Highlight:

Lululemon's early enthusiasm originated from a community-driven marketing strategy and a brick and mortar store configuration with a clear sense of purpose. The ambassador and Lulu have a mutually beneficial symbiotic relationship. All of Lulu's brick and mortar stores revolve around establishing, cultivating, and enhancing exclusive experiences. These offline brick and mortar stores and exclusive experiences later became the foundation for Lulu's transition to online channels.

In 2023, Lulu's revenue will only account for less than 20% of Nike's, but its profits will account for 30% -40% of Nike's. The core reason why Lulu's profitability and efficiency far exceed Nike's is that it only spends 10% of Nike's advertising expenses, which also indirectly proves the significant effect of its community-driven marketing strategy and vertically integrated retail.

Fashion comes and goes quickly, usually driven by short-term social trends, rarely driven by functionality or necessity; while mainstream trends will exist for a longer time, and over time, trends will become stronger and truly solve problems. For Lululemon, it has already completed the advancement from fashion items to large-scale mainstream brands.

Introduction

Lululemon (hereinafter referred to as Lulu) used to be a very outstanding company. In 2005, Lulu's revenue was $40.70 million. 15 years later, its revenue has grown 100 times, and the Compound annual growth rate is as high as 35%. In comparison, Amazon's this indicator is only 28%.

But the myth it created seems to be stalling. At the end of 2023, Lulu's market value once climbed to an all-time high of $64.80 billion, but its stock price has continued to decline since then. Not long ago, on May 21st, its Chief Product Officer announced his resignation, and Lulu was forced to restructure its product and brand teams. The next day, the stock price plummeted by more than 7%.

At the same time, the core concern surrounding Lulu is the encirclement of "OEM" and the prevalence of substitution, which has led to a decline in expected revenue growth. It seems that male products have not taken over the growth baton well. For a while, there are more and more doubts about "not being able to beat substitution and not being able to cut men".

As of the close on May 30th, Lulu's market value has reached $37 billion, down $27.80 billion from its historical high, a drop of over 40%. How should we understand Lulu's value and this crisis? Can it still turn the tide? Is now a buying opportunity for the company's value to show? RockFlow's research team will provide answers to these questions in this article.

In addition, RockFlow has previously delved into the development history, current business status, and investment value of multiple high-quality US stock companies. Please click to view.

- When will C3.AI return to the uptrend?

- How did Faraday Future become a Meme stock? Which will be the next?

- After NVIDIA, who will be the next early AI beneficiary?

Early Lululemon worship and user frenzy

In 1998, Chip Wilson founded Lulu in Vancouver, Canada. At the beginning of attending yoga classes, he noticed that the women in the class were wearing transparent and thin dance clothes, which were "miniature versions of men's sports shirts and T-shirts". He wanted to provide better clothing choices for women, and Lulu was born.

By any standard, Lulu's yoga pants can be regarded as a "revolution" in women's clothing. Although initially aimed at the yoga crowd, it quickly expanded the Niche market and became more popular. In the era when fast fashion dominated the consumer retail industry, Lulu took a different path.

In hindsight, Lulu's rise is mainly due to changes in three factors: product, marketing, and channels.

In terms of products, the biggest feature of Lulu yoga pants is "extremely comfortable". More importantly, this comfort does not come at the expense of fashion sense. The coexistence of comfort and fashion is the key to attracting users for Lulu. In order to protect its intellectual property and innovative achievements, Lulu has applied for patents for these special fabrics. However, the popularity of yoga pants has attracted competitors to rush in and launch competing products: old rivals Nike, Under Armour, Reebok, Decathlon, GAP's women's sports brand Athleta, and new yoga clothing brands Vuori and Alo all have their own brand yoga clothing.

Obviously, innovation alone cannot become a truly lasting Competitive Edge, let alone continue Lulu's decades-long business miracle. Although Lulu has indeed received high praise for innovation, education, and revolution in women's dressing styles in the West (and increasingly in South East Asia), the more important reasons for its sustained development are marketing strategies and channels.

In terms of marketing, Lulu has chosen a completely different approach from Nike. The biggest difference between Nike and Congeneric Products is not the better quality of their shoes, but their ability to gain recognition from superstars. Some even believe that Nike is not a sports company, but essentially a marketing company that happens to sell sports shoes.

Lulu understood this huge gap from the beginning, so it chose a more community-driven marketing strategy. It has more than 2,000 brand ambassadors worldwide, of which less than 50 are global ambassadors (mostly professional athletes, but not as well-known as Nike endorsers), and the vast majority are store ambassadors, who are usually local yoga coaches or fitness experts.

What to do after becoming an ambassador? Essentially, ambassadors are Lulu's spokespersons in their respective communities. They can arrange free in-store yoga classes and hold a series of in-store activities every month based on different interest themes. What can ambassadors get? They can experience new products and activities first, and Lulu will also listen to feedback on design and product decisions. Ambassadors also have the opportunity to meet new friends and potential customers through Lulu stores to develop their business.

Obviously, there is a mutually beneficial symbiotic relationship between the ambassador and Lulu. Lulu allows a third party to promote products to customers, which is more authentic than the Super Celebrity Endorsement (which obviously receives huge financial rewards). Given Lulu's influence, these ambassadors themselves are indeed loyal fans, which makes its connection with customers more solid and ensures a high conversion rate.

Many loyal fans of Lulu like in-store activities led by store ambassadors because it provides a sense of mission for Lulu's brick and mortar store, not just a shopping place. Lulu's brick and mortar store can effectively use ambassadors to attract customers and integrate them into the Lulu fan circle, which is very difficult to replicate. By cultivating a community-driven strategy of store ambassadors, Lulu has effectively opened up new marketing avenues.

In terms of channels, Lulu's important feature is the vertical integration of retailers. Unlike Nike, Adidas, and Under Armour, customers cannot purchase Lulu products from third-party stores, but need to go to Lulu stores or order online.

There are four types of Lulu stores: 1) traditional stores; 2) seasonal stores or pop-up stores (often to test the waters before launching larger stores, or local markets/locations do not make much economic sense to establish larger stores, but can still generate traffic counting and cater to local demand); 3) co-located stores that sell both men's and women's products after expansion and renovation; 4) giant experience stores: including meditation spaces, various offline course venues, etc.

All of Lulu's brick and mortar stores have a very clear sense of purpose, centered around establishing, cultivating, and enhancing exclusive experiences. Chip Wilson once mentioned why Lulu prefers vertical retail over wholesale retail. The main reason is to ensure brand effectiveness, and another reason he mentioned is very interesting - in the wholesale model, retailers just hope that the brand will continue to provide them with best-selling products. In this model, product design/style is difficult to innovate and take risks. Only in the vertical retail model, Lulu has greater control.

And these offline brick and mortar stores and exclusive experiences have also become the confidence for Lulu to transfer to online channels. In the 2015-2020 fiscal year, Lulu was a direct beneficiary of obvious trends such as e-commerce and DTC. In the 2015 fiscal year, DTC accounted for 19% of its total sales, and by the 2020 fiscal year, this number had grown to 31%. More importantly, Lulu did not sacrifice its profits in addition to achieving high growth rates in e-commerce and DTC channels.

From fashion items to large-scale mainstream brands

Nothing illustrates how Lulu has quietly transformed from a fashion brand to a mainstream brand on a large scale more than a comparison with Nike.

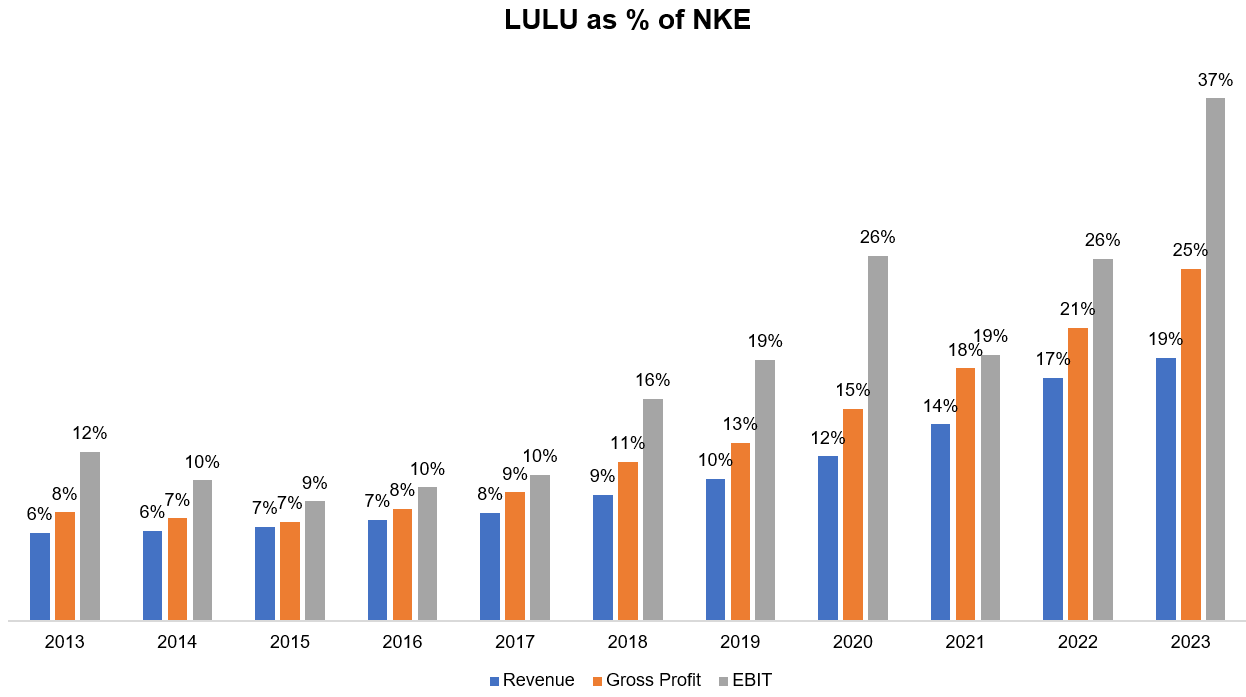

As shown in the above figure, from 2013 to 2018, Lulu's revenue and gross profit as a percentage of Nike's revenue and gross profit have always been in the high single digits (6% -9%). Due to Lulu's higher operating profit margin than Nike's, the percentage of Earnings Before Interest And Taxes (EBIT) to Nike's Earnings Before Interest And Taxes is 10% -16%.

But things have changed since 2019 and 2020. Especially in 2023, in terms of revenue, Lulu only accounts for 19% of Nike, with a gross profit ratio of 25% and an Earnings Before Interest And Taxes ratio as high as 37%.

The core reason why Lulu's profitability and efficiency far exceed Nike's is that it only spends 10% of Nike's advertising expenses, which indirectly proves the significant effect of its community-driven marketing strategy and vertically integrated retail. Compared with global top sports brands like Nike, Lulu's performance in the past 3-4 years has been particularly outstanding.

It is worth mentioning that during the epidemic, Lulu, as an omni-channel product retailer, became one of the key beneficiaries.

As mentioned above, although it attaches great importance to offline brick and mortar stores and experiences, Lulu is actually a vertically integrated retailer with a fairly strong e-commerce business. Lulu's brick and mortar store has huge online value because consumers are more likely to trust the brands they see in the real world. Brick and mortar stores significantly reduce online CAC by helping to improve marketing efficiency (higher click-through rates, higher ad quality scores). In addition, brick and mortar stores also support BOPIS (online purchases, in-store pickup) and BORIS (online purchases, in-store returns), which are also valued by consumers.

The fact proves that Lulu's vertical integration and direct relationship with customers through omnichannel experience have and will help it create lasting advantages in future long-term competition.

Of course, Lulu should not forget the threat from emerging brands such as Alo and Vuori, but do not underestimate the current situation where Lulu has advanced from a fashion item to a large-scale mainstream brand. These rising stars can achieve some success in their own Niche Market, but Lulu's structural advantages are actually greater.

Lulu's revenue growth over the past decade proves its achievements.

2024 is a year of adjustment for Lulu. The management expects revenue to achieve low double-digit growth this year, which directly led to the recent decline of the stock. However, this is mainly due to the market being too accustomed to its 20% or even 30% growth in the past few years. After the excessively rapid growth in 2021-2022, Lulu needs a transitional period to digest the slowdown in performance growth.

Executive departures and recent controversies

Recently, Lulu issued a press release stating that Chief Product Officer Sun Choe will leave after many years of service and seek new development. Lulu's global creative director will assume his responsibilities. In addition, the company is forming a new marketing and branding team to "expand global and regional market size". Nikki Neuburger has been appointed as Chief Brand Officer.

There is a sentence in the press release that has aroused market curiosity.

The strategic organizational change aims to support the company's short-term and long-term growth plans, accelerate product innovation, and further support its marketing strategy.

For a long time, Lulu has maintained a leading position and timely launched new products in response to market trends, which is why it can handle the fashion cycle. This sentence implies that its problems are somewhat similar to Nike's problems, rather than the inventory shortage and other details mentioned in the last quarter's financial report meeting.

From a fair perspective, Lulu's Price-To-Earnings Ratio is currently at a low point in several years, while its long-term growth plan remains stable. The fact that its performance has not fully met expectations is not solely its fault, but rather a challenge to consumer discretionary spending.

In fact, as early as 2010-2012, a well-known hedge fund manager shorted Lululemon and said, "To me, it looks like fashion-only related to yoga clothes. This trend will eventually pass, and its high valuation will prove to be a bubble."

But now we can confirm that Lululemon, which was once thought to rely solely on yoga fashion items, has long since transformed into an important and well-known consumer brand that caters to the current consumer demand for "sports and leisure" (although current CEO Calvin McDonald prefers the term "tech clothing").

At the same time, Lululemon is looking beyond its previous main consumer group, trying to attract the attention of male consumers. A variety of sports casual pants, jackets, casual wear, accessories, and men's shoes have been launched one after another, all exploring the acceptance of this new group.

This shift coincides with international expansion, with the number of stores outside North America increasing from 11 in 2010 to 255 today (the total number of stores increased from 133 to 686 during the same period). Emerging Markets (especially China) may encounter growth resistance in stages, but it does not hinder its long-term expansion pace.

Conclusion

Fashion comes and goes faster, and they are usually driven by short-lived social waves, rarely out of functionality or necessity; in contrast, mainstream trends will exist for a longer period of time, and over time, trends will become stronger and truly solve problems.

Lululemon has already proven to the outside world that it has developed from a trend-following company to a sustainable business. The RockFlow research team believes that Lulu is an excellent company. The company operates well and the brand is one of the most resilient brands in the global retail industry.

Lululemon will release its latest quarterly financial report after the US stock market closes on Wednesday. The market expects Lululemon's latest quarterly revenue to reach $2.198 billion, a year-on-year increase of 9.9%; the expected earnings per share are $2.42, a year-on-year increase of 6.0%. The growth rate has fallen significantly compared to a year ago, and consumer discretionary spending is facing challenges. Sports brands including Nike and Lululemon have faced challenges this year.

In this financial report, investors will focus on the growth rate and latest expectations of the US market, as well as the revenue growth rate and proportion of Emerging Markets such as China. In 2023, Lululemon's revenue growth rate in the US market was only 11.9%, while the revenue growth rate in the Chinese market reached 67.2% (twice the growth rate in 2022), and the proportion of revenue contributed by China also increased from 7% to 10%.

Certainly, Lululemon's future growth path will face more challenges. As Lulu grows larger and expands from yoga to other markets and products, it may eventually compete more directly with Nike/Adidas.

About the Author

The RockFlow research team specializes in long-term analysis of high-quality companies in the US stock market, as well as emerging markets in Latin America and Southeast Asia, focusing on industries with high potential such as cryptocurrencies, biotechnology, and more. The core members of the team come from top technology companies and financial institutions including Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, and CITIC Securities. Many of them have graduated from leading universities such as Massachusetts Institute of Technology (MIT), University of California, Berkeley, Nanyang Technological University, Tsinghua University, and Fudan University.

You can also find us on these platforms: