Sell/Short Stocks on RockFlow

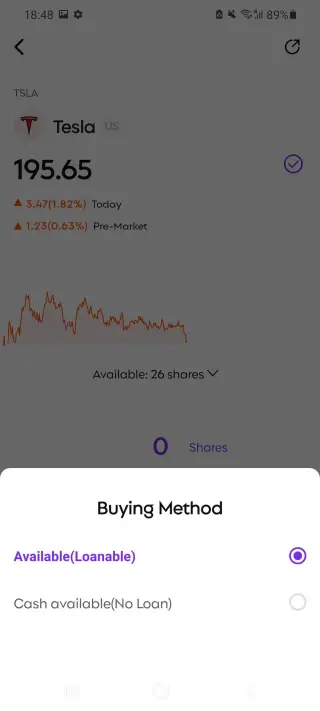

Sell stocks by simply tapping "Sell" Only users with assets over $2500 can short stocks.

|

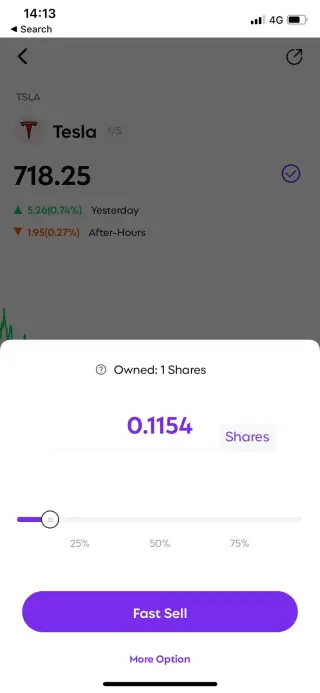

Tap the "Shares" tab to specify whether to buy certain shares.

| |

|

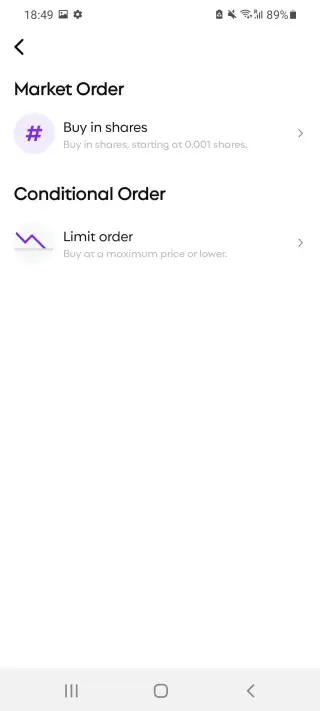

What is Conditional Order:

- Conditional order is to set a condition for each order, and the order will be executed only when the conditions are met. In this way, you can go to sleep and get some rest after placing the order, instead of staring at the price!

- A. Limit Order: A limit order is a type of order to purchase or sell a security at a specified price or better. For example, if you submit a limit sell order and set a limit price of $15, the order will be executed only when the price is higher or equal to $15

- B. Trailing Stop Order: A trailing stop order allows investors to set a 「trailing amount」 or 「trailing ratio」 so that the system continually calculates the stop price as the market fluctuates. When the stop price is hit, a buy/sell market order will be submitted. A stop order is not guaranteed a specific execution price and may execute significantly away from its stop price. Assuming stock XYZ has a current price of 20, you submit a sell trailing stop order with a 5 trailing amount. So, the order's initial stop price will be 15 (20-5). When the market price rises, so does the stop price; when the market price falls, the stop price doesn't change. A sell market order will be submitted as soon as the stop price is hit.Before the sell order fills, if XYZ's market price rises to as high as 30, the stop price will be adjusted to 25 (30-5). When the price falls to 25 or lower, a sell market order will be submitted automatically to the clearing broker and filled at the market price.

*This order mode is not available for now. - C. Stop Order: A stop order is an instruction to submit a buy or sell market order if and when the client-specified stop price is hit. A stop order is not guaranteed a specific execution price and may execute significantly away from its stop price. Assuming you hold stock XYZ with a cost price of 10. To prevent the stock from falling sharply in the future, you submit a sell stop order with a stop price of 15 when the market price is 20. If XYZ's market price falls to 15 or lower, a market order will be submitted automatically to the clearing broker and filled at the market price.

*This order mode is not available for now. - D. Stop Limit Order: A stop-limit order is an instruction to place a buy or sell limit order when the client-specified stop price is hit.Assuming you hold stock XYZ with a cost price of 10. To prevent the stock from falling sharply in the future, you submit a sell stop-limit order with a stop price of 15 and an order price of 14 when the market price is 20. If XYZ's market price falls to 15 or lower, a limit order will be submitted automatically to the clearing broker and filled at 14 or higher.

*This order mode is not available for now.

|