Highlight:

Historically, halving the block reward will cause significant fluctuations in the price of Bitcoin in the previous year. In the previous three times, the price of Bitcoin had a significant increase. Following a similar rhythm, by the end of 2024, Bitcoin is likely to break through $100,000.

- The latest crypto bull market started in 2022/23, a few days after Bitcoin broke through its all-time high, but this is obviously not the end. Benefiting from better regulatory clarity and more mature traditional investment products, as well as more traditional funds flowing in, Bitcoin is becoming an ideal asset class for capital pursuit in the current global inflationary environment. Since the approval of the Bitcoin spot ETF, IBIT and others have risen nearly 40% within two months. In this bull market, the top companies representing the three directions of cryptocurrency trading, Bitcoin asset management, and Bitcoin mining - Coinbase, MicroStrategy, and Marathon Digital - will perform better than Bitcoin itself, bringing greater flexibility, better risk-return ratio, and higher return level.

The encryption industry has gone through multiple cycles.

Bitcoin experienced a brief surge in 2013, but it really entered the mainstream view in 2017. At that time, the term "digital gold" had just gained attention as macro conditions gradually matured and emerging cryptoassets began to flourish.

Since then, the emergence of ETH, the emergence of DeFi protocols, the launch of liquidity mining, and the popularity of GameFi and NFTs have respectively created several small climaxes. Innovative assets and use cases, coupled with the prevailing external environment of inflation, have pushed the cryptocurrency market to new heights several times in a row.

Each small cycle brings more attention, users, and capital to the encryption ecosystem, and builds on the progress made before, expanding the possibilities of encryption technology.

The latest crypto bull market began in 2022/23. A few days ago, the price of Bitcoin broke through a historical high, but this is obviously not the end. Benefiting from better regulatory clarity, more mature traditional investment products, and more traditional funds pouring in, Bitcoin is becoming an ideal asset class that many capital are chasing (or at least willing to allocate more) in the current global inflationary environment.

This article is based on a review and analysis of data from the cryptocurrency bull market over the past year, and explores the possible halving of the market in the future. If we believe that the price of Bitcoin will continue to reach new highs in 2024, which stocks will benefit the most? How do they perform compared to Bitcoin, and what are their fundamentals and investment logic?

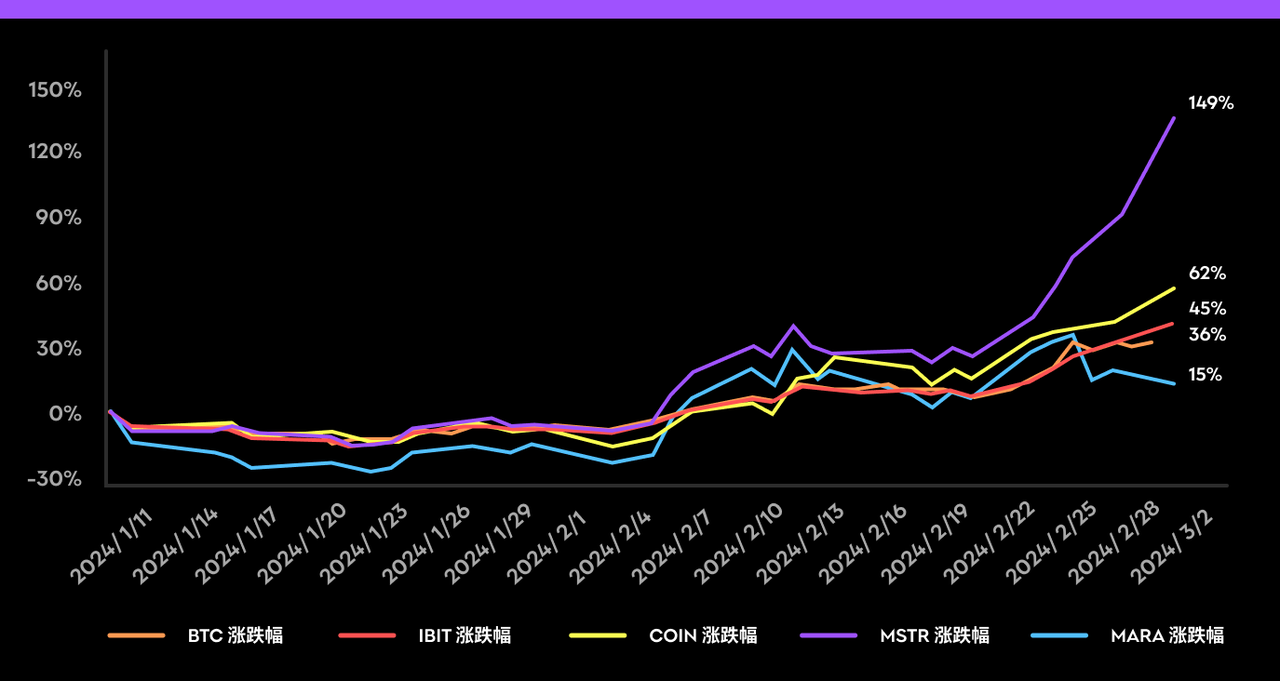

The following chart shows the rise and fall of Bitcoin, Bitcoin ETF (represented by BlackRock IBIT), Coinbase, MSTR, and Mara since the approval of Bitcoin ETF on January 11th (as of the close on March 4th).

The RockFlow research team believes that in this bull market, the top companies representing cryptocurrency trading, Bitcoin asset management, and Bitcoin mining - Coinbase, MicroStrategy, and Marathon Digital - will perform better than Bitcoin itself. They will bring greater flexibility, better risk-return ratio, and higher return levels.

The road to the crypto bull market in 2023

In 2023, there were three main catalysts for Bitcoin.

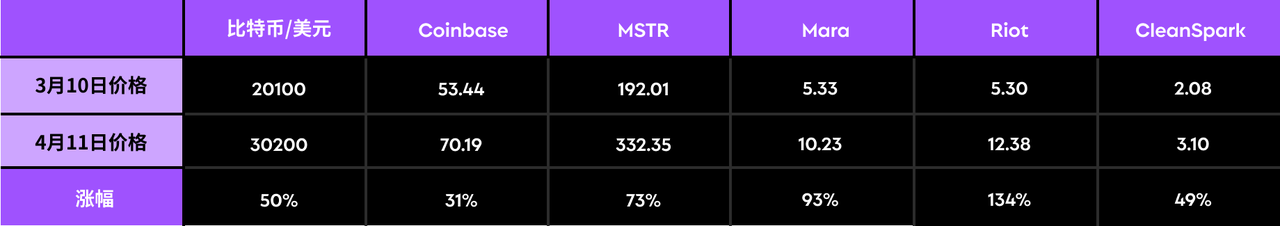

The first catalyst was the banking crisis triggered by the collapse of Silicon Valley Bank on March 10th, which increased people's interest in Bitcoin as a traditional financial alternative. On that day, the price of Bitcoin exceeded $20,100. On April 11th, a month later, the price of Bitcoin was $30,200, up 50% since the crisis began.

As a comparison, crypto concept stocks such as Coinbase, MSTR, Mara, Riot, and CleanSpark rose by 31%, 73%, 93%, 134%, and 49% respectively. The table below shows this:

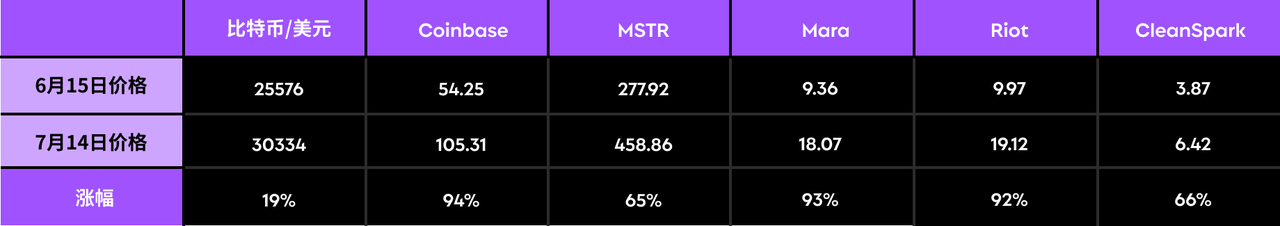

The second catalyst, and also the largest Bitcoin catalyst in 2023, was BlackRock's submission of a Bitcoin spot ETF application to the US SEC on June 15, 2023. This news quickly swept the market and was recognized as an olive branch thrown by the traditional financial industry. Stimulated by this, the Bitcoin price rose 19% from $25,500 on June 15 to $30,300 on July 14.

During this period, the stock prices of Coinbase, MSTR, Mara, Riot, and CleanSpark increased by 94%, 65%, 93%, 92%, and 66%.

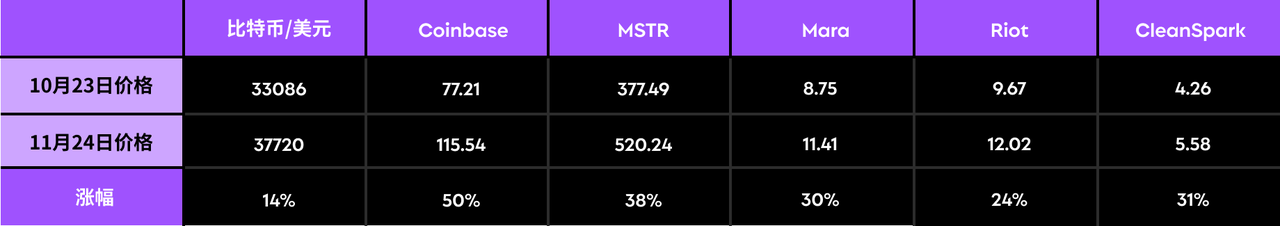

The third catalyst was the BlackRock ETF code that appeared on the DTCC website on October 23, 2023, which sparked speculation about the ETF's potential approval. As a result, the price of Bitcoin quickly rose by 14% from $33,000 on October 23 to $37,700 on November 24. Meanwhile, the stock prices of Coinbase, MSTR, Mara, Riot, and CleanSpark rose by 50%, 38%, 30%, 24%, and 31% respectively.

The consecutive boost of three key events has finally cleared the crypto market of the cold winter and gloom brought by the FTX incident. With the rise of Bitcoin price, the crypto bull market has officially arrived.

Taking history as a mirror, the possible halving market in 2024

The approval of Bitcoin spot ETF is an important time node, but obviously not the end. On April 19, 2024, the crypto market will usher in another major event - the fourth halving of Bitcoin, and the block reward is expected to decrease from 6.25 Bitcoin to 3.125.

Historically, halving block rewards will cause significant fluctuations in Bitcoin prices in the year before and after.

The first Bitcoin halving occurred on November 28, 2012, when the price of Bitcoin was $12. The year before the halving, the price of Bitcoin was $3, which meant that Bitcoin had risen by 300% during this period. This strong upward trend continued for a year after the halving. On November 28, 2013, the price of Bitcoin was $1016, which meant that Bitcoin had risen by 8367% since the halving and by 33767% since the year before the halving.

The same trend can be seen in the second halving that occurred on July 9, 2016. On that day, the price of Bitcoin was $647, compared to $268 on July 9, 2015, which means that Bitcoin rose 141% during the halving period. The price of Bitcoin continued to rise after the halving, reaching $2491 on July 9, 2017 (one year after the halving).

A similar upward trend was confirmed during the third halving on May 11, 2020, when the price of Bitcoin was $8,563, up 18% from $7,232 a year ago. Since then, the price of Bitcoin has continued to climb in 2021, reaching over $56,000 on May 11, 2021, an increase of 561% since the halving.

Will this trend continue during the upcoming fourth Bitcoin halving? Very likely. On April 19, 2023, the price of Bitcoin was about $29,000, and in early March 2024, it had already surpassed $66,000, an increase of over 127%. Following the previous pace, Bitcoin is likely to break through $100,000 by the end of 2024.

Three US stock targets that outperformed BTC

Currently, the value of assets managed by Bitcoin-based investment products (futures and spot ETFs, etc.) worldwide has exceeded 1 million bitcoins (about $64 billion), highlighting the growing interest in the traditional Financial Market in crypto investment portfolios.

According to K33 Research, more than 83% of the 1 million bitcoins are held by US spot and futures ETFs, followed by investment products in Europe and Canada. As of the close of trading on March 4th, they collectively held 1008,436 bitcoins, accounting for 5.13% of the circulating supply of bitcoins.

Taking BlackRock's IBIT as an example, its asset management scale has exceeded $10 billion in just 7 weeks, while Fidelity's FBTC fund assets have exceeded 115,000 bitcoins (worth $7.50 billion). Compared with traditional ETFs, their expansion speed can be understood: among the current 3,400 ETFs, only about 150 have asset management scale exceeding $10 billion, and the vast majority of them have been launched for more than 10 years.

These investment tools have greatly shaken the original market structure of Bitcoin. A few years ago, the circulating supply of Bitcoin held by spot exchanges was 20%; now, this number has dropped to 11%, and the scale of ETFs/ETPs and other various derivative products based on Bitcoin is rapidly expanding.

Unlike before when Bitcoin was stored on exchanges as leverage collateral, this time traditional asset management products enter the market, significantly lowering the threshold for Bitcoin investment (previously, pension funds could not buy Bitcoin spot, but now they can buy ETFs). At the same time, the purchased Bitcoin will be stored in the hands of the custodian and cannot be pledged or lent to market makers, making it difficult to generate liquidity overflow.

If you believe that Bitcoin will usher in a bull market in 2024, which stocks will benefit the most? How do they perform compared to Bitcoin, and what are their fundamentals and investment logic? Next, the RockFlow investment research team will analyze in detail the investment prospects of the top companies in the three directions of encrypted trading, Bitcoin asset management, and Bitcoin mining - Coinbase, MSTR, and Mara.

It should also be pointed out that another advantage of holding crypto stocks instead of bitcoin is that investors face lower risks. Holding bitcoin directly involves risks such as hacking, fraud, crypto wallet and exchange failures. A typical example is the collapse of FTX at the end of 2022, which caused customers to lose $8.90 billion in crypto assets.

Coinbase

On February 15th, Coinbase released a much better-than-expected financial report for Q4 2023, and its stock price soared nearly 30% in the following weeks. This quarterly report convinced investors that Coinbase's fundamentals are improving due to the widespread recovery of the cryptocurrency market. With the approval of the Bitcoin spot ETF by the US SEC, the rise in Bitcoin prices has further strengthened investors' confidence in the cryptocurrency market. Coinbase has become the best bet on the booming development of the cryptocurrency economy.

In fact, the expectation of the US SEC making a positive decision on the Bitcoin ETF has already led to a general rise in cryptocurrency in Q4 2023, which is also reflected in the surge in Coinbase's trading revenue. Attracted by the rise in cryptocurrency prices, institutions and retail investors have joined this trend, resulting in a 64% year-on-year surge in Coinbase's trading revenue in Q4 2023. Institutional trading revenue increased by 160% quarter-on-quarter, while retail customer trading revenue increased by 79% quarter-on-quarter.

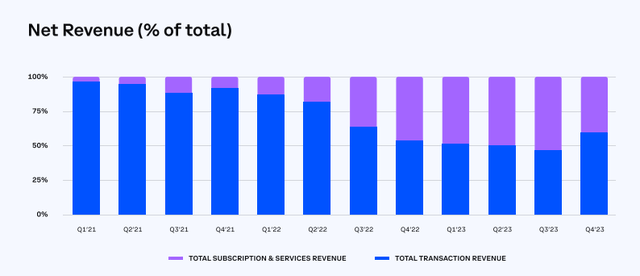

In addition, since 2022, Coinbase's revenue has become more diversified and strives to reduce its reliance on unpredictable transaction revenue. Coinbase's subscription and service revenue has grown significantly (a year-on-year increase of 78%), reaching $1.40 billion by fiscal year 2023. These services include blockchain rewards, custody services, customer loan interest income, and fees for stablecoin publishers.

In fiscal year 2023, 48% of net income comes from non-trading related services, while in fiscal year 2022, this proportion is only 25%. This diversification helps reduce the volatility of Coinbase's future income and also brings more stable profitability.

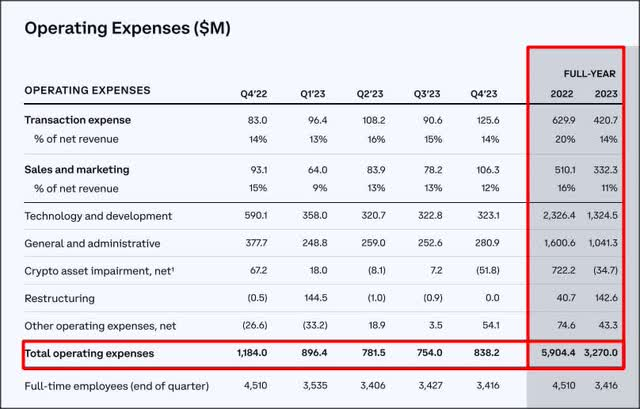

On the other hand, Coinbase's significant reduction in operating expenses has begun to pay off. During the last crypto bear market, Coinbase laid off a large number of employees and significantly reduced costs. Today's Coinbase is a much leaner company, and its operating expenses for the 2023 fiscal year have decreased by 45% year-on-year.

Currently, Coinbase has become a profitable and stable cryptocurrency trading platform. The US SEC's approval of the Bitcoin spot ETF directly stimulated the demand for Bitcoin trading, made a huge contribution to boosting investor sentiment, and further legalized the entire cryptocurrency economy.

However, it should be pointed out that Coinbase is not completely risk-free. Investors need to pay attention to regulatory trends, cyclical fluctuations in the cryptocurrency market, and bankruptcy risks of other trading platforms. The bankruptcy of FTX in 2022 had a very negative impact on investors, and similar events may once again seriously damage the bullish sentiment of the cryptocurrency market.

MicroStrategy

MicroStrategy (MSTR) was originally a BI (Business Intelligence) and analytics software service provider. Of course, they are still doing related businesses and have recently entered the AI field. But what is its real value? It holds nearly 200,000 bitcoins.

MSTR chooses to "invest" in Bitcoin and hold it for the long term, which is one of the best ways to build a portfolio of volatile assets such as Bitcoin. This method is bringing huge returns in the current bull market of cryptocurrency.

MSTR's move to buy bitcoin began in August 2020, about three months after the third bitcoin halving. About a year after the first purchase, MSTR's bitcoin holdings jumped to 92,000. The company currently holds 193,000 bitcoins, worth more than $13 billion at current prices, with an unrealized profit of $6 billion.

It is also because of its continuous issuance of bonds to buy Bitcoin that since 2020, the MSTR stock price and Bitcoin price have shown a strong correlation. Historical data shows that the MSTR stock price can effectively amplify Bitcoin price fluctuations. On average, the fluctuation level of MSTR is 1.5 times that of Bitcoin price.

Therefore, if you are optimistic about the after-market performance of Bitcoin, you can consider using MSTR to obtain excess returns beyond the increase in Bitcoin.

However, it should be pointed out that given the continued volatility risk of Bitcoin prices, MSTR stock prices will also bear greater volatility. Unexpected global events, including geopolitical tensions or macroeconomic shocks, may affect the cryptocurrency market and thus affect MSTR.

Marathon Digital

Due to the improvement of macroeconomic conditions and the continuous surge in Bitcoin prices, Bitcoin mining stocks have achieved significant returns in the past few months. The RockFlow research team believes that Marathon Digital (Mara) is the best target among all Bitcoin mining stocks because its computing power and Bitcoin reserves make its competitors pale in comparison. Mara provides investors with a more flexible trading opportunity, and given that Bitcoin may continue to reach new highs after its halving this year, Mara is also worth looking forward to.

As a leading Bitcoin mining company, Mara's strategy is to mine and hold Bitcoin as a long-term investment after paying operating costs. Currently, Mara mines Bitcoin through joint ventures in the US, Abu Dhabi, and Paraguay. Although some mines were previously entrusted to third-party custody, it is abandoning this model, which helps it reduce mining costs and improve Operational Efficiency.

As mentioned earlier, halving events often have an extremely positive impact on Bitcoin prices, but the impact on Bitcoin mining stocks is not the same.

Due to the halving of block rewards, this basically means that their mining costs have doubled. Therefore, mining stocks rely heavily on the rise in Bitcoin prices after the halving to compensate for the expected decrease in production. For this reason, mining companies with insufficient capital reserves may find it difficult to continue, while leading companies are more likely to take all.

Why are you optimistic about Mara becoming a winner in mining stocks? The reasons are as follows:

Mara's first advantage is its Bitcoin reserves. Currently, Mara has the largest Bitcoin reserves among mining companies, holding 15,741 Bitcoins. In contrast, its biggest competitors Riot and CleanSpark hold 7,648 and 3,573 Bitcoins respectively. In other words, the rise in Bitcoin prices will benefit Mara the most.

Mara's second advantage over its peers is its computing power. Currently, Mara's deployed computing power is 26.7 EH/s, higher than Riot and CleanSpark (the latter two had 12.4 and 10.09 EH/s in January, respectively). Mara expects its computing power to increase to 34.7 EH/s by the end of this year; Riot expects its computing power to increase to 28.8 EH/s in the fourth quarter; CleanSpark expects its computing power to reach 20 EH/s in the first half of the year, and has recently reached more than 16 EH/s after completing the expansion of Sandersville. With higher computing power levels, Mara is more capable of continuously producing more bitcoins after the halving.

Mara's third advantage is its cash reserves. According to January data, Mara's cash balance is $319 million, exceeding Riot's $290 million and CleanSpark's $173 million. More ample ammunition clearly supports Mara to explore more growth opportunities, including increasing the acquisition of Bitcoin miners that may not survive after the halving, purchasing more miners or purchasing new facilities.

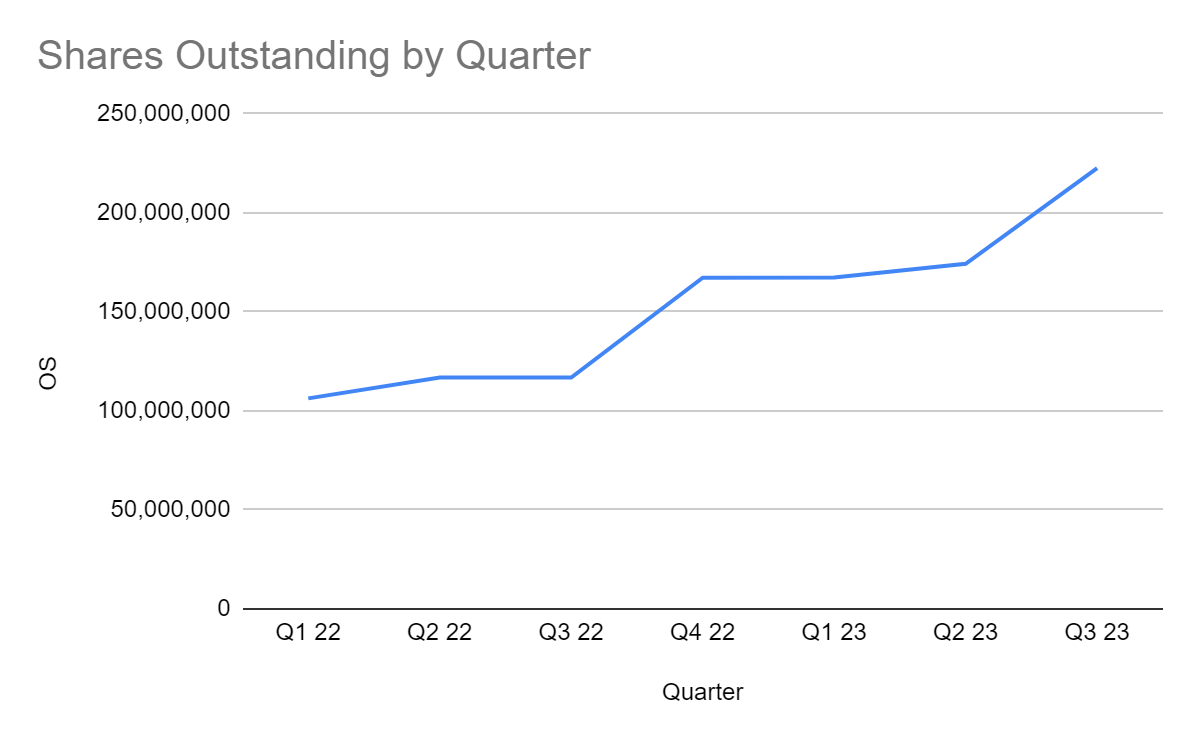

However, Mara also has certain risks. The first is the continuous issuance of stocks, and its circulating shares increased from 106.30 million shares in Q1 2022 to 222.60 million shares in Q3 2023, an increase of nearly 110%. This is a negative factor for its stock price.

The more significant risk comes from Bitcoin itself. The premise of Mara's stock price rise is that Bitcoin continues to appreciate. If Bitcoin prices do not rise sharply after the halving or fall due to other unforeseen events, Mara will be in trouble.

Conclusion

Since dozens of Bitcoin ETFs were approved, the prices of Bitcoin and Bitcoin ETFs have risen by 40% in less than 2 months. Given the upcoming halving event in April and the historical volatility that pushed up the price of Bitcoin, the RockFlow research team believes that the price of Bitcoin will continue to rise this year.

Coinbase, MSTR, and Mara, as high-quality targets in their respective fields, are excellent alternatives to Bitcoin in this round of market trends. They will bring investors greater flexibility, better risk-return ratio, and higher return levels.