Highlight:

The launch of the Bitcoin spot ETF has brought in billions of dollars in traditional funds in the past three months, effectively helping the Bitcoin price reach a historical high of $73,000.

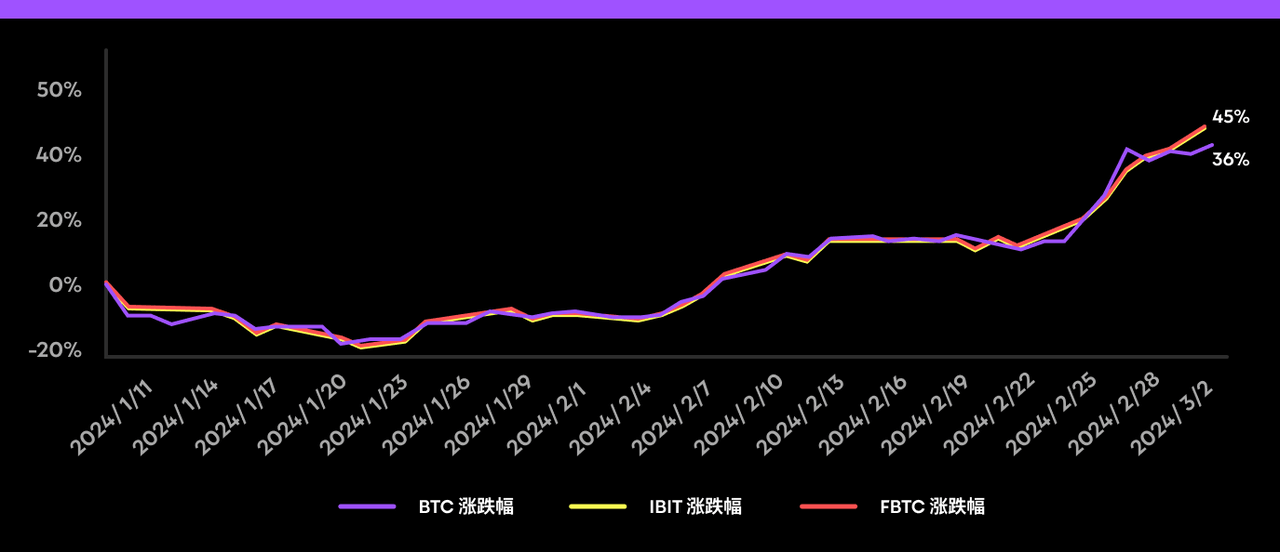

The price of Bitcoin spot ETF closely follows Bitcoin itself. Within three months of launch, BlackRock IBIT and Fidelity FBTC achieved a return of nearly 45% (other smaller ETFs also basically matched this return). The bull market of Bitcoin is consistent with the global liquidity cycle and the Bitcoin halving cycle. The adoption of spot ETFs means that the cryptocurrency industry is entering a "turning point" stage - it will be more integrated with the traditional financial system.

2024 is the year when Bitcoin becomes mainstream.

In January, the US SEC approved Bitcoin spot ETFs from dozens of publishers represented by BlackRock. Many people believe this is a mature moment for the emerging asset class of Bitcoin. Bitcoin has officially landed on Wall Street.

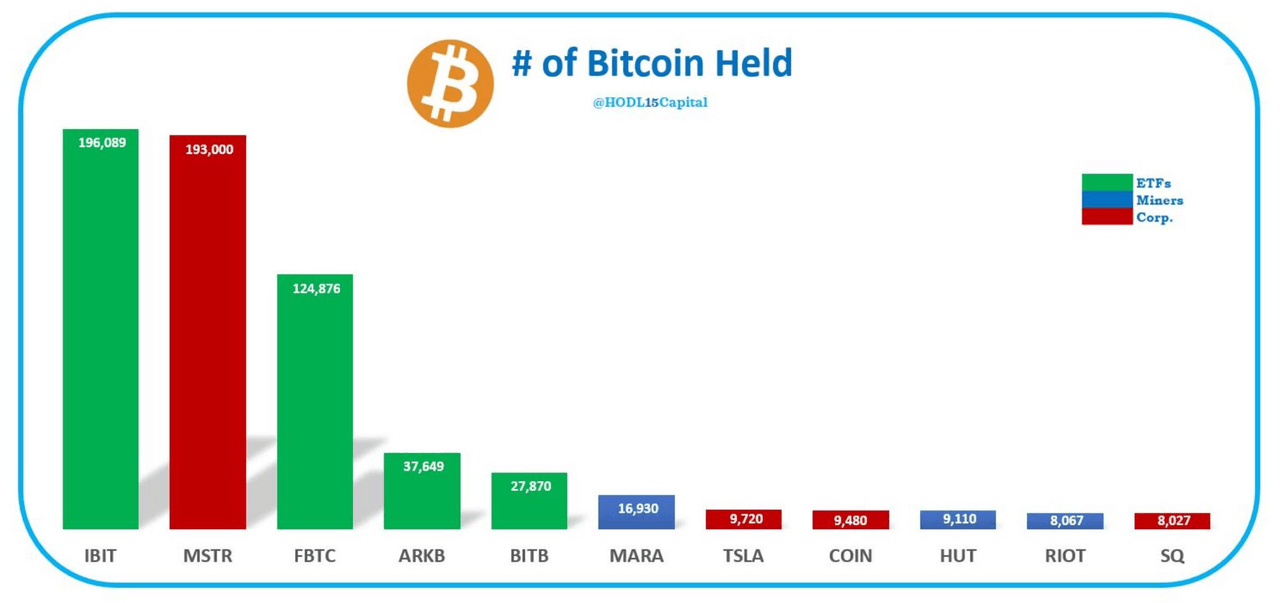

BlackRock's IBIT quickly became the leader. It reached a new record of $10 billion in just 7 weeks. The previous record belonged to SPDR's gold ETF - GLD, which took 27 months. In less than three months, IBIT's scale approached $18 billion, and the second-ranked Fidelity's FBTC has also broken through the $10 billion mark.

This article will delve into the market's enthusiasm and expectations since the launch of the Bitcoin spot ETF three months ago. As an emerging product category, why do investors favor it so much? What is its current development status? What impact has it had on the price of Bitcoin?

The superiority of Bitcoin ETFs

In terms of results, the Bitcoin spot ETF has fully achieved the effect of following the price fluctuations of Bitcoin. Since its launch on January 11th, BlackRock IBIT and Fidelity FBTC have achieved a return of nearly 45% in about three months (other smaller ETFs have also basically matched this return).

One question that investors are very concerned about is why they buy Bitcoin through ETFs instead of directly owning Bitcoin through Coinbase and others?

RockFlow research team has summarized five advantages of Bitcoin spot ETF:

Low cost: Compared to buying Bitcoin through encrypted platforms, buying Bitcoin ETFs has lower costs. Stock trading reduces the transaction fees and friction of encrypted trading and deposits and withdrawals. Moreover, many Bitcoin ETFs now have no transaction fees, and the US stock commission is very low and can be ignored.

Safety: Compared to buying and storing Bitcoin by oneself, the security of Bitcoin spot ETF is more guaranteed. If assets are damaged, the Bitcoin custodian will compensate investors based on commercial insurance. Taking BlackRock IBIT as an example, its prospectus states:

Direct investment in Bitcoin requires the investor to decide on the storage method (encrypted wallet or encrypted exchange), which incurs certain risks (such as stolen or lost private keys). Holding Bitcoin spot ETFs is different, as investors do not need to bear management risks, which will be the responsibility of the ETF custodian.

3)Convenience: ETFs can alleviate the hassle of opening accounts on multiple platforms and the complexity of tax reporting. For most ordinary people, buying Bitcoin through the same securities firm as buying stocks is much more convenient than buying it on an encrypted platform.

Compliance: Bitcoin itself may not meet the needs of some professional investment institutions or advisors' clients. Before the emergence of spot ETFs, Bitcoin futures ETFs used to be an option. However, obviously, spot ETFs have a wider audience and their regulatory compliance brings additional security.

Diversity: Although Bitcoin spot ETFs currently only offer risk exposure to a single asset (Bitcoin), it can be imagined that these funds are expected to offer diverse investment categories in the future. This diversification may further expand its appeal.

Bitcoin spot ETF provides a cheaper, safer, more compliant, and simpler investment path. At the same time, as more traditional institutions include it in the Asset Allocation category and launch it to users, we will also see more new funds arrive.

How does Bitcoin ETF affect Bitcoin itself?

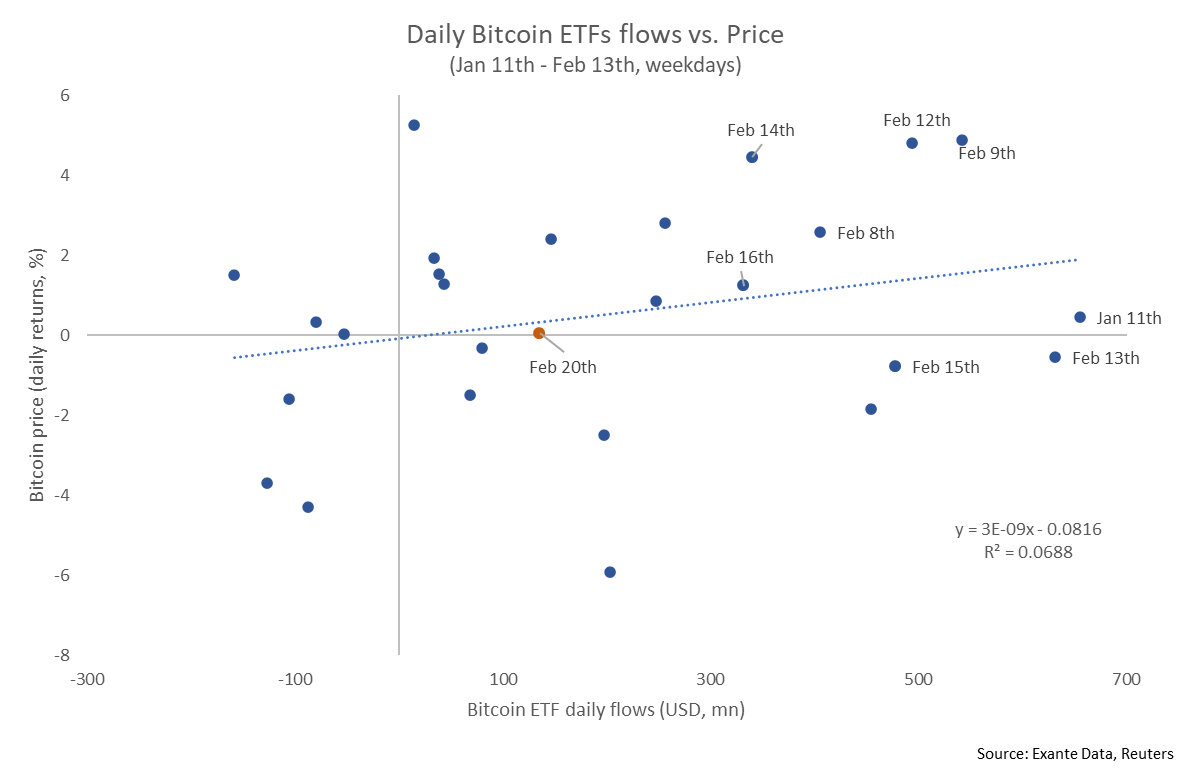

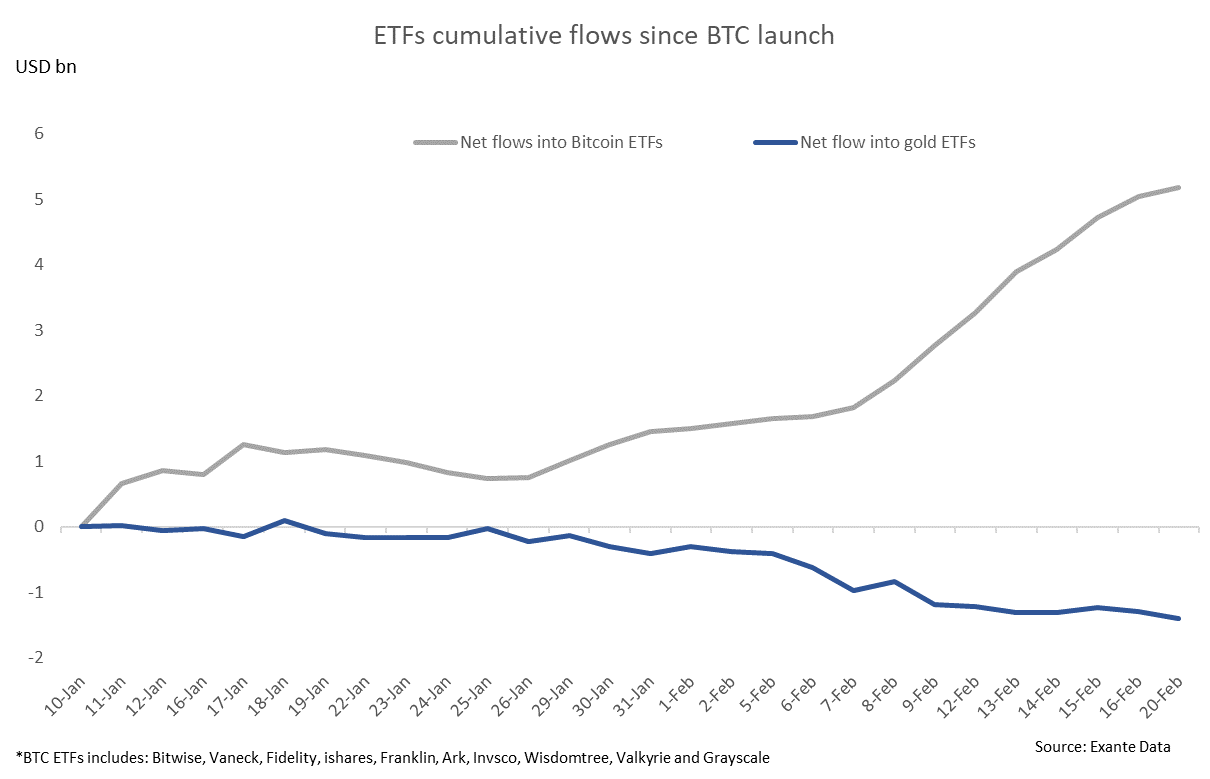

The following chart shows the correlation between the inflow of funds into the Bitcoin ETF and the price of Bitcoin. About ten days after its launch (January 11th to 23rd), the price of Bitcoin fell by 15%, which to some extent dampened the enthusiasm of fund inflows. However, in the next three weeks, the price of Bitcoin rose by about 30%, driving a large amount of funds into the cryptocurrency market.

As mentioned above, after three months of launch, BlackRock IBIT and Fidelity FBTC have reached $180 and $10 billion respectively. The total size of the Bitcoin spot ETF accounts for more than 4% of the current total supply of Bitcoin. We believe that the influx of off-exchange funds has played an important role in maintaining Bitcoin buying and responding to seller pressure from long-term holders taking profits.

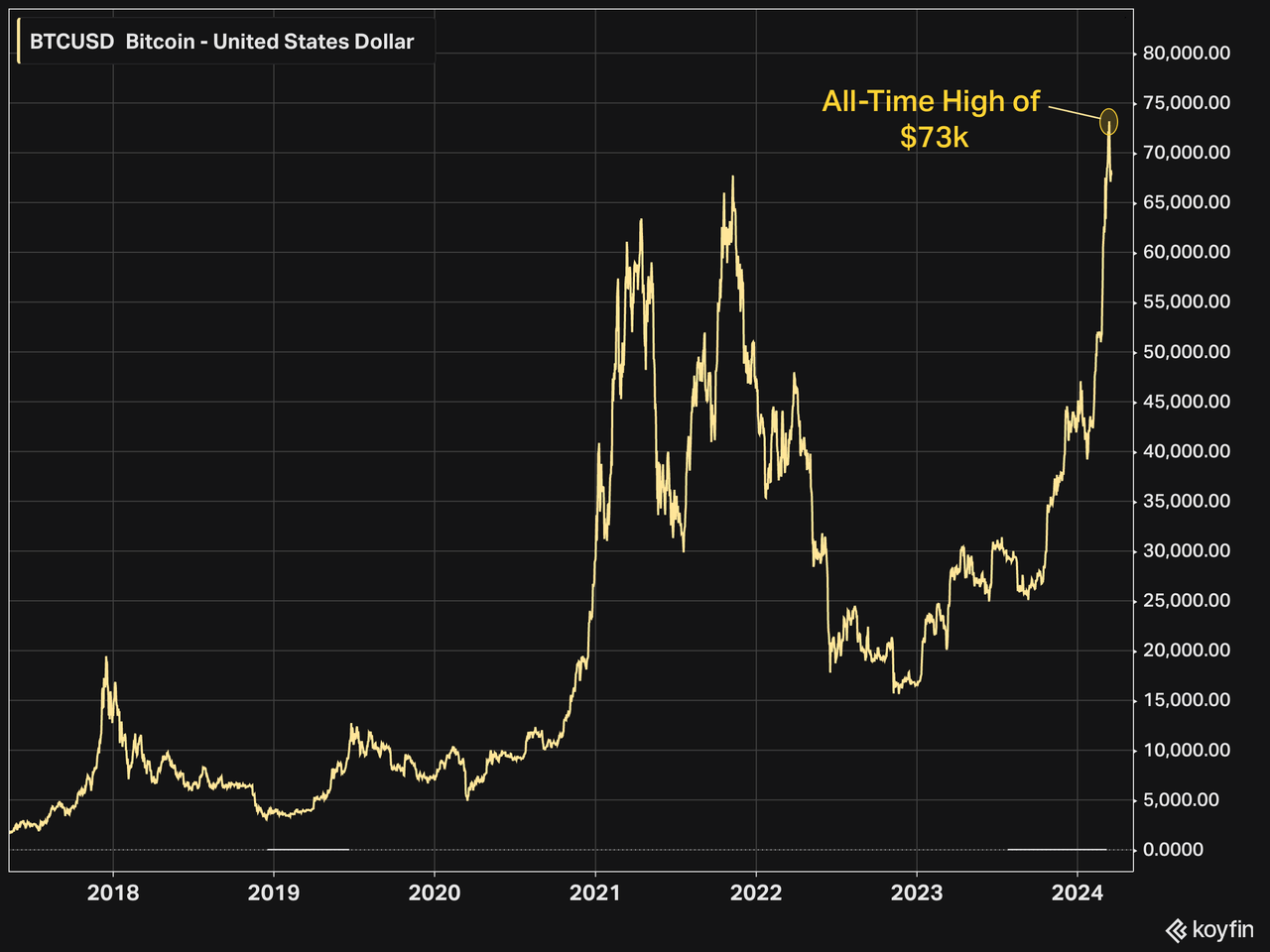

At the same time, the price of Bitcoin also hit a historical high of $73,000 due to the influx of billions of dollars in traditional funds - this is the fourth historical high reached by Bitcoin after $19,450 in 2017, $63,400 in April 2021, and $67,700 in November 2021.

Looking at another number, the amount of funds raised by US VCs in 2023 is about $67 billion. At this pace, BlackRock IBIT alone (just one of the 11 existing Bitcoin spot ETFs) is expected to match the total financing of all US VCs last year.

Separately, according to The Block, Bitcoin spot ETF trading volume nearly tripled in March to $111 billion compared to $42 billion in February.

February was the first full trading month for the product since its launch on January 11th. The increase in trading volume in March highlights people's increasing interest in new financial instruments, with a scale more than twice that of February and January combined. So, how big will the trading volume be in April? It's worth looking forward to.

Is Bitcoin ETF eroding the scale of gold ETF?

The traditional tool for fighting inflation is gold, but later there was a new option called Bitcoin, which is a "digital gold". In the past period of time, as the price of Bitcoin itself has risen, the price of gold has also repeatedly hit new highs. Some investors wonder if there may be competition between the two?

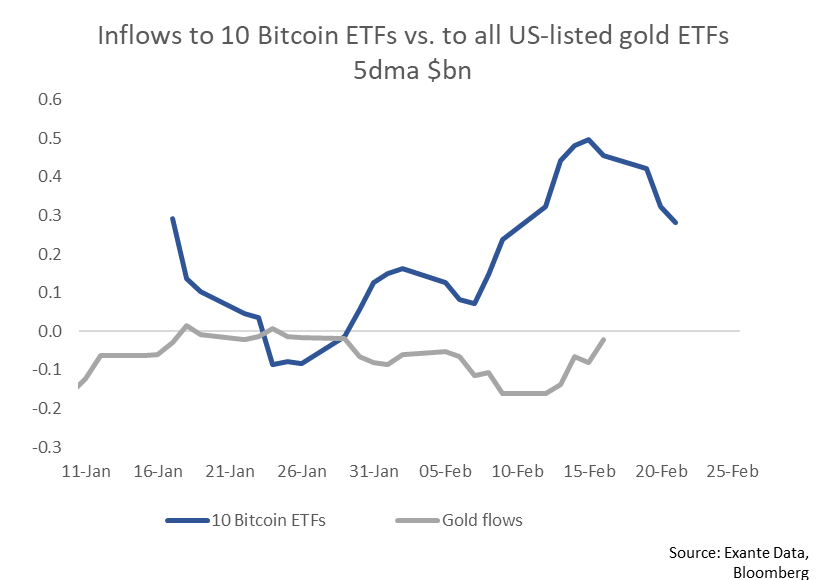

Comparing with the largest gold ETF - GLD's recent data, it can be seen that since the launch of the Bitcoin ETF, the inflow of funds into the gold ETF has turned negative, which means that the Bitcoin ETF may have indeed diverted some of the funds originally intended to be invested in the gold ETF.

At the same time, with the decrease in the inflow of Bitcoin ETF funds in the second half of February, the outflow of funds from gold ETF is also decreasing synchronously. This indicates that the phenomenon of diversion has been alleviated to a certain extent in the short term.

However, overall, both have become ideal asset allocation categories in the current global inflation environment due to their anti-inflation characteristics, so they have the potential for long-term benefits.

Beyond ETFs, the price drivers of Bitcoin

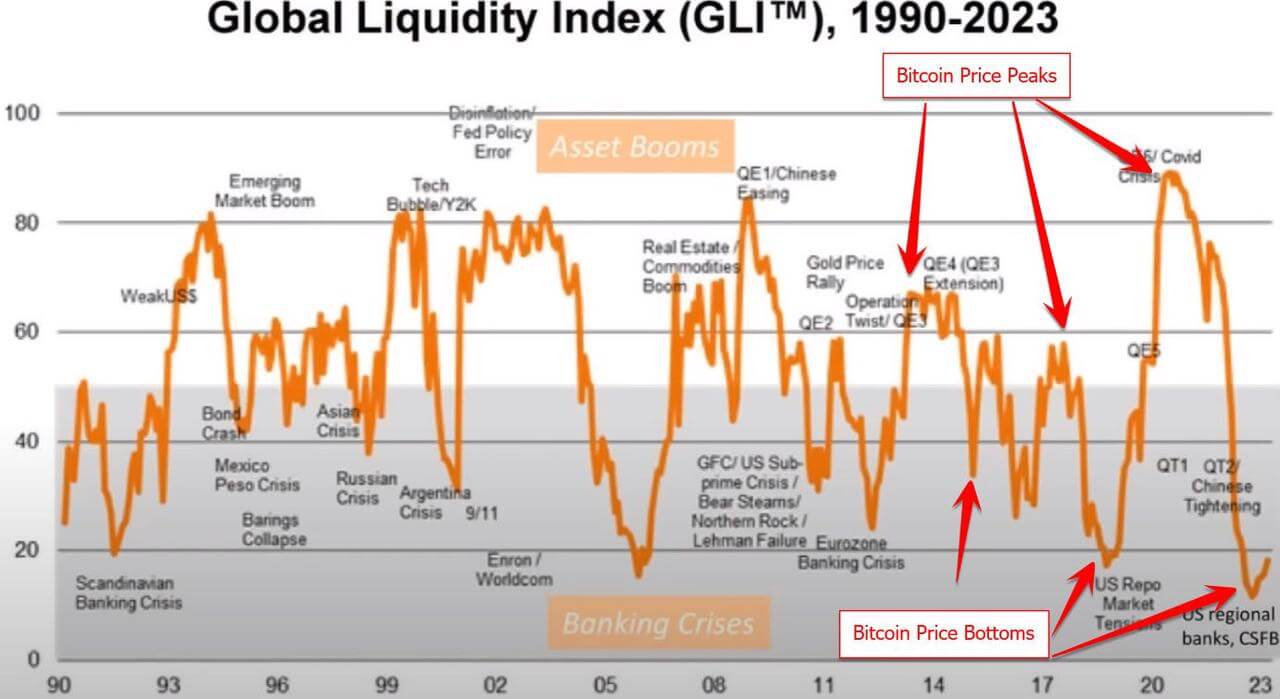

We can see that this bull market of Bitcoin is consistent with the global liquidity cycle and the Bitcoin halving cycle.

In addition, the frequent actions of some companies once again reflect the interest of commercial institutions in Bitcoin. MicroStrategy spent $821.70 million to purchase about 12,000 Bitcoins between February 26th and March 10th, increasing its total holdings to 205,000 Bitcoins, which is very close to the current holdings of BlackRock IBIT.

The fourth halving of Bitcoin in two weeks is expected to increase market attention and enthusiasm for Bitcoin. Historically, halving has increased the volatility of Bitcoin prices and ultimately led to price increases.

We believe that the cryptocurrency industry represented by Bitcoin, like countless previous innovation cycles, will gradually shift from speculation and narrative-based investment to value and fundamental investment as the industry matures. The adoption of Bitcoin spot ETF means that the cryptocurrency industry is entering a "turning point" stage - it will be more integrated with the traditional financial system.