Highlight:

Based on the previous average participation cost of $0.2-0, early investors who entered Faraday Future made a profit of 10-15 times at the peak. Retail investors who bought at the lowest point of $0.04 made even more substantial profits (over 80 times).

The essence of the 2021 GameStop event is a "short squeeze", and Faraday Future is no exception. As of April 30th, its short-selling ratio was as high as 95.37%. This indicates that Faraday Future is extremely pessimistic, but if the bulls concentrate their efforts to squeeze short, the winning rate is quite high.

Faraday Future is just another replica of the previous GME and AMC events. Similar phenomena have appeared in multiple segmented markets: Meme demon stocks, NFTs, SPACs, cryptocurrency, and sometimes even large-cap stocks such as Tesla. Reality is often crazier than expected.

Introduction

A week ago, the US stock market seemed to have returned to 2021.

It all started with a tweet posted by Keith Gill on Sunday night. He is better known as "Roaring Kitty" and was the leader of retail investors during the last Meme stock surge.

This is the first time he has posted on social media in three years.

Then, last Monday and Tuesday, in just two days, GameStop and AMC's stock prices rose by more than 100%, and the sharp fluctuations in stock prices caused them to be delisted 38 times on Tuesday alone. According to data company S3 Partners, within two days, GME bears lost about $2.20 billion.

Unlike 2021, the market trends belonging to GME and AMC dissipated quickly this time.

But the story did not end there. Faraday Future (FFIE), an electric vehicle company from China, subsequently carried the banner. It soared 5700% in the new round of Meme stock boom last week, becoming the favorite of retail investors after GME, AMC and other monster stocks.

According to the Nasdaq official website, from May 14th to 16th, the daily trading volume of Faraday Future surged more than 10 times compared to the previous average, with the highest daily trading volume exceeding 1.50 billion stocks. Based on the previous average participation cost of $0.2-0, early investors made a profit of 10-15 times at the peak. Retail investors who bought at the lowest point of $0.04 made even more substantial profits (over 80 times).

As the stronghold of the previous wave of Meme demon stocks, in the sub-districts and shortsqueeze formed by Roaring Kitty fans, retail investors with hundreds of thousands of positions and over ten thousand positions have shown their positions, further stimulating the enthusiasm of a large number of retail investors for spreading and bottom fishing.

According to data company Thinknum, on May 17th, the peak of this round of gains, Faraday Future became the second most mentioned stock by WallStreetBets, the headquarters of US Tieba Reddit retail investors, second only to Nvidia.

So, how did FFIE steal the limelight from big brothers like GME and AMC and become China's own Meme monster stock in this round of market? Who will be the next one? RockFlow's investment research team has made a brief analysis of this.

In addition, RockFlow has previously delved into the development history, current business status, and investment value of multiple high-quality US stock companies.

- After NVIDIA, who will be the next early AI beneficiary?

- Tesla's Hopes and Worries

- Coinbase: Exchange, broker, crypto bank or a belief?

FFIE's fundamentals and what are the necessary conditions for being selected?

In the past six months, Faraday Future's stock price has fallen from $1.50 to 4 cents. In just five days, its stock price has been rising steadily, breaking through the $1, $2, and $3 mark for the first time since January this year.

Before understanding why Faraday Future was chosen by retail investors (or big investors?) this time, let's briefly understand it.

Faraday Future went public on NASDAQ in 2021, with its headquarters in New York and a market value of over $4 billion. The stock price peaked at $4,980 on February 1, 2021. It then steadily declined, falling to a low of $0.038 earlier this year - a drop of 99.99%, with a market value of less than $2 million.

Compared to the tens or hundreds of thousands of annual deliveries of peers, in 2023, Faraday Future will only deliver 10 new cars, including founder Jia Yueting himself. Obviously, such small deliveries are far from enough to achieve profitability.

From a fundamental perspective, Faraday Future is clearly in a deadlock. It was unable to disclose its financial reports for the last two quarters in a timely manner as required. Its reported revenue for the last quarter (Q3 2023) was $551,000, with a net loss of $78.046 million. The cash position as of the quarter was $8.567 million, almost destined for delisting.

Nasdaq's delisting notice has made things worse. In April of this year, Faraday Future received a delisting notice from Nasdaq due to its low stock price. In the last communication, FFIE plans to request an extension of time and may conduct a reverse stock split.

Under such a crisis, data from Faraday Future is particularly noteworthy - according to the Nasdaq official website, as of April 30th, its non-position squaring bear position stocks reached 36 million. That is, calculated based on the circulating share capital of 38.1063 million shares, the proportion of short selling is as high as 95.37%.

So many stocks were sold short, indicating that Faraday Future is extremely bearish. However, this also means that if the bulls concentrate their efforts short, the winning rate is quite high.

"Short selling" is a common financial phenomenon. When the price of a stock that is seriously shorted rises rapidly, it forces the short sellers to buy stocks to make up for their losses. At this time, if the short interest rate is high and the buying pressure increases sharply, it will further lead to the continued rise of stock prices. The more short sellers are eager to position squaring, the more stocks they must buy back, which will further push up the stock price and create a self-perpetuating cycle.

The essence of the GameStop event in 2021 was a "short squeeze". At that time, although GameStop was rising strongly, Robinhood was influenced by important financial supporters and prohibited ordinary retail investors from buying GameStop stocks (only allowed to sell), resulting in a sharp drop in stock prices. In the end, Wall Street won, and many retail investors who chased high suffered heavy losses.

This time, retail investors discovered Faraday Future and began to gather again. The two sides may continue to clash around several important stock price levels. The battle between bulls and bears may last for weeks or even months.

Why has FFIE become the leading meme stock?

The possibility of short-selling is just one of the reasons why Faraday Future was selected.

The characteristics of Meme demon stocks are strong interest from retail investors, high discussion on social media, violent price fluctuations, and a disconnect between the stock price and the company's basic financial health. Faraday Future meets all of the above conditions, so it coincides with the return of Roaring Kitty. His legendary experience of participating in GameStop has stimulated too many retail investors. When emotions arise, it is necessary to find one or even several outlets to vent.

In fact, the reason why Faraday Future can become the pioneer of this round of Meme demon stocks is also due to the resonance triggered by the following external news:

- Geopolitical dynamics

One factor driving up Faraday Future's stock price was the US government's announcement on May 14th that it would impose additional tariffs on Chinese electric vehicles and other products. This sudden news reminded agile investors of the uniqueness of Faraday Future.

As the only Chinese-backed electric vehicle company headquartered in the US and developed locally (i.e. the only electric vehicle China Concepts Stock not affected by tariffs), Faraday Future's position is unique and may generate certain M & A value. This is one of the triggers for speculative transactions.

2)Fundamental "Value"

As mentioned earlier, Faraday Future has indeed suffered serious losses, with losses exceeding $600 million in the past year. However, some analysts expect that its fundamentals may improve this year and next. If we have to look for bright spots, the company expects to earn 12 cents per share by 2025, which may also be one of the driving forces for the stock price rebound.

- Jia Yueting needs to protect Faraday Future's listing status

Another key factor affecting the recent surge in Faraday Future's stock price is the proactive measures taken by the company's founder Jia Yueting. After receiving the delisting notice in April, Jia Yueting couldn't sit still and hoped to use his personal IP to seek benefits for the company.

In the past few weeks, Jia Yueting, who also serves as Faraday Future's Chief Product and User Ecosystem Officer (CPUO), has posted several videos on various social media platforms. In the videos, he announced his plan to monetize his personal IP to generate additional income, inject funds into Faraday Future to support car production and overall operations, in addition to repaying debts. He emphasized his commitment to playing a more active leadership role with the co-CEO and sharing the challenges facing the company.

If his words still have a little bit of credibility, they may also convince a small number of retail investors to buy them.

Where will the next Meme demon stock be born?

Obviously, Faraday Future is just another replica of the previous GME and AMC incidents.

Looking back at the GME incident, besides Keith Gill mentioned earlier, the core figure is actually Ryan Cohen. He quit his pet e-commerce company Chewy in 2017 and chose to enter GameStop in 2020. In September 2020, Cohen disclosed that he held 9% of the company's stock.

The intervention of Mr. Cohn, who has carefully run Twitter and achieved success in ecommerce, caught the attention of investors, possibly more than retail, and sent the stock up 24 per cent on the news.

Two months later, he issued an open letter to GameStop's board of directors outlining plans to develop its e-commerce business. In January 2021, Cohen increased his shareholding ratio to 12.9% and joined the board, once again shocking the world.

At this time, just like Faraday Future this time, GameStop gathered a large number of bears due to fundamental factors, and then the "short squeeze" market began, and its stock price rose by more than 1000%.

Retail investors may have missed out on GameStop in 2021, but some of them won't want to miss out on GME, AMC, and Faraday Future again.

In the past few years, similar phenomena have emerged in multiple segmented markets: Meme stocks, NFTs, SPACs, cryptocurrency, and sometimes even large-cap stocks such as Tesla.

In each case, the asset actually generates a certain emotional value, which is divorced from the original underlying value. This is closely related to a company's attention and liquidity. Even if the fundamentals have not changed, as long as it is seen by the market, it can be given new value (although it is often short-lived and easily faded).

Conclusion

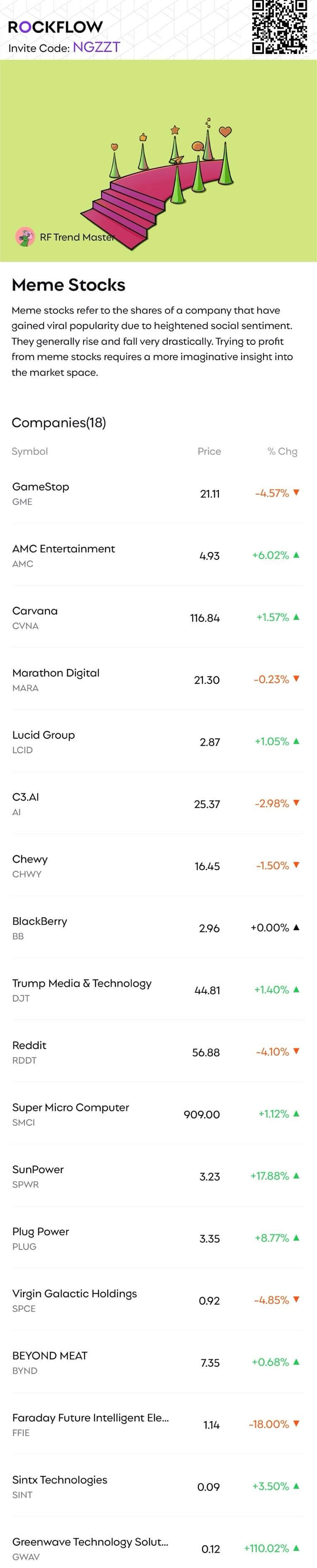

The recent significant fluctuations in the stock price of Faraday Future not only reflect the risks of the stock market, but also reflect the charm of the stock market. Reality is often crazier than expected, especially in the US stock market, which is filled with retail investor sentiment, geopolitical factors, and internal development of the company. The RockFlow investment research team has carefully sorted out a Meme stock list. Scan the code to follow their latest developments and performance.

As for when the game of Faraday Future will come to an end? Who will be next? We wait and see.

About the Author

The RockFlow research team specializes in long-term analysis of high-quality companies in the US stock market, as well as emerging markets in Latin America and Southeast Asia, focusing on industries with high potential such as cryptocurrencies, biotechnology, and more. The core members of the team come from top technology companies and financial institutions including Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, and CITIC Securities. Many of them have graduated from leading universities such as Massachusetts Institute of Technology (MIT), University of California, Berkeley, Nanyang Technological University, Tsinghua University, and Fudan University.

You can also find us on these platforms: