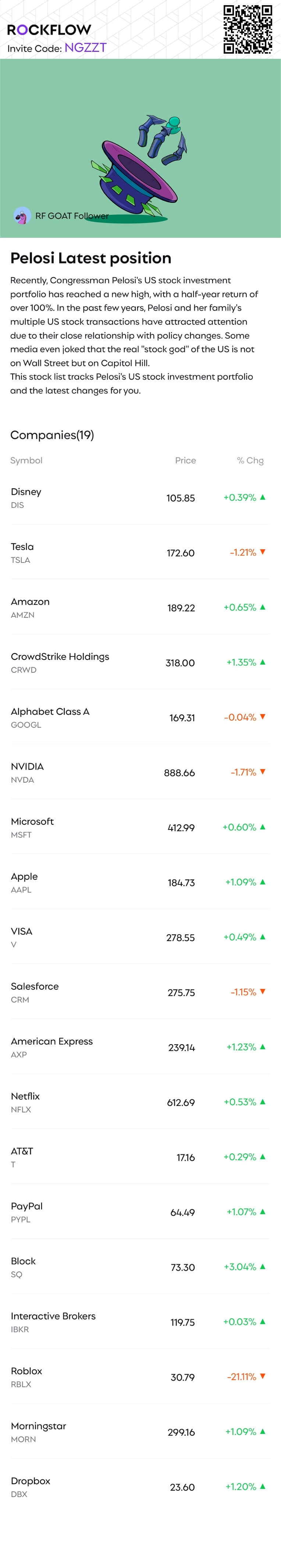

RockFlow recently launched a list of stocks held by many investment experts on Capitol Hill and Wall Street, including Pelosi. Scan the QR code below to track Pelosi's current holdings and latest trends:

So, why are Pelosi and her husband Paul (Speaker of the US House of Representatives and a senior Democrat) known as the "Capitol Hill Stock Gods"? What kind of uproar has the stock trading operations of such congressmen caused in the US investment community? Is there any simpler way for ordinary investors besides trying to track their operations? This article will provide the answer.

In addition, the RockFlow investment research team has previously conducted an in-depth analysis of the business status and investment value of multiple stocks such as Palantir, Adobe, and Coinbase. Please click to view.

- After NVIDIA, who will be the next early AI beneficiary?

- Adobe: AI beneficiary stock or Sora victim?

- Coinbase: Exchange, broker, crypto bank or a belief?

Why is "Capitol Hill Stock God" named?

According to a report, the trading volume of US stock options involved by US congressmen soared to a record $160 million last year, significantly higher than the $30 million in 2022. According to US media estimates, the 50 richest US congressmen are worth more than $4.80 billion. Based on the average annual salary of $174,000, they would need to work for 27,500 years to accumulate such huge wealth.

Do wealthy legislators who frequently trade stocks and options, some of which have shown amazing returns, know better than top hedge funds how to find investment opportunities and profit from them? Or is it just because they "know too much"?

According to relevant disclosure information, among these lawmakers, Nancy Pelosi ranks among the best investment performers on Capitol Hill.

In 2023, Pelosi's US stock holdings earned as much as $43 million. In the first three months of 2024, according to Quiver Quantitative's estimate, her investment portfolio made a profit of about $9 million. Most of this comes from her heavy investment in technology stocks, especially in Nvidia.

As a senior politician in the US, Pelosi has long held important leadership positions in the Democratic Party. She grew up in a political family, and her father served as the mayor of Baltimore. Pelosi was first elected to Congress in 1987 and has since represented California in Congress. In 2007, she became the first female Speaker of the House of Representatives in US history and was regarded by US media as the "woman closest to the US presidency" at the time.

In addition to political achievements, Pelosi and her husband Paul's precise operations in the stock market, especially their investments in technology stocks, have earned them the title of "Capitol Hill Stock God".

Taking Paul's purchase of 50 NVIDIA bullish options with an exercise price of $120 and an expiration date of December 20, 2024 on November 15, 2023 as an example, the trading profit exceeded $2 million. Her recent disclosed transaction is related to Palo Alto Networks. On February 12, 2024, she spent nearly $1.25 million to buy 50 Palo Alto Networks bullish options with an exercise price of $200 and an expiration date of January 17, 2025.

These options transactions show that the Pelosi family is not only good at selecting and timing technology stocks, but also can use reasonable leverage derivatives to maximize returns. At the same time, these options transactions choose relatively safe exercise prices and expiration dates, which are enough to attract professional investors' attention in risk management.

With the significant success of Pelosi's multiple US stock investments, the public has increasingly questioned her possible involvement in insider trading. Although Pelosi denies these allegations, the controversy surrounding her investment behavior is far from over.

Her US stock trading has attracted the attention of many legislators and lawmakers in recent years. Taking Missouri Senator Josh Hawley as an example, he proposed the "Preventing Elected Leaders from Owning Securities and Investments Act" in January 2023 as a response (the bill was later directly referred to as the "Pelosi Act"). Hawley said, "Although Wall Street and large technology companies work together with elected officials to get rich, hardworking Americans have paid a price. The solution is clear: we must immediately and permanently ban all members of Congress from trading stocks."

In addition, it is worth noting that according to Unusual Whales' report, Pelosi's return in 2023 is in stark contrast to that in 2022, when her investment portfolio net worth fell by 19.8%, worse than the performance of the S & P 500 index that year.

Why Are Officials Often Involved in Insider Trading?

Coincidentally, in addition to some US Democratic lawmakers represented by Pelosi, other party leaders have also been deeply involved in the suspicion of "insider trading", even triggering investigations by the US Securities and Exchange Commission (SEC) and the Central Intelligence Agency. One of the more well-known ones is Richard Burr, a senior US senator and Republican.

According to the US Broadcasting Corporation News Network and The Washington Post, Burr suddenly sold 33 stocks he and his spouse held, including several chain hotel stocks, worth $1.60 million, before the COVID-19 pandemic broke out on February 13, 2020.

Burr is a Republican senator from North Carolina, US. He is both the chairperson of the Senate Intelligence Committee and a member of the Senate Health Committee. In 2006, Burr pushed Congress to draft the Pandemic and All Hazards Preparedness Act, which was the legal framework for the US government's response to the COVID-19 pandemic.

On January 24, 2020, the US Senate held a closed-door briefing on the COVID-19 pandemic attended by all senators. Experts who provided the briefing information included CDC Director Redfield, National Institute of Allergy and Infectious Diseases Director Fauci, and other senior US health officials.

On February 7th, Burr confidently published an article saying:

"At this moment, the US is the most prepared to respond to a public health challenge like the COVID-19 pandemic than at any time in history. This is due to the work of the Senate Health Committee, Congress, and the Trump administration."

Six days later, he, who had been full of confidence before, seemed to smell risks that ordinary people couldn't see and chose to sell stocks heavily.

He reported the deal about two weeks later, on Feb. 27, for no other reason than US law requires officials to publicly disclose information about financial transactions within 45 days of making them.

A year later, Burr was investigated by the U.S. SEC to determine whether his previous sale of more than $1.60 million of stock violated federal insider trading laws.

According to the US Stop Trading on Congressional Knowledge (STOCK) Act of 2012, the insider trading ban applies to all members of Congress, congressional staff, and other federal officials.

Coincidentally, Burr was one of three senators who voted against it.

What else happened on February 27th?

According to a secret recording disclosed by a news station, Burr attended an entrepreneur gathering that day. From the details of the gathering, Burr told the attendees that the virus "is more aggressive in its spread than anything we have seen in recent history" and "may be similar to the 1918 flu pandemic".

Burr's luncheon is for entrepreneurs or elites whose businesses or organizations donated more than $100,000 to Burr's campaign in 2015 and 2016.

Burr's spokesperson explained that Burr's stock sale was made long before the market began to show signs of tension.

In fact, on the 27th, there were a total of 15 confirmed COVID-19 cases in the US. Trump also stated at a press conference that the COVID-19 pandemic has been exaggerated, the epidemic is "under control", and will soon "disappear".

Will ETFs of Congressional Stock Trading Become a New Investment Trend?

If you can't defeat them, then join them.

Since so many members of Congress may have obtained "insider information" in advance and traded based on it, and they must disclose it in a timely manner according to regulations, is it a good idea for other investors to closely monitor the trading of members of Congress or even directly follow their orders? Recently, RockFlow has launched a batch of exclusive stock holdings of well-known institutions on Capitol Hill and Wall Street, which can help investors timely understand the latest holdings and trends of investment experts.

In addition to direct copy trading ①, there is a simple way to track the transactions of members of Congress and their families - by purchasing related ETFs.

Last year, relevant institutions brought the idea of following members of Congress to the forefront. They launched two ETFs, the one tracking Democratic lawmakers' stock transactions was named NANC ("tribute" to House Speaker Nancy Pelosi), and the one tracking Republican lawmakers' stock transactions was named KRUZ ("tribute" to Senator Ted Cruz). The two have a simple common goal - to help investors track the transactions of members of different parties.

As an actively managed ETF, it requires constant buying and selling, and both charge investors a 1% management fee. Compared to passively managed funds, this fee is higher. However, their returns are still decent.

The ETF with the code NANC has consistently outperformed the S & P 500 index since its launch in 2023. It earned 30% in the past year and is nearly 80 million in size, which is not too small. The performance of this ETF is largely due to significant investments in major technology companies. Microsoft, Amazon, Apple, and Nvidia are the top four holdings, with only Microsoft accounting for nearly 10%. Together with Salesforce and Google, six stocks account for 32% of the total market value of the fund.

In contrast, the ETF KRUZ, which tracks Republican lawmakers, has been lagging behind the market. It has only risen nearly 20% since its establishment last year. The reason can be basically explained by Democrats investing more in technology stocks (which will soar in 2023), while Republicans invest more in the banking and oil industries.

Of course, it should be clear that, as mentioned earlier, given the insider trading and conflict of interest issues raised by members of Congress' stock trading, according to the Stock Act passed in 2012, members of Congress are required by law to submit relevant stock trading information to the US SEC within 45 days.

Therefore, whether it is directly copying or buying related ETFs, for ordinary investors, the risk is that the market may undergo huge changes from actual trading by legislators to public trading. Moreover, compared with the profits of stock trading, the fines for non-compliance with rules are negligible.

Conclusion

Through in-depth analysis of Pelosi and other members of Congress' investment performance and trading strategies over the past few years, the RockFlow investment research team believes that we can draw several important insights.

On one hand, technology stocks are still an important area for creating value. Pelosi's heavy investment in many technology stocks (and the resulting huge profits) proves the value and growth potential of the technology industry in the current US stock market. Including the AI boom led by Nvidia, it will continue to bring returns to investors in the long term.

Secondly, in Pelosi's operation, options trading frequently appears, obviously achieving the dual purpose of risk management and leverage appreciation: through strategic options trading, Pelosi demonstrated how to effectively manage and diversify investment risks while pursuing high returns.

Thirdly, market insight and strategic selection are the keys to success: Pelosi's investment success is not only based on her selection of individual stocks, but more importantly, on the long-term trend of the US stock market and Pelosi's perfect execution of investment strategies.

About the Author

The RockFlow research team specializes in long-term analysis of high-quality companies in the US stock market, as well as emerging markets in Latin America and Southeast Asia, focusing on industries with high potential such as cryptocurrencies, biotechnology, and more. The core members of the team come from top technology companies and financial institutions including Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, and CITIC Securities. Many of them have graduated from leading universities such as Massachusetts Institute of Technology (MIT), University of California, Berkeley, Nanyang Technological University, Tsinghua University, and Fudan University.

You can also find us on these platforms: