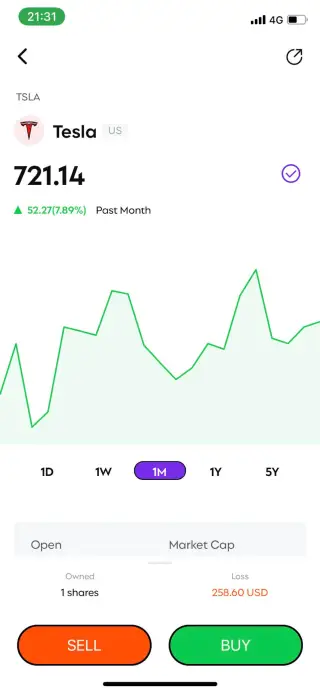

Buy Stocks on RockFlow

Buy stocks by simply tapping the "Buy" button!

|

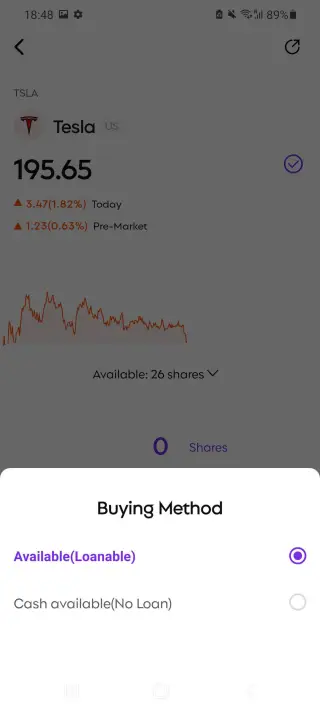

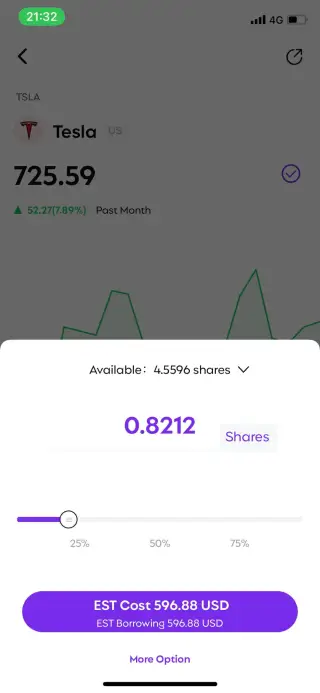

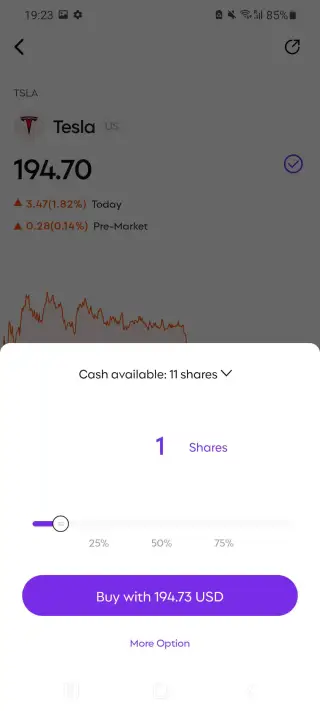

Tap the "Shares" tab to specify whether to buy certain shares.

| |

|

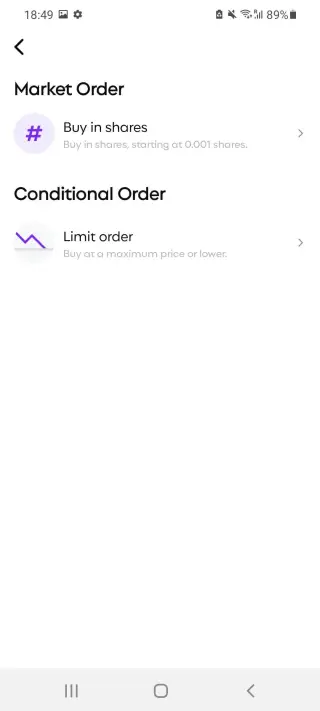

When tapping "buy", the default order is set to "Market Order". Tap "More Option" at the bottom to change your order setting to conditional order.

What is Conditional Order:

- Conditional order is to set a condition for each order, and the order will be executed only when the conditions are met. In this way, you can go to sleep and get some rest after placing the order, instead of staring at the price!

- A. Limit Order: Market orders are transactions meant to execute as quickly as possible at the present or market price. Conversely, a limit order sets the maximum or minimum price at which you are willing to buy or sell.For example, if a trader is looking to buy XYZ's stock but has a limit of $14.50, they will only buy the stock at a price of $14.50 or lower.

- B. Trailing Stop Order: A trailing stop order allows investors to set a 「trailing amount」 or 「trailing ratio」 so that the system continually calculates the stop price as the market fluctuates. When the stop price is hit, a buy/sell market order will be submitted. A stop order is not guaranteed a specific execution price and may execute significantly away from its stop price.Assuming stock XYZ has a current price of 10, you submit a buy trailing stop order with a 50% trailing ratio. So, the order's initial stop price will be 15 (10+10*50%). When the market price falls, so does the stop price; when the market price rises, the stop price doesn't change. A buy market order will be submitted as soon as the stop price is hit. Before the buy order fills, if XYZ's market price falls to as low as 8, the stop price will be adjusted to 12 (8+8*50%). When XYZ's market price rises to 12, a buy market order will be submitted automatically to the clearing broker and filled at the market price.

*This order mode is not currently supported. - C. Stop Order: A stop order is an instruction to submit a buy or sell market order if and when the client- specified stop price is hit. A stop order is not guaranteed a specific execution price and may execute significantly away from its stop price. Assuming stock XYZ has a current price of 10, you submit a buy stop order with a stop price of 15. If XYZ's market price rises to 15, a market order will be submitted automatically to the clearing broker and filled at the market price.

*This order mode is not currently supported. - D. Stop Limit Order: A stop-limit order is an instruction to place a buy or sell limit order when the client-specified stop price is hit. Assuming stock XYZ has a current price of 10,you submit a buy stop-limit order with a stop price of 15 and an order price of 16. If XYZ's market price rises to 15, a limit order will be submitted automatically to the clearing broker and filled at 16 or lower.

*This order mode is not currently supported.

|  |