Introduction:

2024 is an exciting year in the history of encryption. The price of Bitcoin has reached a historic high, the blockchain infrastructure has been significantly improved, stablecoins have found a product-market fit, and Bitcoin and Ethereum spot ETFs have been approved. At the same time, US legislation and regulatory environments are paving a positive path for the industry. All of these are laying the groundwork for the continued outbreak in 2025.

For the US stock market, the emergence of Bitcoin spot ETFs is obviously of great significance. They have expanded the investment channels for retail and institutional investors in Bitcoin, attracted billions of dollars in net capital inflows, and elevated this asset class from a niche asset to a mainstream asset. This may be the most successful ETF in financial history, with assets under management (AUM) exceeding $110 billion in just one year.

In this article, the RockFlow research team will take you through the significant success of the Bitcoin spot ETF on the occasion of its first anniversary, review their top publishing institutions and the profound impact they have brought to Bitcoin and Financial Market, and most importantly, why we believe that in the era of Trump 2.0, the cryptocurrency market will usher in a new era.

1. Bitcoin spot ETF launched a year ago, and the crypto market has undergone major changes

After a decade of anticipation, repeated application rejections, and false news that caught the crypto market off guard, the US Securities and Exchange Commission (SEC) finally approved the launch of a Bitcoin spot ETF on January 10, 2024.

Shortly thereafter, 11 ETFs entered the market one after another, competing to attract capital inflows. The publishers include asset management companies with asset management scale reaching tens of trillions of dollars - traditional financial giants such as BlackRock and Fidelity, as well as crypto-native institutions such as Bitwise.

Bitcoin spot ETF has attracted a lot of funds since its launch. The acceleration of fund inflows coincides with a period of high market sentiment, which brings fresh blood to various fields of the cryptocurrency ecosystem. Although there was a downturn in the summer of 2024, Trump's victory in the US presidential election in November once again boosted optimism, so the inflow of ETFs was strengthened again.

As of now, the net inflow of Bitcoin spot ETF is about 32 billion US dollars, holding more than 1.10 million bitcoins, equivalent to a total asset size of 115 billion US dollars. These holdings currently account for about 5.7% of the circulating supply of Bitcoin.

On the other hand, Bitcoin spot ETFs account for only about 1% of the total assets under management of all ETFs worldwide, indicating that cryptoassets still have huge growth potential in the future.

Who is behind such abundant funds? In fact, the Bitcoin spot ETF mainly targets three groups - individual investors, wealth advisors, and institutional investors. The 13F document discloses the buyers behind the Bitcoin spot ETF, including both retail and professional investors, as well as hedge funds and financial institutions such as Goldman Sachs and Millennium Management. This reflects Financial Marekt's growing interest in including Bitcoin in its investment portfolio, and the Bitcoin spot ETF perfectly serves as a bridge between traditional finance and the crypto world.

The RockFlow research team expects capital inflows to continue to accelerate in 2025, and with the relaxation of regulatory conditions, we will also see broader participation from pension funds, family offices, and endowments. Optimistically, the AUM of Bitcoin spot ETFs may double.

2. ETF publishers and how it affects Bitcoin itself

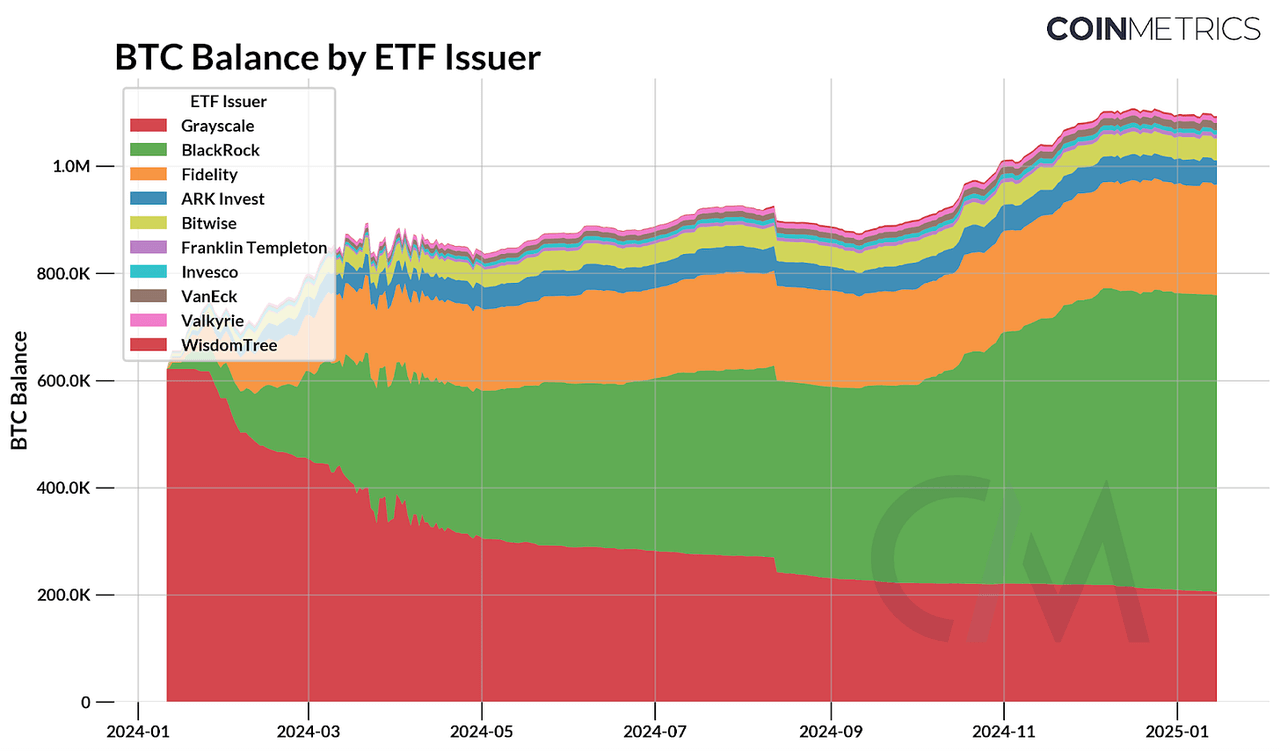

Once upon a time, GBTC under Canary Release was the main tool for indirect investment in Bitcoin. However, after the mass launch of Bitcoin spot ETFs, GBTC gradually faced challenges due to high management fees. Most new investors (even existing investors) turned to the newly launched Bitcoin spot ETFs because their fees were generally around 0.2% (many even had zero fees at the beginning), far lower than Canary Release's GBTC's 1.5%.

In addition, GBTC is also seeking change and has proactively spun off another lower-fee canary release, Bitcoin Mini Trust (BTC), as a low-cost alternative to GBTC.

From the perspective of publishers, BlackRock and Fidelity are clearly the biggest winners. Taking BlackRock as an example, its Bitcoin spot ETF - IBIT currently holds about 540,000 bitcoins, accounting for half of the total bitcoins held by all ETFs. At the same time, Canary Release's GBTC holdings have sharply decreased from 600,000 bitcoins to 200,000 bitcoins, becoming the biggest loser.

On the other hand, BlackRock's IBIT Asset Under Management has approached $60 billion, far exceeding the size of BlackRock's largest gold ETF - IAU ($35 billion), further consolidating Bitcoin's position as "digital gold". According to Bloomberg ETF analysts, IBIT reached the milestone of $50 billion management size in just 227 trading days, breaking the previous record of 1323 days set by iShares' core MSCI Emerging Markets ETF (IEMG).

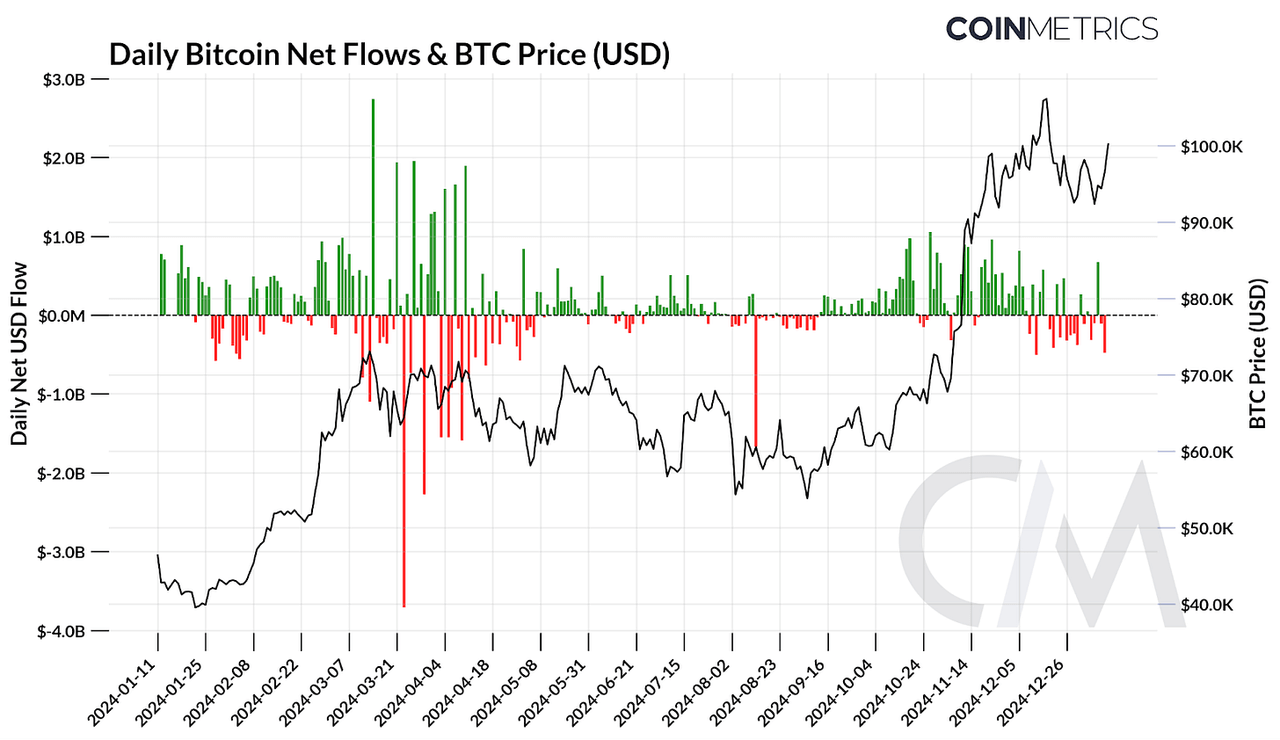

Investors choose to support Bitcoin spot ETFs with real money due to their interest in Bitcoin. At the same time, Bitcoin spot ETFs are also affecting the price and market structure of Bitcoin itself. According to Coin Metrics' statistical analysis, as a stable source of demand for Bitcoin, the net inflow of funds into Bitcoin spot ETFs has a very significant impact on the price of Bitcoin.

The chart below shows that the large inflow or outflow of Bitcoin spot ETF funds almost always coincides with the major price fluctuations of Bitcoin.

Especially during periods of strong market momentum or significant increase in capital inflows, the correlation between the two often strengthens, indicating that as publishers buy Bitcoin to meet the needs of ETF investors, it has become a structural driving factor for the rise in Bitcoin prices. With the continuous rise in Bitcoin prices, the attractiveness of ETF products to retail and institutional investors has increased, forming a mutually reinforcing feedback loop, thereby attracting more capital inflows.

Of course, it should be noted that the trends of the two are not completely consistent, because in addition to spot ETFs, the broader macro environment, investor sentiment, and market influence of institutions such as MicroStrategy also play an important role.

3. In the era of Trump 2.0, the crypto market will usher in a new situation

RockFlow's research team believes that the crypto market will rise further in 2025, mainly due to the entry of crypto-friendly president Trump into the White House. In the previous year, he had repeatedly expressed his support for the crypto economy during his campaign, including but not limited to:

Dismiss the current SEC chairperson Gary Gensler who repeatedly "troubles" the cryptocurrency industry, reduce the sentence of the founder of Silk Road, end the US's suppression and "crusade" against cryptocurrency, prevent the US from further developing CBDC, make the US the world's "cryptocurrency capital", prevent the US from selling its holdings of Bitcoin, establish a strategic Bitcoin reserve, suggest using cryptocurrency to solve the US debt problem, appoint a cryptocurrency advisory committee and promote rules "made by people who love the industry", and so on.

Trump, who has just taken office, is indeed steadily advancing his commitment to the encryption industry at that time. Therefore, in 2025, the Trump administration and the Republican-controlled Congress may bring significant changes to the encryption field - a welcome change for industry participants.

In addition, in this round of US election, the crypto industry has begun to "show off" and become one of the important top gifters of the election: according to relevant reports, Fairshake, a super political action committee (PAC) supporting cryptocurrency, raised more than $200 million from the crypto industry to help candidates who support cryptocurrency win. It mainly targets Republican and key Democratic candidates, and this move is expected to continue to bring much-needed regulatory clarity to the crypto industry.

It is worth mentioning that as early as December 2024, Trump appointed former PayPal executive Sachs as the "AI and cryptocurrency czar" of the White House. Sachs is seen as a supporter of innovation and the crypto industry. Some crypto practitioners believe that this "crypto czar" is expected to bring more benefits in supporting digital assets.

In addition, during the previous Congress, the US House of Representatives passed the Financial Innovation and Technology for the 21st Century Act (FIT 21), which aims to establish a regulatory framework for digital assets and allocate jurisdiction between the SEC and the Commodity Futures Trading Commission (CFTC). Although FIT 21 does not meet all the requirements of the cryptocurrency industry, it represents the largest effort made by the US Congress to date.

Also, people's interest in establishing a bitcoin strategic reserve has been reignited. Wyoming Republican Senator Cynthia Lummis recently launched the Bitcoin Act, which will establish a strategic bitcoin reserve for the US and develop a structured bitcoin purchase plan.

In addition to the above, the RockFlow research team expects that the US Federal Bank and other financial regulators will re-examine the encryption policies of the Biden era. Since 2021, regulatory agencies have put pressure on banks to "cancel" controversial encryption businesses by issuing multiple relevant explanations, basically preventing banks from engaging in custody and other activities. Given that Trump has promised to protect the encryption industry from regulatory "persecution", the revocation of these explanations means a significant shift in regulation.

Finally, the increase in Capital Markets activity in the cryptocurrency industry is also an important positive news. With the improvement of regulatory transparency, coupled with factors such as sustained investor attention, increased institutional adoption rates, and increased venture capital funds, related Capital Markets activities (including IPOs) are expected to increase significantly. As the cryptocurrency economy continues to mature, the integration of regulatory development and market enthusiasm will create more opportunities for public listings, M & A transactions, and deeper institutional participation.

4. Conclusion

The RockFlow research team believes that financial products represented by Bitcoin spot ETFs are reshaping the cryptocurrency investment landscape. They not only effectively attract institutional and retail investors' capital inflows, but also drive structural demand for Bitcoin. In the past year, they have proven their potential to legalize and expand the use cases of cryptoassets.

Meanwhile, although the Ethereum ETF started slowly, its good development momentum is gradually emerging, and investors' demand for it is increasing. As the market further matures, new opportunities may further enhance the attractiveness of the cryptocurrency market to traditional financial investors. The next wave of ETF inflows may unleash even greater growth.

In 2025, with the expectation of crypto-friendly policies heating up, regulatory environments becoming clearer, institutional investors continuing to enter the market, and strategic reserve plans, the crypto market will usher in a new round of growth cycle.

Author Profile:

The RockFlow research team has a long-term focus on high-quality companies in the US stock market, emerging markets such as Latin America and Southeast Asia, and high potential industries such as encryption and biotechnology. The core members of the team come from top technology companies and financial institutions such as Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, CITIC Securities, etc. Most of them graduated from top universities such as Massachusetts Institute of Technology, University of California, Berkeley, Nanyang Technological Institute, Tsinghua University, and Fudan University.

Additionally, you can also find us on these platforms: