|

Highlight:

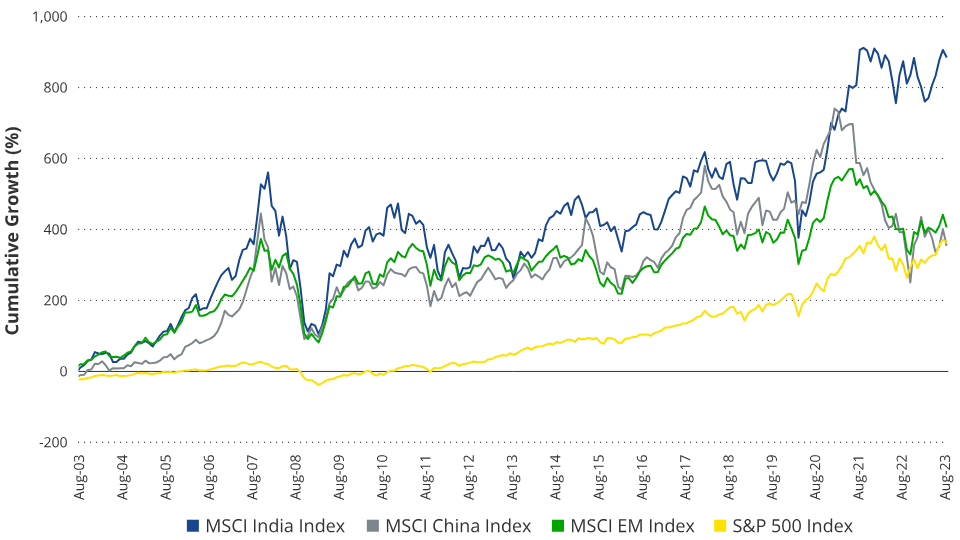

1)India's economy is another miracle after China. In the past 20 years, the MSCI India Index has risen by over 900%, far exceeding the S&P 500 Index and the MSCI Emerging Markets Index. Currently, India has become the third largest weight in the MSCI Emerging Markets Index.

2)The long-term excellent performance of the Indian stock market is driven by various factors, including economic reforms, strong corporate profit growth, and positive investor sentiment. Unlike countries such as Vietnam that have learned a lot from and borrowed from China's development model, India has significant differences from China in terms of economic background, governance methods, cultural habits, etc. Therefore, it is particularly necessary to have a deep understanding of India's development model and future opportunities.

3)Under the prosperity of the Indian stock market, there are also hidden concerns. It relies heavily on foreign investment, which not only effectively activates the Indian market, but also multiplies the volatility.

In addition to the Japanese stock market in 2023, the Indian market will also usher in a bumper year.

This year, the Indian stock market reached a new high, with a market value exceeding $4 trillion for the first time. This marks India as the world's fifth largest stock market (in fact, it briefly became the fourth largest not long ago). According to Bloomberg, the total market value of Listed Company, an Indian exchange, has increased by 1 trillion dollars in less than three years.

At the same time, net inflows into ETFs tracking the Indian stock market also hit a record high in 2023, and investors are and will continue to be bullish on the world's fastest-growing major economy. According to Morningstar Direct data, net inflows into India-focused ETFs reached $8.60 billion last year, exceeding the peak net inflow of $7.40 billion in 2021. And funds flowing into India ETFs account for one-third of the total buying volume of Emerging Markets funds.

Apparently, India's efforts to strengthen investment in Capital Markets and industrial production have attracted strong interest from global investors.

India welcomes an election year this year. According to common sense, foreign investors tend to prepare for increased political volatility. However, unlike the significant outflow of funds from the Argentine stock market before the presidential election, overseas funds have not chosen to leave India. The market believes that the positive trend will not change, and Prime Minister Modi will be re-elected for a third term.

Last month, when Modi's Bharatiya Janata Party won key states from the opposition, the Indian stock market hit a new record high, and foreign investors' monthly stock purchases in December also hit a new high.

Of course, the strong inflow of funds should be attributed to a broader optimistic sentiment surrounding India's economic development and importance, not just the election. After all, India's GDP growth rate is expected to reach 7.3% in 2023, the highest among major economies in the world.

|

The Indian economy is another miracle after China. As shown in the figure above, the MSCI India Index has risen by more than 900% in the past 20 years, far exceeding the S & P 500 Index and the MSCI Emerging Markets Index. Currently, India has become the third largest weight in the MSCI Emerging Markets Index, second only to China and Taiwan. This once again highlights its prominent position and influence in the global emerging landscape.

So, what has happened in India in recent years? What has this market done right?

The driving force of the Indian stock market in the past 20 years

The long-term excellent performance of the Indian stock market is driven by multiple factors, including economic reforms, strong corporate earnings growth, and positive investor sentiment. In short, investors see positive performance in the following three areas:

The first is the country's upbeat economic outlook. According to International Monetary Fund data, India is expected to become the third largest GDP country in the next five years. This expectation is clearly based on the significant economic growth it has already achieved. Like China, India's economic success is not only due to its large population, but also to its strong economic activity, growing consumer base, and booming domestic market.

Secondly, the long-term tailwind of India's economic policies. Policymakers have laid the foundation for a favorable business environment in the country's market. Simplified regulations, orderly reforms conducive to business development, and incentives for domestic and foreign investors have made India an attractive capital destination.

The third is the commitment of the Indian market to reinvestment: it is not satisfied with existing achievements, and multiple economic sectors are vigorously promoting reinvestment and revitalization. Whether it is the modernization of old infrastructure or meeting the housing needs of the vast population, there has been significant progress.

If we look at the Indian market more proactively, we can make new discoveries.

Unlike other countries, India's unique population advantage gives it unique development opportunities in the future. With an average age of 28, it has one of the youngest populations in the world. In addition, as the second largest English-speaking country in the world, this is a significant advantage for overseas companies looking to expand in the region. The combination of a young, English-speaking workforce and a rapidly growing consumer base naturally makes India a vast market that is highly attractive to both businesses and investors.

According to TRAI, India is expected to have over 800 million smartphone users by 2023. Compared to other countries that have already gone through this stage, India's future digital transformation is expected to have a ripple effect throughout the economy.

No one will question the exponential growth potential of India's e-commerce market in the next few years. Nor will anyone question how high its fintech industry and consumer base will reach, driven by the growth of mobile payments. With the popularity of smartphones and the continuous initialization of the Internet, what awaits India will be a brighter digital revolution, followed by the general growth of various industries such as e-commerce, digital payments, and online entertainment.

Not to mention, in addition to natural growth, the Indian government has also proposed several important measures to promote financial inclusion and promote the fintech industry.

The most noteworthy one is the Inclusive Finance Plan. It is a plan launched by the Indian government to improve financial inclusion. It was launched on August 15, 2014, aiming to ensure that every Indian household has at least one member with a bank account and provide simple and inexpensive Financial Services. India is using its own way to provide basic Financial Services and promote direct welfare payments. As of 2021, the plan has helped Indian nationals open more than 400 million bank accounts.

The other is the UPI payment system launched by India in 2016. It is considered as the "digital public infrastructure" designed by the National Payments Corporation of India. The system integrates more than 300 banks and can provide services through more than 60 applications (such as Google Pay, Amazon Pay, and India's popular payment application Paytm). It allows users to transfer money directly from one bank account to another in real time. Today, about 300 million people in this country with a population of 1.40 billion use the system. It is not an exaggeration to say that it is completely changing financial transactions in India.

Objectively view India's economic development

India's achievements should not be underestimated, which is also the core reason why it can attract global attention. However, it is also necessary to see some shortcomings and gaps in this market.

In terms of economic growth, India is relatively stable but not too fast. Its average actual growth rate from 2000 to 2010 was 7.24%, and the average growth rate from 2011 to 2019 dropped to 6.58%. In contrast, China's average growth rates from 2000 to 2010 and 2011 to 2019 were 10.38% and 7.35% respectively. Therefore, India has not achieved the feat of surpassing China in actual growth rate after the global financial crisis.

If we consider per capita GDP growth, the growth gap between India and China is even more obvious. From 2011 to 2019, China's average per capita GDP growth was 9.49%, while India's was only 4.85%. As of 2022, India's per capita GDP is about $2,410, while China's per capita GDP is 5.28 times higher, indicating a significant gap.

There are many reasons behind this. Firstly, India's weak infrastructure and relatively scarce capital are almost unsolvable old problems that still need time to solve. Secondly, in terms of trade, due to India's high dependence on external resources, its commodity trade is in a continuous deficit state, which needs to be filled by advantageous service trade. It is not easy to form a sustained trade surplus before India's structural reform and infrastructure improvement.

Furthermore, in terms of population, as mentioned earlier, India does have a clear supply advantage, but its large working-age population does not directly equal the labor force population: on the basis of weak education level, India's labor force participation rate is significantly lower than that of South East Asia's manufacturing countries, which leads to a gap in high-quality labor supply compared to China.

Not only that, India's industrial structure and large informal economy also determine that it is difficult to guide labor to high value-added categories such as manufacturing and high-end services. A large number of labor forces are scattered between agriculture and low-end service industries, and the youth unemployment rate is high.

Of course, all of the above does not mean that India is not worth investing in. With the support of multiple favorable factors, India is expected to continue to maintain an annualized real growth rate of 6% -7% for a considerable period of time. This is rare among the current economic development levels of various countries. While its economic volume will grow by more than 80% in the next decade, it will naturally bring considerable investment returns.

Therefore, in any case, India, which is gradually rising, is becoming an undeniable force among countries around the world. Moreover, it is particularly important to note that unlike Vietnam and other countries that have learned and borrowed a lot from China's development model, India has significant differences from China in terms of economic background, governance methods, cultural habits, etc. Therefore, it is particularly necessary to deeply understand India's development model and future opportunities.

The prosperity and hidden worries of the Indian stock market

In addition to having a multi-faceted understanding of the Indian economy, investing in the Indian market necessarily requires a better understanding of the country's stock market itself.

In 2023, 48 of the 50 stocks tracked by the Nifty 50 index, the most representative index of the Indian stock market, showed positive growth. Among them, 27 stocks rose by more than 20%, and 40 stocks rose by more than 10%. Most of the gains in the index occurred after October; the Sensex index generally followed the performance of the Nifty 50 index, showing a positive trend dominated by the banking, automotive, and real estate sectors.

Such a thriving stock market is actually rare among major global economies. With stock index growth rates far exceeding those of other countries in the past decade and great potential beyond reasonable doubt in the next decade, the future prosperity of the Indian stock market is almost a clear card.

But if we dig deeper, why has October become an important time node? This is the hidden worry about the prosperity of the Indian stock market.

In short, in September 2023, FII had a net outflow of 188.80 billion rupees; in October, it had a net outflow of 221.10 billion rupees. These are precisely two important nodes where the Indian stock market is under pressure. The rebound of the Nifty 50 index after October was mainly due to the bullish sentiment of foreign investors (FPI). After two months of net selling, FPI injected about 245.46 billion rupees into India in November, followed by a larger investment of about 773.88 billion rupees in December.

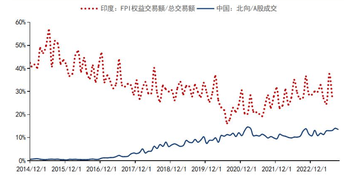

This is just one manifestation of the Indian stock market's considerable reliance on foreign capital. In fact, the existence of foreign capital effectively activates the Indian market and amplifies volatility exponentially.

Taking two numbers as an example: In the past four to five years, the proportion of foreign investment in India's transaction volume has been around 30%, while if only measured by market value, the proportion of foreign investment in India is only 6.5%. 6% of active funds bring 30% volatility, which shows the strong dependence of the Indian stock market on foreign investment.

|

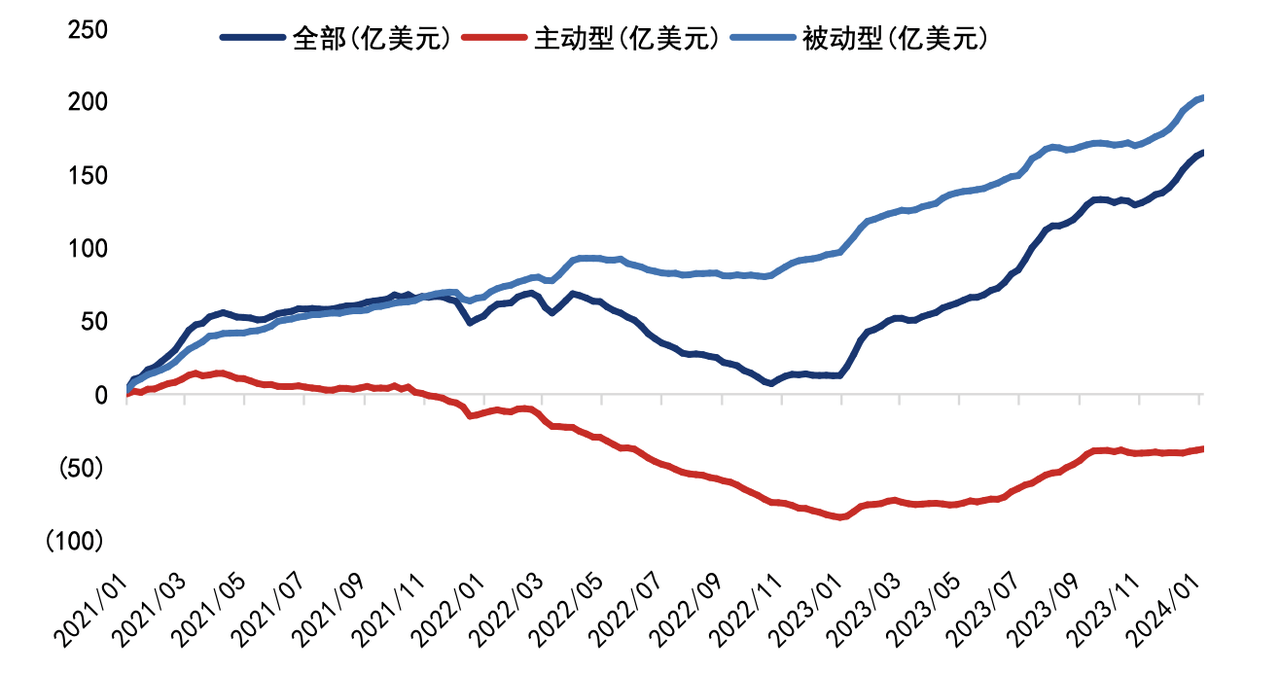

On the other hand, all the stock market corrections in India have been accompanied by foreign capital outflows. Conversely, when the Indian stock market is bullish, it is often dominated by foreign capital inflows. The following chart shows the global capital flow to India's equity assets (cumulative value, starting from 2021). It can be seen that foreign capital has actually become an important part of the Indian stock market.

|

In addition, a number worth paying attention to in the Indian stock market is the high securitization rate, which is both a development opportunity and a valuation pressure. Buffett believes that when the US securitization rate is between 70% and 80%, it is suitable to hold stocks. When the securitization rate is below 60%, stocks can be bought in large quantities. When this indicator is greater than 100%, the market begins to be vigilant. Once it exceeds 120%, the market has entered a warning state.

Currently, India's securitization rate is around 100%. Investors do not need to fully apply Buffett's experience summary of Mature Market (because high valuations are the norm in the early stages of Emerging Markets), but they also need to be wary of the pressure of short-term valuation decline.

What to invest in the Indian stock market? How to invest?

For foreign investors, there are mainly two ways to participate in Indian stock market investment:

Investing in ADR, an Indian company listed in the US, Europe and other places, has the advantage of relatively simple procedures and no need to pay taxes to the Indian government. The disadvantage is that it is very difficult and requires extreme familiarity with a certain company.

Purchase Indian stock index ETFs. Especially recommend ETFs with strong liquidity, long establishment time, and strong benchmark tracking. They are expected to capture the most potential high-growth industries and companies in India to the greatest extent for investors.

RockFlow research team believes that the following Indian stock index ETFs have their own characteristics, and investors can choose according to their own goals and interests.

INDA is the most suitable stock index ETF for novice investors. It has good liquidity and is sufficiently diversified to track Indian companies. The MSCI India Index it tracks represents the performance of large and medium-sized companies in the Indian stock market. Therefore, investors can indirectly invest in the Indian stock market by purchasing INDA.

EPI, tracking index is WisdomTree India Earnings Index, with slightly greater volatility than INDA, but also higher potential returns.

INDL, Double Bullish Indian Stock Index ETF. It belongs to the leveraged ETF category, with an average performance twice that of INDA (both up and down).

FLIN is a stock index ETF that mainly invests in the Indian financial industry. The fund usually invests at least 80% of its total assets in indices aimed at measuring the performance of Indian Financial Marekt and companies. Its main holdings include banks, financial institutions, housing finance, insurance companies, and other financial services companies.

PIN, a more stable stock index ETF that tracks the performance of high-quality companies in the Indian market. The fund will invest at least 90% of its total assets in the constituent stocks of the index. The index excludes the worst 10% of companies based on their 12-month dividend yield and rebalances and screens every six months.

In addition to the Indian market, RockFlow's latest "RF Selected ETF Strategy" stock list is committed to providing users with a diversified securities portfolio that spans multiple quantitative and qualitative factors (such as geography, industry, market value, value, etc.). By combining multiple Emerging Markets' stock index ETFs and a small number of high-quality star industry ETFs, investors can obtain a stable portfolio of global asset allocation.