Trading & Investing

1. What is a limit order?

Buy:

Market orders are transactions meant to execute as quickly as possible at the present or market price. Conversely, a limit order sets the maximum or minimum price at which you are willing to buy or sell.

if a trader is looking to buy XYZ's stock but has a limit of $14.50, they will only buy the stock at a price of $14.50 or lower.

Sell:

A limit order is a type of order to purchase or sell a security at a specified price or better.

if you submit a limit sell order and set a limit price of $15, the order will be executed only when the price is higher or equal to $15.

2. What is a market order?

Buy:

Buy your stock shares, or other securities at the best available price in the current financial market.

Sell:

Sell your stock shares, or other securities at the best available price in the current financial market.

When placing a market order, you do not need to specify a price, or Time In Force, as the order would be executed at the current market price as qucikly as possible. However, please keep in mind that although market order could guarantee the speed of order execution. Also, market order is not available in U.S. Extended Trading Hours including pre-market hours and after hours. If you think a stock will hit a level you find acceptable soon, try a Limit Order.

3. What is a trailing stop order?

Buy:

A trailing stop order allows investors to set a 「trailing amount」 or 「trailing ratio」 so that the system continually calculates the stop price as the market fluctuates. When the stop price is hit, a buy/sell market order will be submitted. A stop order is not guaranteed a specific execution price and may execute significantly away from its stop price.

Assuming stock XYZ has a current price of 10, you submit a buy trailing stop order with a 50% trailing ratio. So, the order's initial stop price will be 15 (10+10*50%). When the market price falls, so does the stop price; when the market price rises, the stop price doesn't change. A buy market order will be submitted as soon as the stop price is hit. Before the buy order fills, if XYZ's market price falls to as low as 8, the stop price will be adjusted to 12 (8+8*50%). When XYZ's market price rises to 12, a buy market order will be submitted automatically to the clearing broker and filled at the market price.

Sell:

A trailing stop order allows investors to set a 「trailing amount」 or 「trailing ratio」 so that the system continually calculates the stop price as the market fluctuates. When the stop price is hit, a buy/sell market order will be submitted. A stop order is not guaranteed a specific execution price and may execute significantly away from its stop price.

Assuming stock XYZ has a current price of 20, you submit a sell trailing stop order with a 5 trailing amount. So, the order's initial stop price will be 15 (20-5). When the market price rises, so does the stop price; when the market price falls, the stop price doesn't change. A sell market order will be submitted as soon as the stop price is hit.Before the sell order fills, if XYZ's market price rises to as high as 30, the stop price will be adjusted to 25 (30-5). When the price falls to 25 or lower, a sell market order will be submitted automatically to the clearing broker and filled at the market price.

*RockFlow will support this order mode in the future.

4. What is a stop limit order?

Buy:

A stop-limit order is an instruction to place a buy or sell limit order when the client-specified stop price is hit.

Assuming stock XYZ has a current price of 10,you submit a buy stop-limit order with a stop price of 15 and an order price of 16. If XYZ's market price rises to 15, a limit order will be submitted automatically to the clearing broker and filled at 16 or lower.

Sell:

A stop-limit order is an instruction to place a buy or sell limit order when the client-specified stop price is hit.

Assuming you hold stock XYZ with a cost price of 10. To prevent the stock from falling sharply in the future, you submit a sell stop-limit order with a stop price of 15 and an order price of 14 when the market price is 20. If XYZ's market price falls to 15 or lower, a limit order will be submitted automatically to the clearing broker and filled at 14 or higher.

*RockFlow will support this order mode in the future.

5. What is a stop order?

Buy:

A stop order is an instruction to submit a buy or sell market order if and when the client- specified stop price is hit. A stop order is not guaranteed a specific execution price and may execute significantly away from its stop price.

Assuming stock XYZ has a current price of 10, you submit a buy stop order with a stop price of 15. If XYZ's market price rises to 15, a market order will be submitted automatically to the clearing broker and filled at the market price.

Sell:

A stop order is an instruction to submit a buy or sell market order if and when the client-specified stop price is hit. A stop order is not guaranteed a specific execution price and may execute significantly away from its stop price.

Assuming you hold stock XYZ with a cost price of 10. To prevent the stock from falling sharply in the future, you submit a sell stop order with a stop price of 15 when the market price is 20. If XYZ's market price falls to 15 or lower, a market order will be submitted automatically to the clearing broker and filled at the market price.

*RockFlow will support this order mode in the future.

6.What is ETF?

ETFs (Exchange-Traded Fund) are an investment vehicle which issues and trades shares representing an underlying basket of assets, to let you invest in the broader market or a sector, industry, or even region. ETFs allow small investors to diversify their risk over a broad spread of investments, tracking an index, while offering the flexibility of trading like a share. When you invest in an ETF, the value of your investment will depend on how the collective group of companies is doing. You can buy or sell ETFs just as you would a stock, which can be bought and sold throughout the trading day, which is a feature that mutual funds do not offer.

7. What is ADR?

ADR refers to American Depository Receipt (ADR) is a receipt for shares of non-U.S. based companies listed for trade on a U.S. exchange. An ADR is issued by a US bank and represents a bundle of shares of a foreign corporation held in custody overseas. Trading in ADRs rather than the underlying shares reduces administration and trading costs, both for companies and for investors.

ADR Fee Account holders maintaining positions in ADRs should note that such securities are subject to periodic fees intended to compensate the agent bank providing custodial services on behalf of the ADR. These services typically, include inventorying the foreign stocks underlying the ADR and managing all registration, compliance and record-keeping services. If you hold a position in a dividend paying ADR, these fees will be deducted from the dividend as they have in the past. If you hold a position in an ADR which does not pay a dividend, this pass-through fee will be reflected on the monthly statement of the record date on which it is assessed.

Similar to the treatment of cash dividends, RockFlow will attempt to reflect upcoming ADR fee allocations within the Accruals section of the account statements as well. While the amount of this fee will generally range from $0.01 - $0.03 per share, the amounts may differ by ADR and it is recommended that you refer to your ADR prospectus for specific information.

8. What is fractional share?

Overview:

A fractional share is a portion of an equity stock that is less than one full share. Such shares may be the result of stock splits, dividend reinvestment plans (DRIPs), or similar corporate actions. At RockFlow, when you purchase shares based on the amount of cash you specify, instead of based on the number of the shares, you will be buying a fraction of a share.

What products can I trade in fractions?

U.S. stocks listed on NYSE, AMEX, NASDAQ, ARCA, or BATS, are available for fractional shares trading. Non-U.S. stocks are not available for fractional shares trading at this time.

Can I transfer fractional shares to RockFlow?

RockFlow does not accept fractional shares through a position transfer.

Do I receive dividends on my fractional shares?

Your fractional shares positions are eligible to receive dividends in the same manner as your full positions on the same stocks.

What are the fees associated with fractional shares?

There is no additional fee to use fractional share trading. Standard commission rates apply.

9. What is penny stock?

Penny stock generally refers to a stock issued by a company that’s valued at less than $5 per share.

Investing in low-priced stocks is considered speculative and involves considerable risk including high price fluctuation, low liquidity, and facing a higher chance of quitting the market.

10. What is time in force?

Time in force is a special instruction used when placing a trade to indicate how long an order will remain active before it is executed or expires. Currently, RockFlow provides time in force specifications as below:

Day Order: A day order is valid for the day only, it will be automatically cancelled if it is not executed by the end of the trading day.

GTC orders will be automatically cancelled under the following conditions: If you do not log into your RockFlow account for 90 days. If a corporate action on a security results in a stock split (forward or reverse), exchange for shares, or distribution of shares. At the end of the calendar quarter following the current quarter.

an order placed during the first quarter of 2022 will be canceled at the end of the second quarter of 2022. If you placed an Good till canceled order on 3rd Jan 2022, the order will be canceled on the 30th Jun 2022. If the last day is a non-trading day, the cancellation will occur at the close of the final trading day of that quarter.

if the last day of the quarter is Sunday, the orders will be cancelled on the preceding Friday.

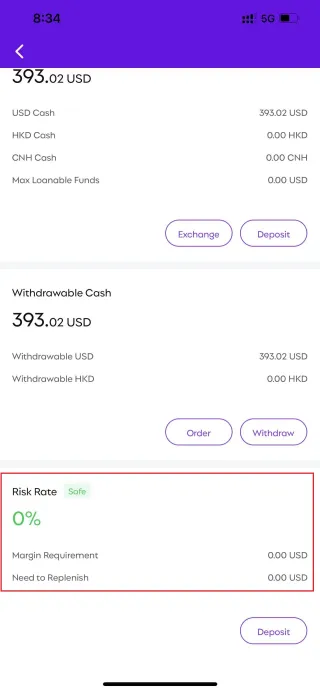

11. What is account risk rate?

Your Account Risk Rate could give you a quick glance of how your account is doing, and how close it is to being forced liquidation. You could check it at your account details page, by scrolling down to the bottom of the page.

|

The Account Risk Rate is calculated by Margin Requirement/Account Value*100%. There are three levels of your account risk rate: Safe: Risk Rate is lesser or equal to 85% Warning: Risk Rate between 85% to 100% Danger: Risk Rate is greater than 100% We will inform you if your Account Risk Rate is at Danger level, when you enter into your RockFlow App. When your Account Risk Rate is at Danger lever, you will be restricted to opening new positions that will increase your margin requirement.

12. What are circuit breakers and trading halts?

What’s a circuit breaker?

After the 1987 stock market crash, known as “Black Monday,” the US Securities and Exchange Commission adopted market-wide circuit breakers, or certain thresholds at which trading is halted for a pre-defined period of time. These circuit breakers were updated in 2012 in order to make them more meaningful in today’s high speed electronic markets. Market-wide trading halts are designed to curtail panic selling during volatile periods. When these take effect, all trading temporarily stops on US equities, options, and futures exchanges.

What’s a market-wide trading halt?

A market-wide trading halt is like a timeout. It gives everybody a chance to catch their breath and may help slow the stampede of a selloff. Halts are issued by US equities, options, and futures exchanges.

There are three circuit breakers that can trigger market-wide halts in the US:

Level 1: The S&P 500 drops 7% from its closing price the previous day, triggering a 15-minute trading halt.

Level 2: The S&P 500 drops 13% from its closing price the previous day, triggering another 15-minute trading halt.

Level 3: The S&P 500 drops 20% from its closing price the previous day, and trading is suspended for the remainder of the day.

It’s worth noting, Level 1 and Level 2 halts may only happen once per trading day. That means, if the S&P 500 slides by 7% (resulting in a 15-minute timeout), trading would only stop again if the decline reaches 13% or more. Likewise, if the S&P 500 drops by 13% (again, resulting in a 15-minute suspension), trading would only cease if the downturn reaches 20%.

Please keep in mind, Level 1 and Level 2 circuit breakers can only take effect before 3:25pm ET. At 3:25pm ET and beyond, only a Level 3 halt—a 20% decline in the S&P 500—would cause trading to stop for the day. Regular US stock market trading hours are 9:30am – 4:00pm ET.

13. What is a margin call?

A margin call occurs when the value of your margin account falls below the required amount, or, say, when your account value is going to be unable to meet your maintaince margin requirement.

When you find yourself in a margin call, there are couple of things you can do to resolve it:

First and the easiest, to close some of your positions, it will reduce your initial and maintaince margin right away.

Secondly, you can deposit more cash into your account . However, please take into account that it might take at least a few hours or even a few days for the cash to arrive in your account, which may be too slow to resolve a margin call in fast moving market conditions. If you failed to resolve the margin call, and your account falls below the margin requirement, it will be subject to forced position liquidations.

14. What is the initial margin requirement?

Initial margin is the percentage of the purchase price of a security that must be covered by cash or collateral when you enter into a new position. The initial margin of stocks varies from 25% to 100%, depending on the risk level of each stock.

if you want to purchase 100 shares of AAPL stock at a price of USD 160 per share, and the initial margin requirement is 50%, then the cash and the collateral in your account must exceed USD 8,000.

15. How do I know when I’m trading on margin?

Before you can invest on margin, you have to upgrade to Reg-T Margin Account or Portfolio Margin Account first, to be eligible for margin investing. You’ll only start trading on margin after the cash in your brokerage account has been fully used. This means that if you still have cash in your account, you won’t trade on margin until it’s fully spent.

suppose you have $5,000 in your brokerage account—$3,800 in stocks and $1,200 cash. If you buy an additional $2,000 of TSLA stock, you will use your $1,200 in remaining cash first and the remaining $800 would be traded on margin using the securities in your account as collateral. Please keep in mind that margin trading involves interest charges and risks, including the potential to lose more than deposited or the need to deposit additional collateral in a falling market.

Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. Regardless of the underlying value of the securities you purchased, you must repay your margin debt.

RockFlow can change their maintenance margin requirements at any time without prior notice. If the equity in your account falls below the minimum maintenance requirements (varies according to the security), you’ll have to deposit additional cash or acceptable collateral. If you fail to meet your minimums, RockFlow may be forced to sell some or all of your securities, with or without your prior approval.

16. How much money do I need in my account to invest in margin?

There are three types of account in RockFlow:

- Cash Account;

- Reg-T Margin Account;

You would need to have at least USD 2,000 or equivalent cash in your account to apply for a Reg-T Margin account, where you can start to invest on margin.

17. What is Reg-T?

Regulation T, or Reg-T is a collection of provisions that govern investors' cash accounts and the amount of credit that brokerage firms and dealers may extend to customers for the purchase of securities.

According to Reg-T, an investor may borrow up to 50% of the purchase price of securities that can be bought using a loan from a broker. The remaining 50% of the price must be funded with cash. Thus, if you have a Reg-T account at Rockflow, the amount that the most you can borrow is equal to the the cash that you have in your account.

if you have 5,000 USD in your account, then you can borrow up to another 5,000 USD and buy securities worth USD 10,000.

While the primary goal of Regulation T was to govern margin, it also introduced transaction rules for cash accounts. Because it takes up to two days for securities transactions to settle and the cash proceeds to be delivered to the seller of securities, a situation can arise when you buy and sell the same securities before paying for them from the cash account. This is called free-riding, and it is prohibited by Reg T. You may refer to the link below from the Electronic Code of Federal Regulations website to view details on the Regulation T. eCFR :: 12 CFR Part 220 -- Credit by Brokers and Dealers (Regulation T)

18. What is US stock market holiday calendar?

Please refer to the New York Stock Exchange Calendar: https://www.nyse.com/markets/hours-calendars.

19. What are extended trading hours (US market)?

Traditionally, the markets are open from 9:30 AM EST - 4 PM EST during normal business days, we call this Regular Trading Hours. We offer both pre-market trading and after-hours trading, which enable you to trade US securities listed on the NYSE, NASDAQ, or AMEX exchanges during these extended trading hours. Pre-Market Hours: 4:00 AM EST - 9:30 AM EST After Hours: 4:00 PM EST - 8:00 PM EST.

What you should know about trading during extended hours:

Please be aware that there are risks inherent in trading in the extended trading hours, including reduced liquidity, increased volatility, wider spreads. Order Types - Only limit orders are allowed during extended hours. Available Securities - Securities listed on NYSE, NASDAQ, or AMEX are available for trading during extended hours. OTC stocks, bonds, funds, options, and other securities may be traded only during Regular Trading Hours. Order Modification - Price changes and cancellations of extended hours orders are permitted before the order is executed.

20. Do U.S. stocks support day trade?

Yes, you can buy and sell a U.S. Stocks within the same day, and there is no limit on the number of times that you can do day trade in U.S. Stocks.

21. What is the limit on price fluctuations for US stocks?

There is no limit to the price fluctuation for US stocks. However, when a certain stock price fluctuates over a threshold, the measure of "Circuit Breaker" will be adopted, and the trading of the stock will be halted for a pre-defined period of time.

22. What is the trading and settlement rule for US stocks?

Trading rules U.S. stocks are trading T+0 transactions, and stocks bought (shorted) on the same day can be sold (buyback) on the same day. Day trading is allowed and there is no limits on the numbers of day trading.

Settlement rules The standard settlement period for securities traded on U.S. exchanges will be 1 business days (T+1).

when there is no public holiday in between the trading days, if T0 is Monday, the settlement will be completed on Wednesday. If T0 is Monday, but Tuesday is a U.S. Holiday when stock market is closed, then the settlement will be completed on Thursday. When withdrawing or transferring shares out, you would need to wait until the trade had been settled.

if you sold the shares on Monday, when you withdraw your cash out, you would need to wait until Wednesday when the trade had been settled before RockFlow could release the cash.

23. Can I short sell US stocks?

Generally RockFlow supports short selling U.S. Stocks if your account is a margin account. However, it depends on the market situation whether RockFlow has the certain shares available to lend you. Please keep in mind that there will be borrowing fees and other operation risks involved in short selling a stock . Before you decide to short sell stock, please make sure you are already aware of the fees and risks.

24. What is the minimum trading unit for US stocks?

The minimum trading unit for U.S. stocks is 1 share. However, RockFlow gives investors the ability to trade in Fractional Share, which allows you to invest in the companies which you may not be able to afford the full share price.

you want to invest in Tesla Inc, which share price is currently over $1,000 per share, but you only have $500 in your account. Instead of giving up the investment opportunity, at RockFlow, you may purchase by indicating the amount of cash you want to spend, instead of the number of shares. Say in this case, you could buy $500 of Tesla Inc stock, and currently the share price is $1,000, you will end up buying 0.5 shares of Tesla Inc.

25. Can I short sell Hong Kong stocks?

Short selling of Hong Kong stocks is not currently available, but RockFlow will launch this function in the future. Thank you very much for your patience!

26. What is Hong Kong stock market holiday calendar?

Please find the HKEX Calendar via HKEX Calendar

27. What are Hong Kong stock market trading hours?

Hong Kong stock market opens from Monday to Friday, except for public holidays or in extremely bad weather.

| A | B | C | D |

|---|---|---|---|

| Full Day Trading | Half Day Trading | ||

| Auction Session | Pre-opening Session | 9:00 a.m. - 9:30 a.m. | |

| Continuous Trading Session | Morning Session | 9:30 a.m. - 12:00 noon | |

| Lunch Break | 12:00 noon - 1:00 p.m. | Not applicable | |

| Afternoon Session | 1:00 p.m. - 4:00 p.m. | Not applicable | |

| Auction Session | Closing Auction Session | 4:00 p.m. to a random closing between 4:08 p.m. and 4:10 p.m. | 12:00 noon to a random closing between 12:08 p.m. and 12:10 p.m. |

28. Do Hong Kong stocks support day trade?

Yes, similar to US stocks, Hong Kong stocks also support day trading, and there is no limit on the number of times that you can do day trade on Hong Kong Stocks.

29. What is the limit on price fluctuations for Hong Kong stocks?

The Hong Kong Exchanges and Clearing Limited adopts a Volatility Control Mechanism (VCM) that provides a temporary cooling-off period when an applicable security or futures contract experiences extreme price volatility. During the cooling-off period, a fixed price limit is set to confine trading within a specified price range. When the price of an applicable security or futures contract fluctuates extremely due to some trading incident such as algorithm error, the VCM's five-minute cooling-off period offers time for investors to reassess their strategies, and helps to safeguard the market and other products against the chain effect and systematic risks arising from the trading incident. However, the VCM is not a suspension of trading as the applicable security or futures contract can still be traded within a fixed price limit during the cooling-off period.

30. What are the stocks that I can trade in the Hong Kong Market?

The list of the stocks available on Hong Kong stock market may be changed from time to time. You could refer to the HKEX official website for the most updated lists for the stocks that are available: Equities (hkex.com.hk)

31. What is the minimum trading unit for Hong Kong stocks?

The smallest trading unit for an order executed on the automatic order matching system of the Hong Kong Stock Exchange is 1 lot. 1 lot may be 100 shares, 500 shares, 1,000 shares and 2,000 shares, depending on the stock price.

in the current Hong Kong stock market, Alibaba Group Holdings Ltd has 100 shares per lot, while Xiaomi Corporation has 500 shares per lot. You may view the number of stocks per lot in the [stock detail page]. Stocks with less than one lot are called odd lot, odd lot usually occurs when a company carries out bonus issue or rights issue. Odd lot cannot be traded through the automatic order matching system of the Hong Kong Stock Exchange, should you need to sell an odd lot, please contact Customer Services.

32. What is margin trading?

Basic concepts

Margin trading refers to using marginable securities or cash in the account, and conducting margin trading/short-selling from a brokerage firm.

- Margin loan: In short, it is borrowing money to buy stocks.

- Stock loan (short-selling): In short, it is borrowing stocks to sell. After the stock price falls, the investor can buy back the stocks to return.

Margin: Asset guarantees required to borrow funds and shares from brokers. There are two categories: initial margin and maintenance margin. The margin ratio for different securities may vary.

- Initial margin: The minimum value of collateral, generally expressed as a percentage of the current market value of securities, that a user needs to give to a broker in order to borrow money to purchase a security or to borrow securities to sell, which is in excess of the value of his or her own assets.

- The user wants to buy a $200 stock with an initial margin rate of 30%, so in order to buy the stock, he or she needs to provide a minimum of $60 worth of collateral to the broker.

- Maintenance margin: The minimum value of the collateral that a user needs to give to a broker in order to continue borrowing money/securities from the broker to maintain an existing position.

- If a user holds $200 of stocks with a maintenance margin rate of 20%, then in order not to be liquidated by the broker, he or she must provide a minimum of $40 worth of collateral to the broker.

- Initial margin: The minimum value of collateral, generally expressed as a percentage of the current market value of securities, that a user needs to give to a broker in order to borrow money to purchase a security or to borrow securities to sell, which is in excess of the value of his or her own assets.

If an investor wants to trade on margin, he or she needs a margin account and cannot use a regular cash account. A margin account is a standard brokerage account that allows investors to use cash or securities in their account as collateral for a loan. At RockFlow, you only need to make a deposit to unlock a margin account with assets greater than $2500.

Advantages and disadvantages of margin trading

Advantage:

- Higher purchasing power

Margin trading allows investors to borrow money/securities from brokers for trading, allowing investors to buy more stocks and use their money more efficiently. - Short-selling Strategy

Another advantage of margin trading is that it allows you to engage in short selling. Short selling is a strategy where you can sell securities you don't own, if the stock price drops, you can buy them back at a lower price and then make a profit. - Magnify potential profits

Margin trading utilizes capital leverage, magnifying the potential profit for investors. Disadvantage: - Higher risks

Borrowing money to invest comes with risks. Whether the securities purchased appreciate or depreciate in value, the investor must repay the amount borrowed. - Paying interest charges

Borrowing money comes with interest. When investing using margin, investors must pay interest on the amount borrowed. This can erode your profits if your investments do not perform as expected. - Requiring margin

Before trading on margin, investors are required to deposit a certain amount of money as initial margin, usually charged by a certain percentage of the transaction amount. After a margin trade occurs, the ratio of the amount of margin to the market value of the securities purchased will vary with market fluctuations, investors will need to ensure that this ratio is above a minimum level set by the broker (i.e. maintenance margin). If an investor fails to meet the maintenance margin requirement, a margin call may be triggered, which notifies the investor that additional funds must be deposited. If the investor fails to meet the margin call within a specified period, the brokerage firm may force the closing of the position.

Frequently asked questions

I have a cash account. Why is the maximum available fund in the account lower than the cash balance?

You may have pending or partially completed orders, which will take up available funds in your account to ensure that the orders can be successfully completed. However, the cash in your account will not be deducted at this time, resulting in the maximum available fund in your account being lower than the cash balance in your account.Why does buying Baby Bear or Baby Bull require higher margins in the account?

Generally speaking, buying Baby Bear or Baby Bull does not charge additional margin from you. However, from an account risk perspective, buying Baby Bear or Baby Bull is equivalent to converting a portion of your available funds into equivalent but non-collateralized funds. Take the following equation for a general idea: available funds in the account = net asset value of the account - overall initial margin requirement of the account. So the increase in margin requirement for the account that buys in Baby Bear or Baby Bull actually represents a reduction in the available funds in the account, similar to the principle of buying a non-collateralized stock (100% financing margin rate). Please also note that for risk control, if you buy an in-the-money or near-in-the-money Baby Bear or Baby Bull on the expiration date of the option, the margin requirement to open the position will be calculated based on the purchasing power/stock required to exercise the option.Why is the margin requirement higher for close-to-expiry Baby Bear or Baby Bull?

Expiring options refer to Baby Bear or Baby Bull that are within 5 trading days of expiration. Because of the possibility of an exercise on the expiration date of a Baby Bear or Baby Bull, for an expiring Baby Bear or Baby Bull, RockFlow will start calculating the margin/number of shares required for an in-the-money or near-in-the-money Baby Bear or Baby Bull to be exercised. If there is not enough funds for the potential exercise, the account will become "at risk" and the client should ensure the account has sufficient liquidity for option exercise via closing positions or injecting more funds. RockFlow reserves the right to execute the following actions in case of insufficient funds/exercise shares in the account: 1) close out the positions of the Baby Bear or Baby Bull; 2) exercise the Baby Bear or Baby Bull and close the corresponding stock positions afterwards.Why does the cash available not match the cash amount shown in my account?

- The amount of cash you see in your account is the total amount of cash in your account. The cash available for withdrawal refers to the portion of your cash that can be withdrawn without resulting in financing, based on your transaction activity, settlement, etc.

- Generally, cash available for withdrawal ≤ total cash. Items such as unsettled cash, and cash from securities financing, are not included in "cash available".