Highlight:

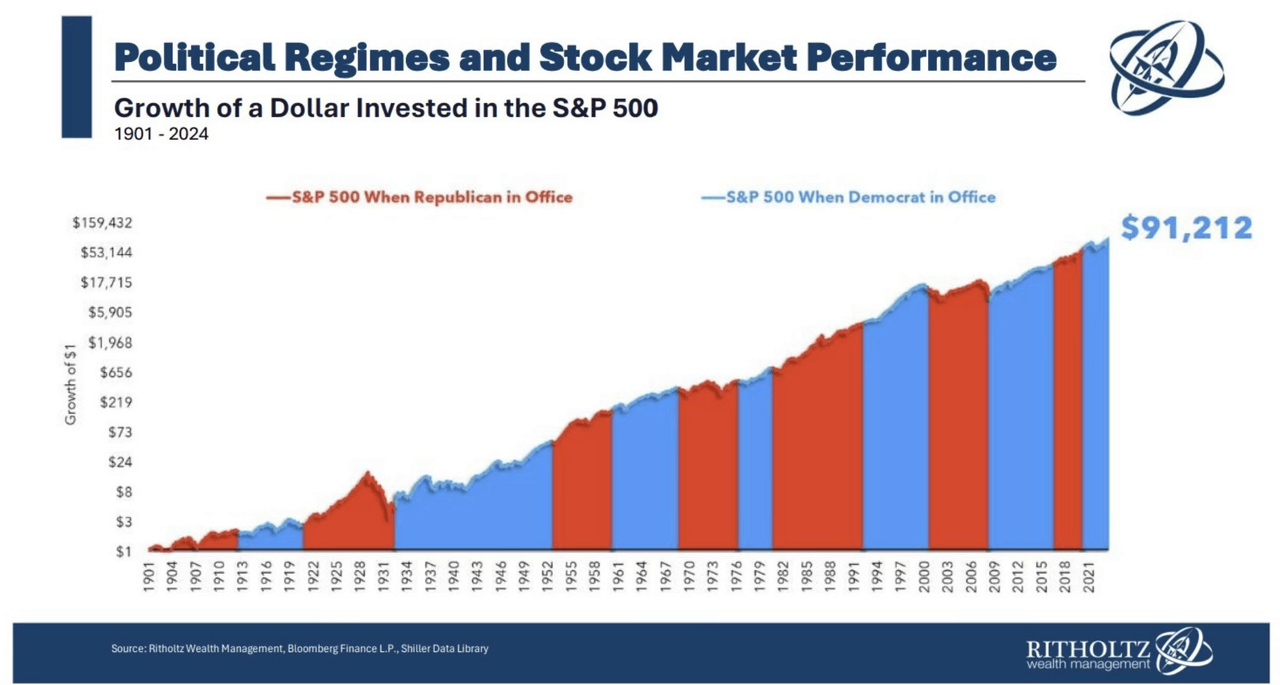

The historical trend data of the S & P 500 index since 1901 shows that regardless of which party is in power in the White House, the index will rise in the long run.

The market generally believes that, given Trump's current stance, he supports policies such as cryptocurrency, traditional energy, infrastructure buildings, and tax cuts; while if Harris takes office, he tends to favor welfare policies, healthcare, green energy, US export growth, housing support, etc.

Currently, the US stock market is picking up the "Trump trade". Taking DJT, a social media company under Trump, as an example, the stock has doubled since October; Phunware has risen more than 200% this month; in addition, cryptocurrency concept stocks publicly supported by Trump have collectively rebounded, and Bitcoin has risen more than 10% since its low point in the month.

Introduction:

With the Federal Reserve previously announcing its first interest rate cut since 2020, the market's attention is turning to the next heavyweight event - the US election on November 5th.

The following chart shows the trend of the S & P 500 index in the US stock market since 1901. Red represents the Republican era in the US, while blue represents the Democratic era. Historical data shows that regardless of which party is in power in the White House, the index will rise in the long run.

However, due to the different policy tendencies held by candidates from different parties, the appointment of the new president will have an important impact on different sectors of the US stock market.

Recent public opinion polls show that Harris and Trump are evenly matched in the presidential election. In the ABC/Ipsos poll, Harris leads by 4 percentage points, while Trump has a slight advantage in other polls. This indicates that Harris' approval rating has declined since the last New York Times poll in early October.

This is also the origin of Goldman Sachs, JPMorgan Chase, and Deutsche Bank's collective statement in recent weeks, and Wall Street's comprehensive bet on the "Trump trade". JPMorgan Chase's report on the 17th stated that hedge fund funds showed a strong preference for Republican themes, while Renewable Energy, a clear representative of the Democratic Party's victory, was heavily sold off in the previous weeks.

The current market generally believes that, given Trump's current stance, he supports policies such as cryptocurrency, traditional energy, infrastructure buildings, and tax cuts; while if Harris takes office, he tends to favor welfare policies, healthcare, green energy, US export growth, housing support, etc.

RockFlow has detailed the different positions of the two and their impact on related sectors, and listed relevant concept companies and targets to help everyone discover more investment opportunities from this important event.

If you are interested, you can learn more about historical articles:

- Learn Wealth Management in 5 minutes and easily buy Nasdaq ETF with AI broker RockFlow | RockFlow

- The real "Investment experts" of the US is not on Wall Street, but on Capitol Hill? | RockFlow

- Why can Nvidia break through 4 trillion? | RockFlow

1. Trump Trade

Recently, as Harris' lead over Trump in the polls narrows, the latest odds in the gambling market also show that Trump has surpassed Harris. The market is picking up the "Trump trade" again.

Taking Trump's social media company DJT as an example, the stock has doubled since October. Phunware has risen more than 200% this month. In addition, cryptocurrency concept stocks publicly supported by Trump have collectively rebounded, and Bitcoin has risen more than 10% since its low point in the month.

RockFlow's research team previously released a Te Trump stock list, which includes important targets related to the "Trump trade", including DJT, a media platform founded by Trump, PHUN, which developed campaign software for Trump's team in the 2020 presidential election, RUM, a video platform where Trump supporters gather, related military stocks Lockheed Martin and Raytheon Technology (expected to benefit from increased military spending after Trump takes office), CAT (expected to benefit from Trump's desired tax cuts and infrastructure policies), Tesla (Musk is a loyal supporter), etc.

In addition, given Trump's political stance and policy preferences, more pharmaceutical stocks (such as Eli Lilly) and bank stocks (such as Goldman Sachs and JPMorgan Chase) are expected to benefit from his re-election.

Specifically, investors can pay attention to the following four sections:

Trump supports cryptocurrency, which may benefit MSTR, COIN, and MARA.

Trump attended the Bitcoin 2024 conference and expressed his views on cryptocurrency. He claimed that if he re-enters the White House, he will strive to build the US into the world's "cryptocurrency center" and "Bitcoin power". He promised to promote the mining and popularization of Bitcoin under his governance to ensure the US's leading position in the global cryptocurrency industry. Trump also announced that the federal government will retain all its Bitcoin holdings, about 210,000, accounting for 1% of the total Bitcoin, making the US the first country in the world to include Bitcoin in its national strategic reserves, giving Bitcoin a strategic value similar to gold.

- Trump supports traditional energy, which may benefit BKR, XOM, and CVX.

This year, the Republican Party released a new policy platform: in terms of energy policy, its position has shifted from "supporting the development of all non-subsidized tradable energy" to "comprehensively increasing energy production, simplifying approval processes, eliminating inappropriate restrictions on the oil, gas, and coal markets, and achieving US energy self-sufficiency; opposing green policies and abolishing electric vehicle subsidies". The Republican Party led by Trump has higher requirements for energy independence, and its support for traditional energy and suppression of new energy are also more obvious.

Trump supports relaxing financial regulation, which may benefit JPM, GS, and BAC.

Trump's regulatory attitude towards Financial Institutions, especially banks, tends to relax restrictions and reduce requirements for indicators such as Capital Base and Capital Adequacy Ratio. He believes that relaxing financial regulation can release the capital stock in the banking system, thereby promoting banks to increase loan issuance. In addition, Trump's proposed tax reform policy also helps to improve the profitability of financial enterprises.

- Trump plans to strengthen infrastructure buildings, which may benefit CAT

The infrastructure building plan advocated by the Trump administration is also a focus of market attention. The goal of the plan is to comprehensively upgrade and transform the US infrastructure through large-scale public and private investment. His advocacy of increasing investment in infrastructure is expected to bring benefits to industries closely related to infrastructure building, including transportation, construction, communication, and material supply.

2. Harris Trade

In contrast to Trump, Kamala Harris emphasizes inclusive economic growth, Sustainability, and addressing wealth inequality. If Harris takes office, investors will need to focus on the following beneficiary sectors:

Harris advocates boosting US exports, which may benefit WMT and AMZN.

Harris takes a more moderate and friendly stance on tariff issues than Trump. She believes that Trump's tariff policy will lead to increased consumer spending on gasoline and daily groceries, which will put pressure on the economic situation of middle-class families. She advocates promoting the growth of US exports. This attitude may have a positive impact on global trade, especially for large US multinational companies with extensive business and overseas revenue in the global market.

Harris calls for more housing support, which could benefit SWK.

According to previous reports, Harris called for the construction of 3 million new housing units in the next four years to cope with the high housing prices caused by the shortage of supply, and plans to cancel the tax incentives for Wall Street Financial Institutions to cope with the rapid rise in housing prices. On the demand side, Harris plans to provide higher down payment assistance and tax credits for first-time homebuyers to stimulate the market. These measures have a positive impact on residential construction suppliers.

Harris supports clean energy, which may benefit FSLR, ENPH, and CSIQ.

With Harris' support, the Biden administration successfully signed the landmark Inflation Reduction Act. In addition, she proposed injecting $20 billion into the Environmental Protection Agency's greenhouse gas reduction fund to promote the growth of clean energy. She emphasized strict regulation of oil companies and other polluting companies, filed lawsuits against multiple fossil fuel companies, including a pipeline company over oil spills, and investigated ExxonMobil's possible misleading behavior on climate change issues. Harris may be more proactive in promoting clean energy than Biden.

Harris supports the legalization of , which may benefit TLRY and CGC.

The Democratic Party is working hard to legalize at the federal level, and Harris also supports it. In the previous vice presidential debate, she stated that the Biden-Harris administration promised to "legalize and clear the criminal records of those convicted of -related crimes." Harris also bluntly criticized the existing restriction policy as "unreasonable" and called on the US Drug Enforcement Administration (DEA) to reclassify . Therefore, if Harris wins, the industry may become one of the main beneficiary industries.

Conclusion

RockFlow's research team believes that the upcoming US presidential election will bring new investment opportunities to the US stock market. If they are optimistic about Trump's election, they can pay attention to opportunities in industries such as cryptocurrency, traditional energy, and infrastructure building. If they believe Harris will ultimately win, they can invest in concept companies related to healthcare, green energy, and housing support.

The targets involved in the "Trump Trade" and the "Harris Trade" will continue to generate heated discussions in the next two weeks. Only by deeply understanding the policy strategies and different preferences of the two candidates can investors effectively avoid investment risks and seize market opportunities.

Author Profile:

The RockFlow research team has a long-term focus on high-quality companies in the US stock market, emerging markets such as Latin America and Southeast Asia, and high potential industries such as encryption and biotechnology. The core members of the team come from top technology companies and financial institutions such as Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, CITIC Securities, etc. Most of them graduated from top universities such as Massachusetts Institute of Technology, University of California, Berkeley, Nanyang Technological Institute, Tsinghua University, and Fudan University.

Additionally, you can also find us on these platforms: