Highlight:

Coinbase's financial performance has always been very volatile. It has proven that it can ride the wave of the cryptocurrency market to earn extremely considerable profits, but it is difficult to recover when the cryptocurrency market turns bearish.

In order to cope with the Downside Risk in the market, Coinbase is gradually optimizing the agility of its revenue portfolio strategy and cost structure, which is an important feature worthy of long-term investment. As a bridge between cryptocurrency and the traditional financial world, Coinbase still needs to strike a proper balance between catering to believers and creating profits.

Is Coinbase an exchange, broker, crypto bank, or a belief?

From a business perspective, it is primarily an exchange: providing encrypted trading services to users. This was the initial goal and the commercial foundation on which it relies for survival.

However, it is also a broker and custodian of a large amount of assets (including cash, various cryptoassets, and most recent Bitcoin spot ETFs).

In addition, it is also a cryptocurrency bank. Even though all types of cryptocurrencies currently do not have true "circulation" value, it can help customers deposit and exchange cash for cryptocurrency, while providing other services similar to traditional banks.

Some people firmly believe that Coinbase is a "faith". After all, Bitcoin has a deceased founder, a unique universal discourse, and a feeling of being "persecuted" by secular authorities. Businesses related to religious beliefs are basically big businesses, and Coinbase doesn't want to do such business.

Coinbase meets all of the above definitions, and it knows that its fate is closely related to cryptocurrency. In order to convince investors and the entire market, Coinbase needs to convince everyone that cryptocurrency technology has broad prospects and a future.

Coinbase is a bridge between cryptocurrency and the traditional financial world. It needs to strike the right balance between catering to believers and creating profits.

Coinbase's business foundation and unique appeal

Coinbase defines itself as a secure, trusted, and easy-to-use cryptocurrency platform that helps three types of customer groups safely participate in the cryptocurrency economy - consumers (i.e. retail investors), institutions, and developers - through solutions such as asset custody. The company serves customers in more than 100 countries worldwide, 60% of which are outside the US. It earns revenue through various services such as trading and subscriptions. The largest portion of trading revenue is generated by consumer customers, with institutions accounting for about 5%.

Although Coinbase is a young company that has just gone public for a few years, investors can only see its publicly disclosed financial performance since fiscal year 2019. However, based solely on data from the past few years, we can also see some key trends.

The table above contains important performance data for Coinbase. Four consecutive years of gross profit margins above 80% indicate huge potential for reinvestment in marketing and business growth, which is Coinbase's core competitive advantage. Another highlight is its revenue growth rate, which increased sixfold from 2019 to 2022, with a compound annual growth rate of up to 82%.

However, this does not mean that Coinbase is a good business. Why did its stock price plummet from a peak of over $400 to less than $40 in less than two years after its listing? In addition to the premium of its initial attention and the uniqueness of its target, an important reason is that multiple quarterly data in fiscal year 2022 revealed its unfavorable side-its own performance is too dependent on the price of Bitcoin.

At the beginning of Coinbase's listing, the crypto bear market did not appear. The market still relies on the recovery of the crypto economy. However, the continuous decline of Bitcoin prices, Luna's collapse, FTX's collapse, and other factors have intertwined, causing the entire crypto market to enter a long winter.

In 2022, the price of Bitcoin plummeted by 65%, and so did Coinbase's revenue. This is not difficult to understand: the lower price of BTC means that the asset's attractiveness to investors and traders has greatly decreased, resulting in a significant reduction in trading volume and other related services on the Coinbase platform. For Coinbase, this is a difficult period, especially considering the significant actions taken by the US SEC during this period, which has led to significant risks to the company's development.

Fortunately, until the end of 2022, Coinbase finally stood firm, and its fundamentals and stock price have undergone very positive changes. Just a few months ago, its stock price once again experienced a strong rise. The following text will capture these two key time points and unfold Coinbase's two rebirth histories.

In addition, it is worth emphasizing that although the BTC price will rise by 156% in 2023, Coinbase's revenue is not expected to recover so quickly. Fortunately, the most difficult days have passed.

At the end of 2022, Coinbase rebounded for the first time

Although Coinbase has the ability to generate huge revenues and profits in the crypto bull market, when interest in cryptocurrency wanes, cash flows dry up and the company plunges into losses.

At its peak in Q4 2021, Coinbase generated $2.50 billion in revenue, nearly twice the revenue of the Nasdaq exchange during the same period. However, since that peak, operating performance has mostly been flat.

In the next 12 months, its revenue fell by 75%, and the company fell into serious losses.

The culprit is Coinbase's business model, which is mainly based on trading revenue. As mentioned earlier, with the arrival of the crypto bear market, the trading volume has decreased, and the prices of various digital assets have dropped significantly, which has dealt a huge blow to Coinbase's revenue.

Management naturally had a keen understanding of this issue, so Coinbase began to develop towards a solid business foundation and tried to diversify.

The Q4 2022 financial report revealed a lot of information about its solid foundation.

Firstly, its platform has a healthier source of transaction volume.

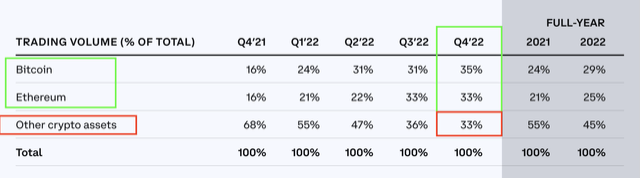

The above table reflects the transaction volume proportion of different asset categories on the Coinbase platform, including Bitcoin, ETH, and others. "Other" refers to "counterfeit products". Compared with the data of five quarters, the proportion of "other" categories decreased from 68% in Q4 2021 to 33% in Q4 2022. This is not only the result of the rapid decline of "counterfeit products" and new ICOs, but also indicates that more relatively high-quality and stable transactions are continuing to grow on the Coinbase platform.

Secondly, the Coinbase platform has a healthier customer base.

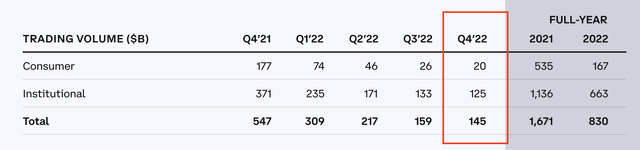

The above table shows the proportion of trading volume contributed by two types of traders on Coinbase. Breaking it down, the trading volume of retail traders decreased from $177 billion (32%) in Q4 2021 to $20 billion (14%) in Q4 2022. Although the trading volume of institutional traders also decreased, from $371 billion in Q4 2021 to $125 billion in Q4 2022, their proportion increased from 68% to 86%.

This is good for Coinbase, as it shows that institutional funds are taking this new class of cryptoassets more seriously (even if interest declines in the short term), and it also proves that Coinbase is winning the trust of institutions (and therefore choosing to trade here).

In Q3 2022, Coinbase was selected by BlackRock, the world's largest asset management company, to provide encrypted trading channels for its Aladdin (end-to-end investment platform) clients. In January 2023, BlackRock chose to add Bitcoin as an investment target to its global allocation fund.

During the Q4 2022 earnings conference call, Coinbase management also stated that they are seeing more and more institutional investors joining their Coinbase Prime program. Not to mention that at the beginning of 2024, dozens of Bitcoin spot ETFs were approved at the same time, bringing in billions of new funds in less than a month.

The third key piece of information revealed in Coinbase's Q4 2022 financial report is that it is exploring new revenue types and making actual progress. Coinbase earns income from assets held on its platform through a combination of staking and interest income. According to the financial report, its Q4 2022 interest income increased by 79% quarter-on-quarter to $182 million. This is mainly driven by rising interest rates, which has resulted in significant returns on the huge customer assets it manages.

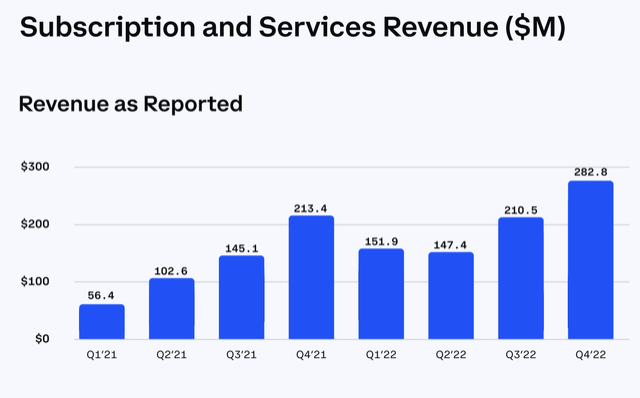

In addition, the company's subscription and service revenue increased by 32.5% year-on-year to $282.80 million (as shown in the figure below). This is mainly due to the Coinbase One program and the continued growth of ETH staking.

The position of the top exchanges is more stable, the continuous hot participation of institutions, and the effective expansion of income categories. These comprehensive effects have led to Coinbase's stock price finally hitting bottom at the end of 2022 and rising nearly threefold in the following six months.

At the end of 2023, Coinbase rebounded strongly for the second time

Coinbase's first rebirth benefited from the company's continuously improving revenue base and cost structure. In the following year, not only did the cryptocurrency market continue to recover, but Coinbase also made new progress in optimizing its revenue mix. Coupled with the effectiveness of adjusting its cost structure, it has proven its long-term value to the market.

In terms of revenue, Coinbase has further diversified its revenue sources to better cope with the difficulties of the cryptocurrency market downturn.

Taking one data as an example, Coinbase's trading revenue in Q3 2023 actually decreased compared to Q2, from $323 million to $283 million, and the overall decline was due to the crypto market being too stable.

However, Coinbase's Q3 2023 service revenue was quite strong, reaching $334 million. Therefore, although the total revenue figures are similar to Q2 ($674 million and $662 million respectively), this combination is much more stable due to more predictable and stable service revenue adding value.

Coinbase's service revenue mainly comes from several places.

Stablecoin income: Income from USDC depends on the USDC balance, USDC market value, and interest rate on the Coinbase platform. Blockchain rewards: income from participating in PoS and various blockchain protocols. Pledge income: a part of the blockchain reward, linked to factors such as customer pledge balance and asset prices. Interest income: generated by customer custody funds and loans, fluctuating with trading volume and interest rates. Custody fee income: Storage and custody fees for encrypted assets, calculated as a percentage of their daily value. Other revenue: includes revenue from Coinbase One, Coinbase Cloud, Prime Financing, and subscription licenses.

In addition, the company has made very positive progress in derivatives trading and other areas. It has been preparing to establish an offshore futures exchange for a long time. In the third quarter of 2023, Coinbase obtained regulatory approval from the Bermuda Monetary Authority to provide perpetual futures to eligible non-US retail customers. In addition, Coinbase Financial Markets has also obtained regulatory approval from the US National Futures Association.

Unlocking the ability to provide derivative products to users is a huge opportunity for Coinbase, as the global cryptocurrency derivatives market accounts for 75% of all trading volume. Derivatives themselves are an important tool, and using margins for crypto trading can effectively improve traders' capital utilization efficiency and significantly reduce investment barriers.

Not to mention, Coinbase's own Ethereum L2 Rollup chain, the Base chain, was widely adopted after its launch and became one of the top 10 TVL chains. All of these measures effectively changed the company's revenue situation at that time and thereafter.

However, income is only one aspect. Its management also closely monitors the organization's internal expenses. In terms of costs, Coinbase is also continuously reducing operating expenses, including a large number of layoffs.

In Q1 2023, Coinbase achieved a significant turnaround, with Earnings Before Interest And Taxes shrinking significantly from $550 million in the previous quarter to $124 million. With revenue still down more than 60% from its peak, such strong profit performance is clearly the result of management's significant cost reduction. Moreover, considering that revenue began to rebound in the previous two quarters, it is clear that the reduction in employee numbers and other expenses has not had a negative impact on the company's continued business expansion.

In other words, Coinbase has achieved beneficial results in both revenue portfolio strategy and cost structure agility, proving that it has huge operational leverage, which is an important quality worth investing in for the long term.

In addition to revenue diversification and cost measures, in the second half of 2023, the US SEC lost the lawsuit against Ripple for publishing unregistered securities in court. This victory is of great significance to Ripple and the entire cryptocurrency industry. It has injected considerable optimism and confidence into the market, and to some extent dispelled investors' doubts about Coinbase, indirectly stimulating its stock price to continue to rise.

End

Coinbase's Q4 2023 financial report will be released after the US stock market closes on February 15th. The market generally predicts that its Q4 revenue will be $820 million, a year-on-year increase of 30%. It is expected that profitability will also significantly improve year-on-year, with adjusted earnings per share expanding from $-2.66 to $0.27.

This number is obviously far from the company's outstanding performance in Q4 2021 (revenue was only 33%, and adjusted earnings per share were less than 10%). However, compared to recent quarters, it has improved a lot. Coupled with the momentum of the Bitcoin spot ETF and the April halving market, the cryptocurrency market is currently filled with very optimistic sentiment, which is exactly what Coinbase is most happy to see.

However, it should be emphasized that due to the market's multiple upward revisions to its EPS expectations in the past 90 days, the bullish sentiment surrounding the upcoming financial report may have been digested to some extent.

Given that people are more optimistic about the cryptocurrency market, Coinbase's financial guidance for the next quarter may still be significantly improved. What kind of answer will it deliver? The market maintains considerable expectations for this.