Highlight:

Chips are not NVIDIA's only competitive advantage. It is actively seeking opportunities to expand its influence. Its multiple external investments are not only for financial returns, but also to further amplify the demand for its high-performance chips and nourish the "NVIDIA ecosystem".

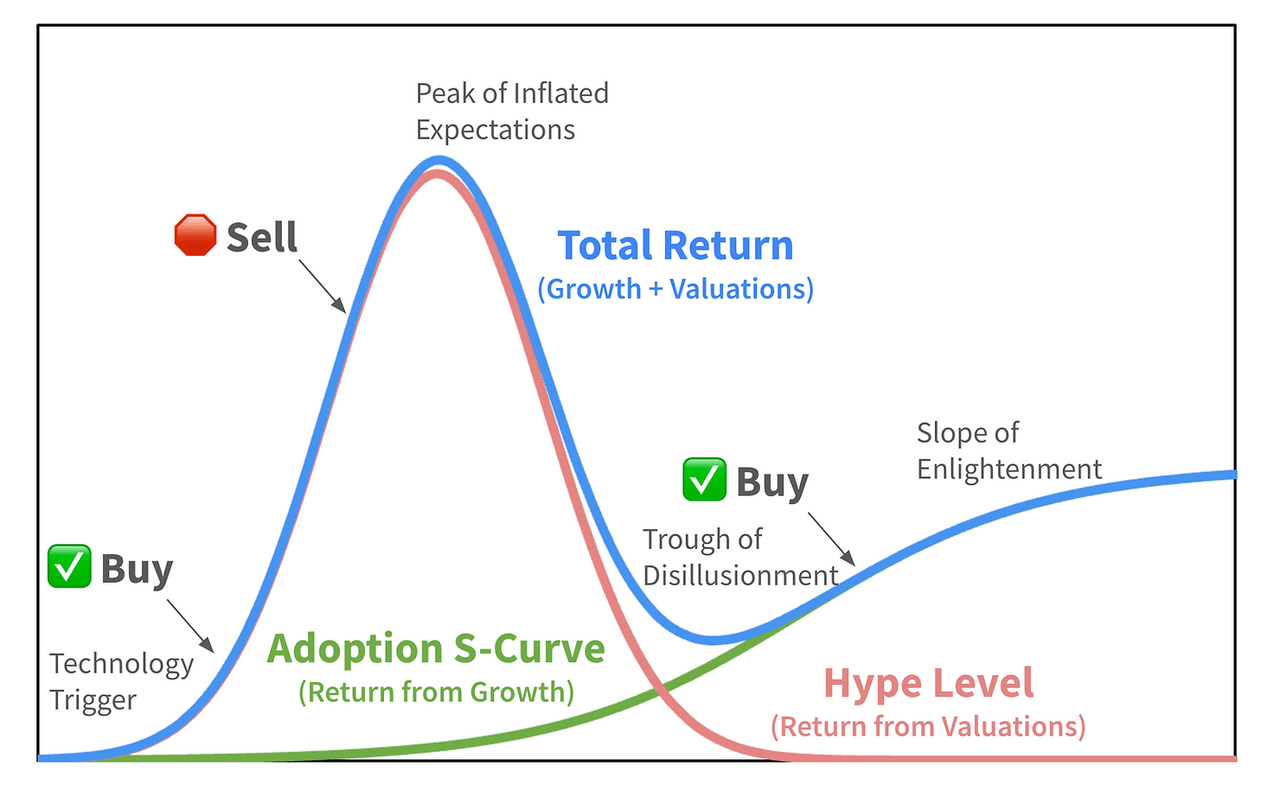

Technological progress will bring real value, but the risk of overvaluation may also offset strong fundamental growth. Therefore, investing in stocks of rapidly growing technologies is only effective when growth has not yet been fully priced. With the continuous diffusion of AI, the liquidity premium it brings is also a kind of value. In the technological revolution, sticking to the rules will miss many opportunities. Investors should dynamically adjust their investment portfolios according to changes in fundamentals and valuations. Goldman Sachs summarized four stages of AI investment: the first stage focuses mainly on NVIDIA; the second stage focuses on AI infrastructure outside of NVIDIA (such as semiconductors, Cloud as a Service providers, Data center REITs, software, etc.); the third stage focuses on companies that increase revenue through AI; the fourth stage focuses on companies that improve productivity through AI.

Last week, NVIDIA just concluded its first offline GTC conference in nearly five years. Multiple heavyweight products were released one after another, including GPUs with stronger performance than the previous generation flagship AI chips, based on Blackwell's new architecture, and a universal basic model for humanoid robots. Essentially, AI is becoming cheaper and more "concrete".

As one of the top three tech giants in the world in terms of market value, the reason why NVIDIA is highly sought after can be simply explained as the advancement of AI has made the vast majority of companies (such as healthcare and finance) compete to research how to introduce this technology. Therefore, they need high-performance chips (or related computing services). Coincidentally, NVIDIA has the best chips.

However, chips are not the only ones. Nvidia is looking for other opportunities to leverage its influence in this wave of AI boom. It has been actively expanding the radius of venture capital and investing in start-up companies that apply AI to a wide range of industries.

In the past few years, Nvidia has invested in a bunch of software, biopharmaceutical, and healthcare companies. In a filing with the US SEC in February, it disclosed that it holds a small percentage of stocks in some AI concept Listed Companies, such as drug discovery company Recursion Pharmaceuticals and SoundHound AI, which develops automatic speech recognition technology.

These investments are paying off. Compared to a year ago, the value of NVIDIA's stock has more than quadrupled. But these investments are not just for financial returns. By investing in companies focused on AI, NVIDIA further amplifies the demand for high-performance chips it manufactures, nourishing the "NVIDIA ecosystem".

Its company blog in December last year outlined how it supports companies that "utilize NVIDIA technology". "NVIDIA's corporate investment department focuses on strategic partnerships that help stimulate joint innovation, enhance NVIDIA's platform capabilities, and expand ecological influence."

Huang Renxun also emphasized the growth potential of this ecosystem. During the February earnings call, he talked about cooperation with biotech companies, healthcare companies, Financial Services companies, semiconductor companies, LLM developers, autonomous car companies, and robotics companies. "All of these companies rely on NVIDIA's platform, and we support each other."

The high market value and importance of NVIDIA are not only based on the market's recognition of its past performance, but also partly due to its high expectations for the future. Perhaps because it has risen too fast and by too much, many investors cannot help but wonder whether it is pushing the current AI boom into a new "bubble". How do we identify the true value among AI concept stocks with vastly different valuations? And most importantly, which AI concept stocks are still undervalued?

AI is hot, but not yet a "bubble"

Looking back, the huge success of ChatGPT may have been the starting point of this AI boom. The transformative potential of LLM and its underlying technology has ignited the enthusiasm of Listed Companies, venture capital funds, and secondary market investors.

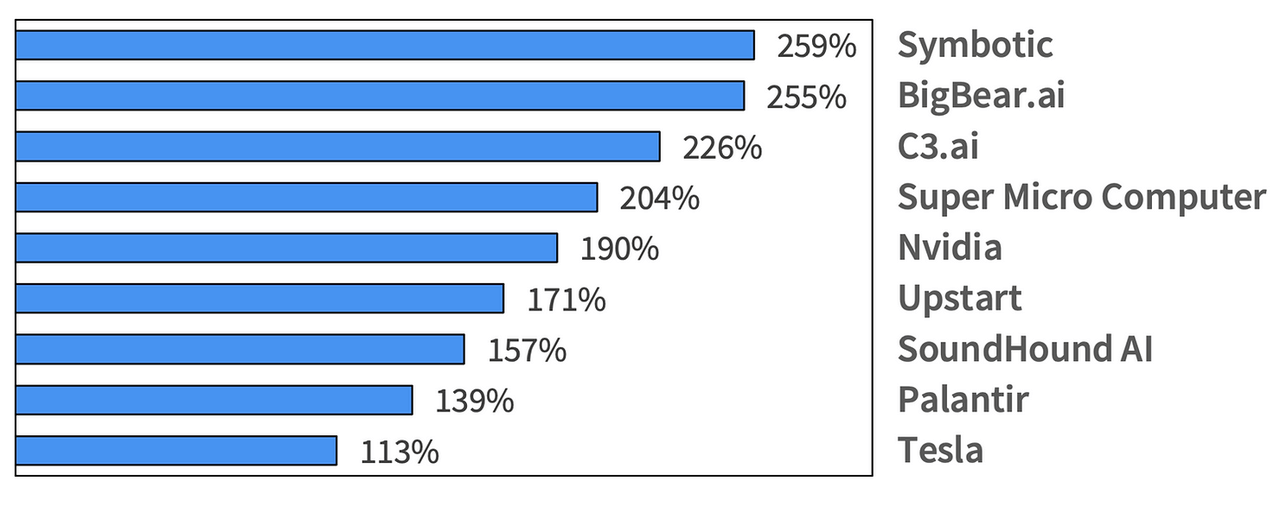

No one does not believe that the changes brought by AI will be real. However, the rapid rise of AI concept stocks is also astonishing. The following chart shows the return level of some AI concept stocks from the beginning of 2023 to June 30th, half a year.

Not to mention the surge of AI concept stocks led by NVIDIA, SMCI, and AMD from the end of 2023 to the beginning of 2024. The surge in their market value has raised concerns among some investors: is the "AI bubble" coming?

History has shown that the emergence of new technologies can easily lead to excessive enthusiasm. All past technological revolutions (such as steam engines, electricity, and oil) were accompanied by bubbles, and the internet bubble at the end of the last century is a vivid example.

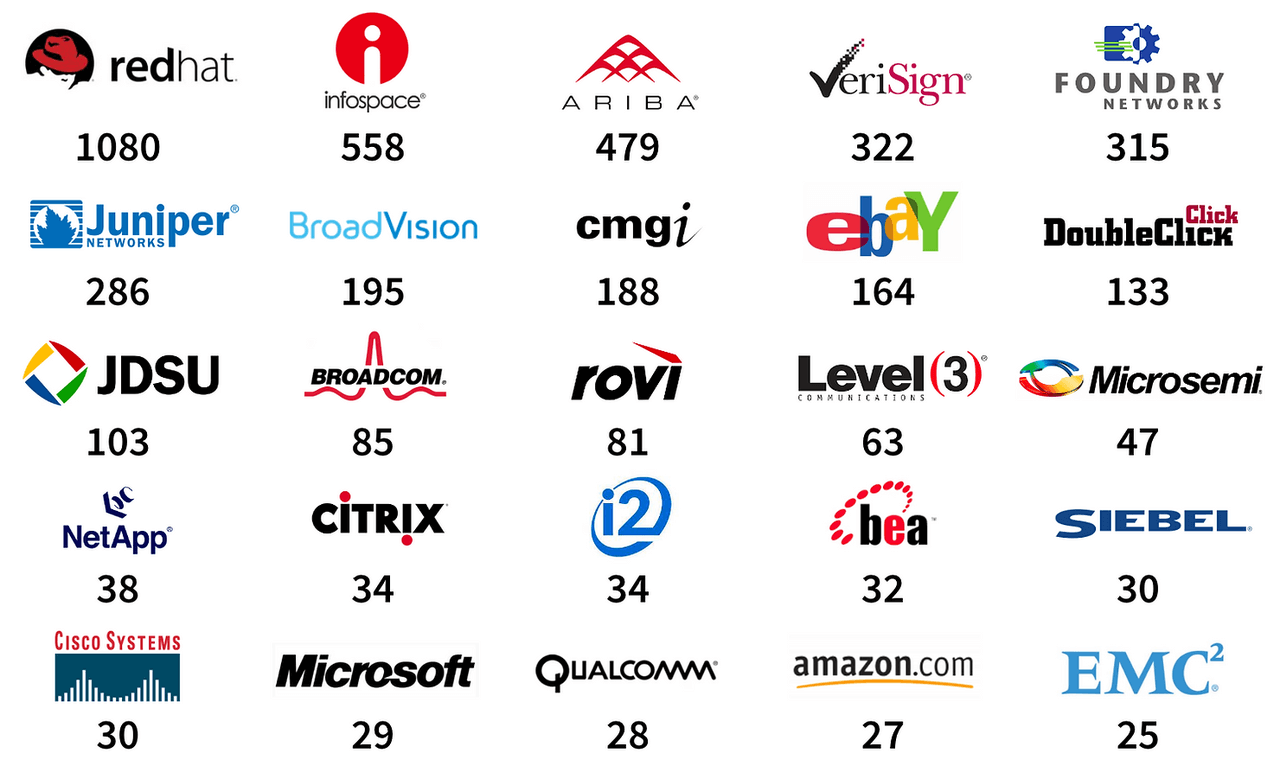

In the late 1990s, investors were excited about the huge potential of the Internet. By 2000, dozens of Internet stocks had Price-To-Earnings Ratios similar to today's NVIDIA. The largest member of the Nasdaq 100 index, Cisco, had a Price-To-Earnings Ratio of up to 30 times. The most exaggerated thing is that the enterprise Linux supplier Red Hat Price-To-Earnings Ratio even exceeded 1000.

These astronomical Price-To-Earnings Ratios reflect investors' extreme optimism about the Internet at the time.

Taking the annual report submitted by Goldman Sachs to the US SEC as an example, Goldman Sachs outlined its internet strategy as follows:

“We believe that over time, internet technology and e-commerce will change the way securities and other financial products are traded and distributed, creating opportunities for our business. In response, we have developed internal development and external investment plans.

Internally, we expand our global electronic trading and information distribution capabilities to clients through the Internet. These capabilities cover many of our Fixed Income, currencies, commodities, stocks, and mutual fund products in the global market. We also use the Internet to improve the convenience and quality of communication with institutional and high net worth clients. Investors can already access our investment research, mutual fund data, and valuation models online.

In addition, our high net worth clients are increasingly accessing their portfolio information via the Internet. We recently formed GS-OnlineSM to act as an underwriter for securities published via the Internet and other electronic means.

Externally, we have invested in e-commerce companies such as Bridge Information Systems, TradeWeb, Archipelago, The BRASS Utility, OptiMark Technologies, and Wit Capital Group. Through these investments, we have deepened our understanding of business development and opportunities in this emerging industry. "

In this report, Goldman Sachs acknowledges the disruptive potential of the Internet and outlines its Internet strategy. It hopes to use the Internet to better communicate with wealth management, trading, and investment banking clients. In addition, it actively invests in external Internet assets (such as TradeWeb).

However, despite the internet's ultimate victory, the once overvalued internet companies did not bring widespread high returns to investors. In 2000, speculation began to gradually fade away, and the valuation level of internet concept stocks plummeted, with the average Price-To-Earnings Ratio dropping from 33.3 to 5.2, a drop of more than 85%.

The important lesson from this history is that technological progress will bring real value, but the risk of overvaluation may also offset strong fundamental growth. Therefore, investing in stocks of rapidly growing technologies is only effective when growth has not yet been fully priced.

AI tech diffusion and liquidity premium

The investment industry is increasingly divided into two factions: "value stocks" and "growth stocks". Many Value Investors choose to stay out of the entire speculation cycle, so they will continue to underperform the market during the boom phase. At the same time, many growth investors are eager to enter, only to find that their returns have turned into illusions in the subsequent market value regression.

The RockFlow research team believes in the middle way. Innovation is the lifeblood of the economy, and investors should actively engage with new technologies and potential emerging markets. However, it is also crucial to listen to the cautious warnings of Value Investors.

We believe that with the continuous diffusion of AI technology, the liquidity premium it brings is also a kind of value. In the technological revolution, sticking to the rules will miss many opportunities. Investors should dynamically adjust their investment portfolios according to changes in fundamentals and valuations.

Generally speaking, there are three types of beneficiaries of the technological "gold rush": infrastructure inventors ("picks and shovels"), natives of emerging industries ("gold miners"), and pioneers of traditional industry transformation. They correspond to innovators, early adopters, and early masses in the technology diffusion model, respectively.

AI concept stocks are the same. First, they are dominated by infrastructure providers such as NVIDIA. As time goes by, indigenous people begin to adopt them, and finally they become fast followers of traditional industries.

Regarding the second and third categories, taking Google, S & P Global, and Moderna as examples:

Google is using LLM to improve User Experience in various fields, including search and YouTube. Google Cloud is collaborating with various companies to leverage AI for transformation. In addition, the company has released PaLM API and MakerSuite tools to provide access to LLM and quickly build generative AI applications.

S & P Global has made significant investments in decision science, AI, and Machine Learning. The company acquired AI start-up company Kensho six years ago and has developed products such as Kensho Link, Extract, , and Scribe. In addition, Kensho is training financial large models based on S & P Global Data assets.

Moderna is also trying to improve mRNA design algorithms with AI. The company has also partnered with Carnegie Mellon University to launch the AI Academy to educate and empower employees to integrate AI and Machine Learning solutions into their systems and workflows.

We believe that there are still many types of companies utilizing AI in various ways. Therefore, there are still many opportunities for AI concept stocks. Although some are overpriced, many are still undervalued.

Under the trend, the era of mining AI

NVIDIA is clearly just the beginning. Recently, Goldman Sachs released a report that internally divides AI investment into four stages.

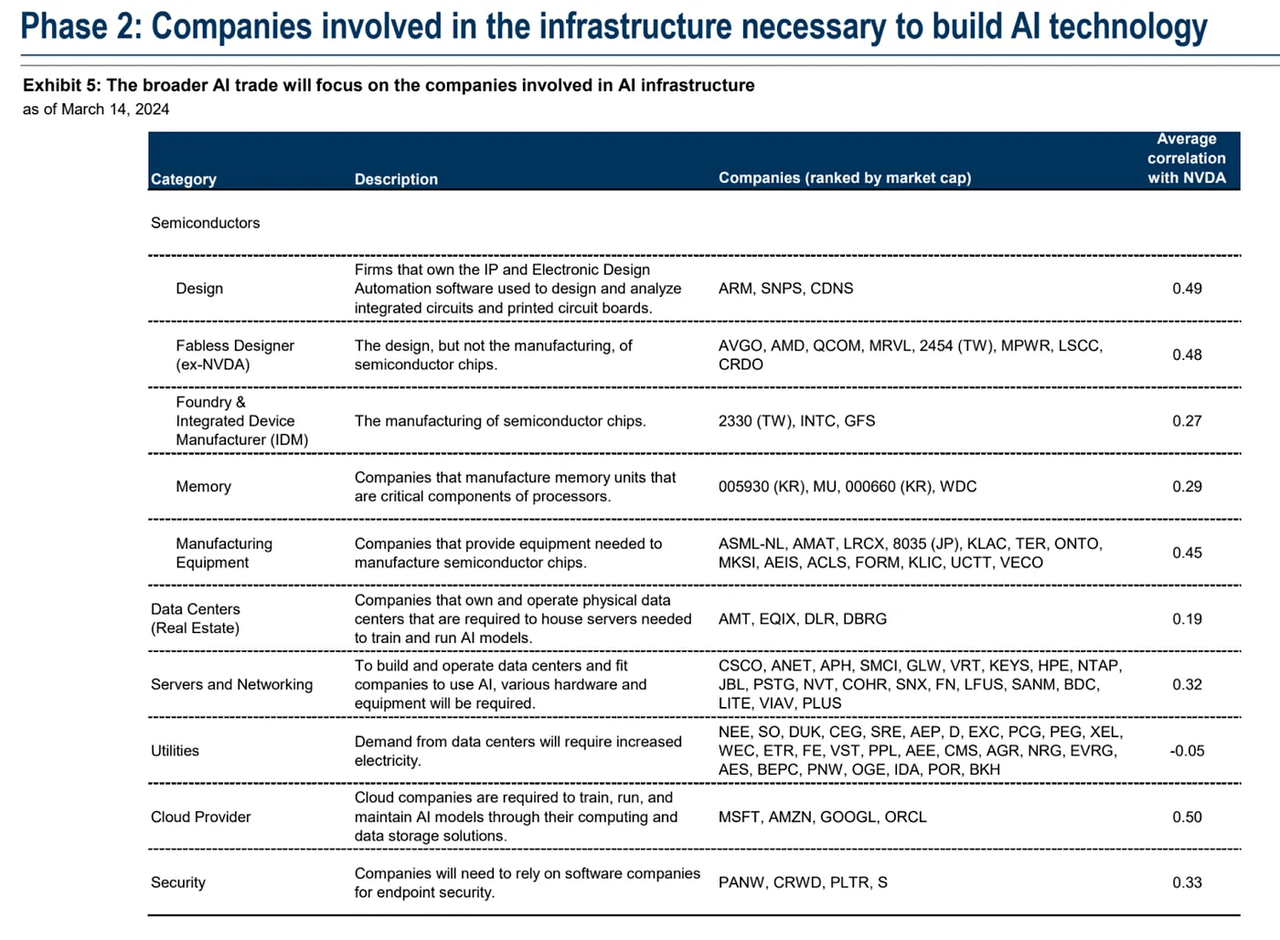

The first phase mainly focuses on NVIDIA. In the second phase, focus on AI infrastructure outside of NVIDIA, including semiconductor companies, Cloud as a Service providers, Data center REITs, hardware and equipment companies, software security stocks, and utility companies. In the third stage, focus on companies that can increase revenue through AI technology. In the fourth stage, focus on companies that can improve productivity through AI technology.

Currently, most companies in the second phase have seen an increase in valuation, but profit revisions vary greatly. Notable examples include Synopsys, chip design software company Monolithic Power Systems, wireless and broadcast communication operator American Tower, and electrical equipment company Vertiv.

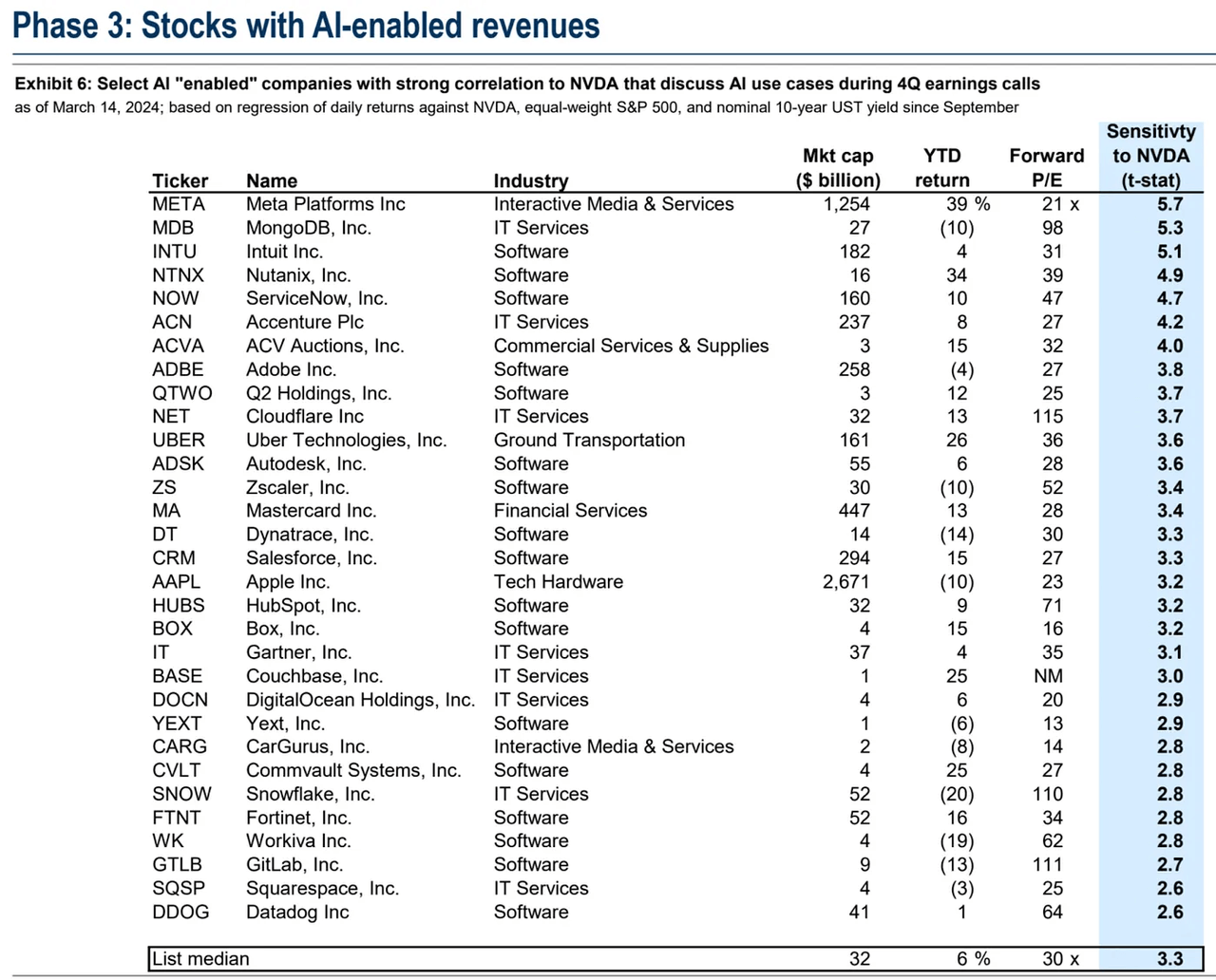

Regarding the third phase of "AI empower", it focuses on companies that integrate AI into their products to increase revenue, such as software and IT service companies. In addition to well-known tech giants, Cloud as a Service provider Cloudflare, software design company Autodesk, database company MongoDB, and Cloud as a Service provider Nutanix are also potential stocks.

Phase III stocks have returned less than 10% so far this year, and while their excess returns are driven by factors other than AI, investor interest in these stocks is on the rise.

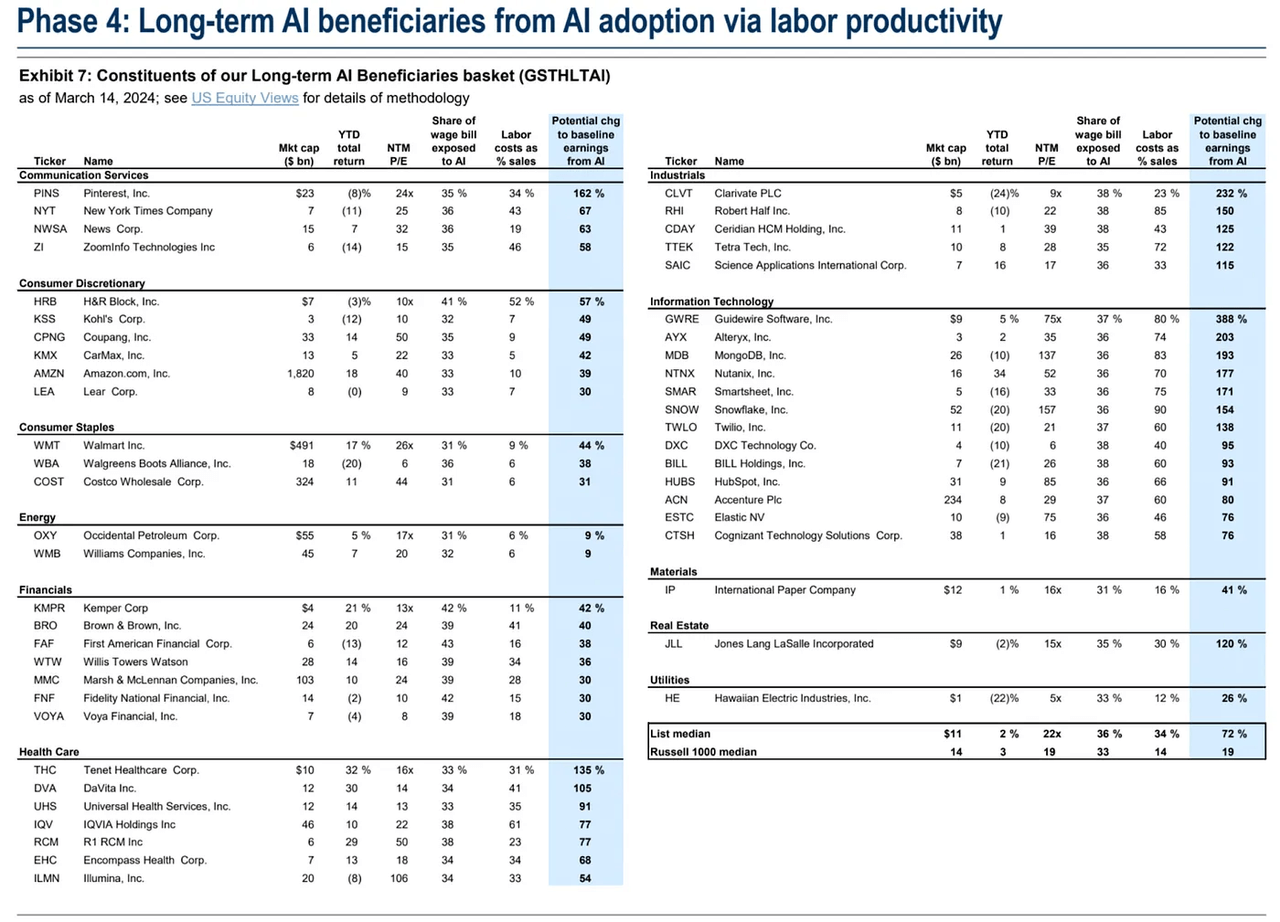

The fourth stage of "productivity improvement" mainly focuses on companies that use AI technology to improve production efficiency, especially labor-intensive industries such as software services and business services, which are easily affected by AI automation.

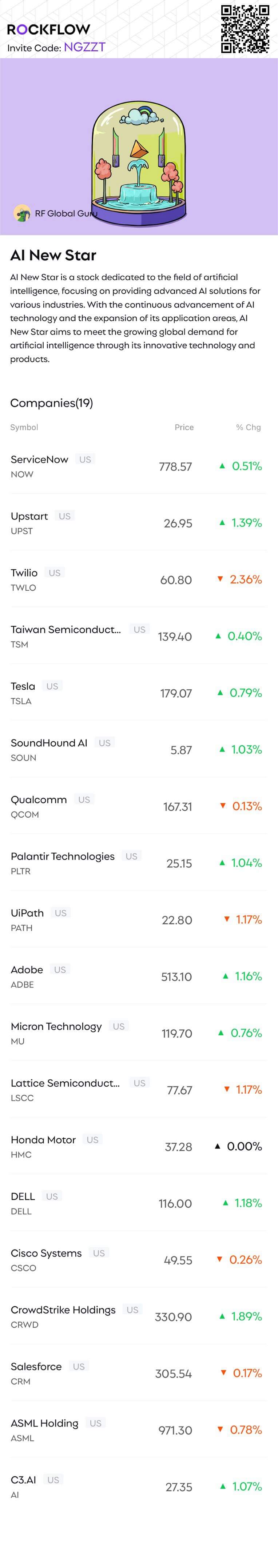

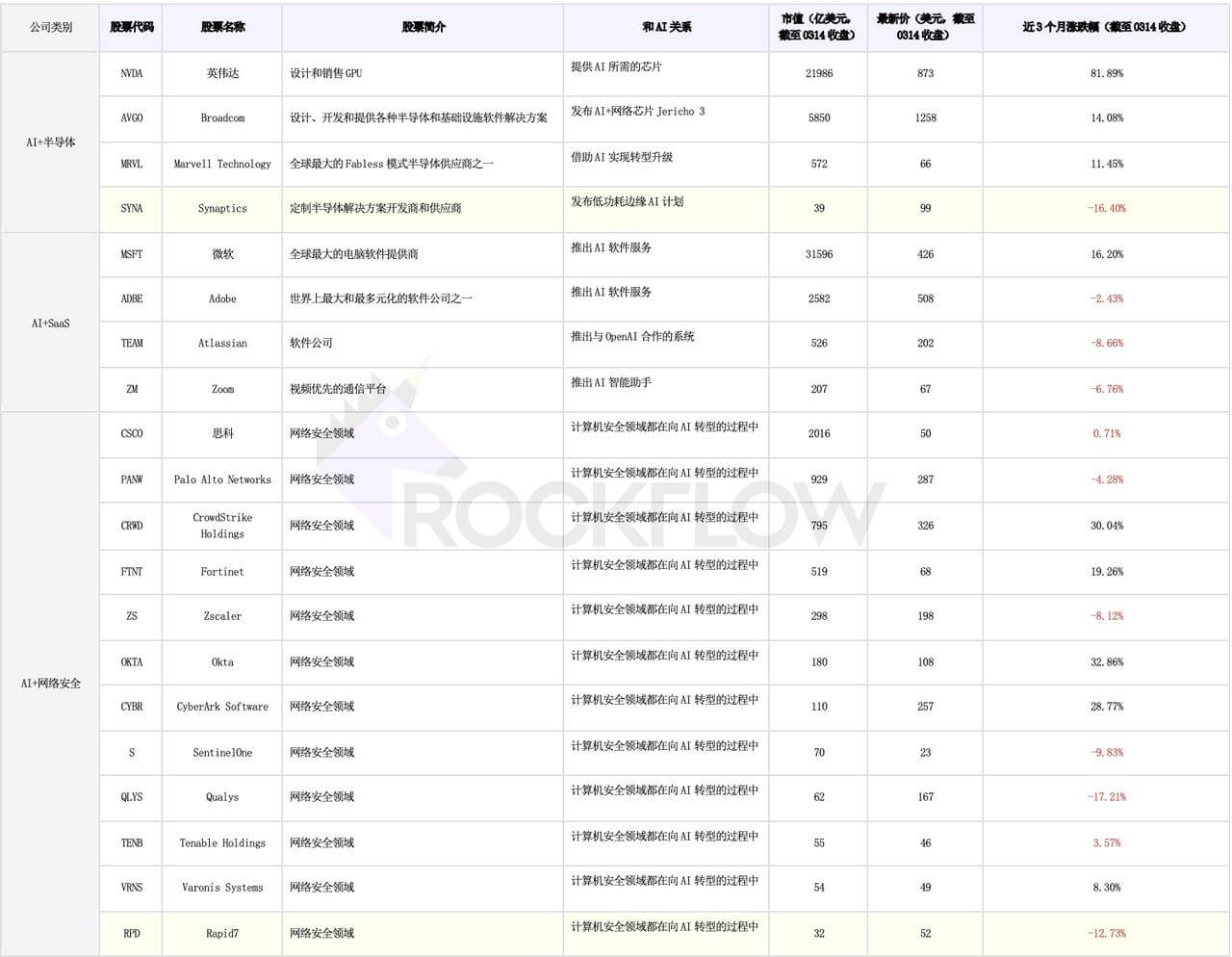

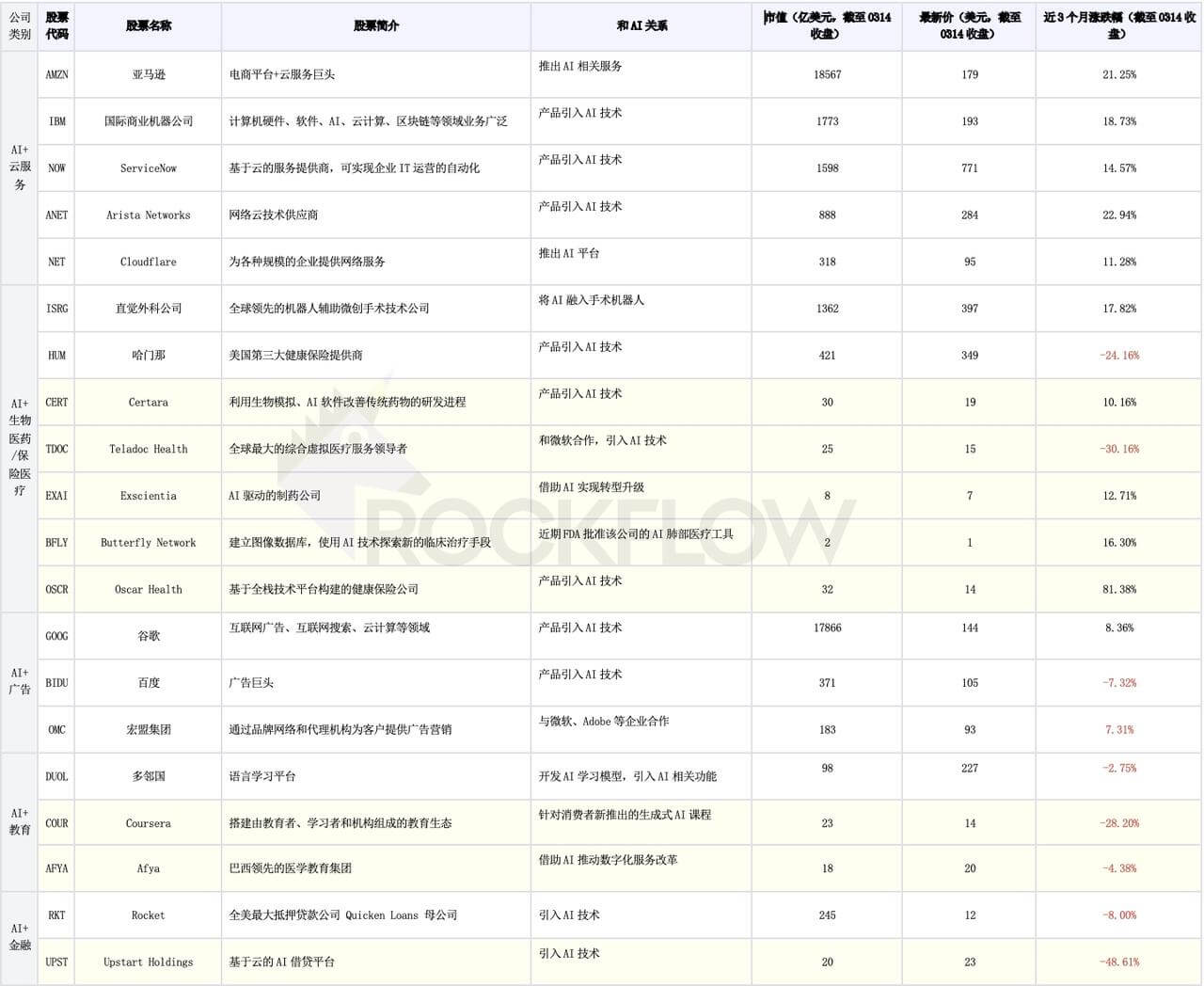

In addition, RockFlow's investment research team has specifically sorted out nine types of AI concept stocks with potential in the US stock market (involving semiconductors, SaaS, cyber security, Enterprise Services, Cloud as a Service, biomedicine/insurance healthcare, advertising, education, and consumer finance), including their recent performance, for easy comparison (the light yellow ones are stocks with a market value of less than 5 billion dollars):

Conclusion

RockFlow's investment research team believes that the AI era is coming, it is becoming increasingly popular, and it will bring profound changes to other industries for a long time. In this process, investors will face many important opportunities, and we need to uphold the following principles:

Firstly, actions need to be flexible. We are still in the early stages of the AI cycle. As new AI concept stocks continue to go public and traditional companies turn to AI, investors need to be patient and maintain liquidity to take advantage of future opportunities.

Secondly, appropriately value-oriented. In a market dominated by speculation, use objective data to discover companies that truly benefit from AI.

Thirdly, diversified investment. In the era of technological change, it is very difficult to pick a single winner. Diversified investment to avoid missing out is a necessary strategy. Technological disruption often brings about a reshuffle of the competition landscape. We are optimistic that fast followers in traditional industries will unlock greater value brought by AI. To this end, the RockFlow investment research team has compiled a list of related company stocks for everyone to easily bookmark and continuously monitor their performance.