Highlight:

Hims is a telemedicine company that focuses on online sales of prescription drugs. It relies on the wisest customer acquisition strategy - prioritizing the medical services that users want the most (male ED, female contraception) and strong execution, and has now surpassed and become the number one in the segmented market, enjoying the advantages of scale economy and network effect.

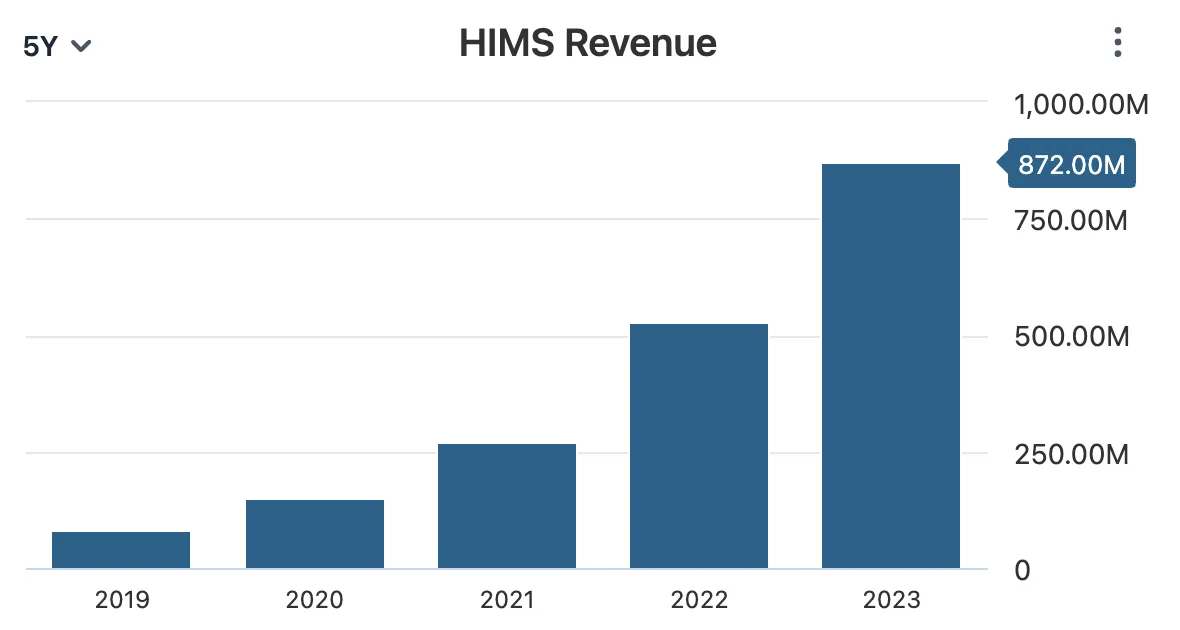

Hims has grown very fast, achieving nearly $1 billion in revenue in just 7 years since its establishment. By 2023, the revenue is more than 10 times that of 2019. In less than a year, Hims' stock price has increased by more than 250%, and there is still plenty of room for growth.

Hims can fully enjoy the benefits brought by successful drug research and development, but it does not bear the risk of failure in pharmaceutical research and development. The industry it is in will ultimately take all, and Hims is expected to use richer databases and AI to help develop and sell more personalized drugs to subscribers in the future.

Introduction:

GLP-1 weight loss miracle drugs have become popular worldwide in the past year or two. While triggering a frenzy among consumers, they have also pushed two old pharmaceutical giants, Novo Nordisk and Eli Lilly, to the throne. In September last year, Novo Nordisk, whose stock price soared to a historic high, won the title of "European Union's most valuable company" from LVMH for the first time.

Unfortunately, this miraculous drug that can regulate blood sugar levels, have excellent weight loss effects, and even have been proven to have a certain effect on reducing organ failure (especially kidney failure) in the latest medical research results, is too expensive. For US consumers, without insurance, the cost of Novo Nordisk's Ozempic drug is about $1,000 per month, and Lilly Mounjaro is even more expensive, costing $1,100 per month without insurance.

What to do if you can't afford expensive drugs? A new medical company has launched a compound somalutide, which has similar functions to Ozempic and Mounjaro, but costs only $199 per month, almost 1/5 of the congeneric product.

This company is called Hims & Her. It has a clear but difficult goal: to provide everyone with high-quality medical services at low prices. Currently, its development is quite good. Since its establishment 7 years ago, its financial performance has been rising steadily. Since October last year, its stock price has soared by 250%, making it a highly sought-after star pharmaceutical stock.

The RockFlow research team will delve into why Hims can quickly grow into a rising star in the pharmaceutical platform and why it is considered an excellent investment opportunity in this article.

RockFlow will continue to track the follow-up development and latest market trends of high-quality US stock companies such as biopharmaceuticals and AI. If you want to learn more about the development overview, investment value, and risk factors of related companies, you can check out RockFlow's previous in-depth analysis articles.

1. Simple Business Model and Competitive Edge for Hims

As a telemedicine company, Hims focuses on selling prescription drugs online through subscription. Its specific operation is as follows:

1)The user fills out a medical status form.

2)Licensed physicians review the form and determine the treatment method. If the policy requires audio or video interviews, they will contact the user; if not, the user can directly obtain the prescription through the chat box.

3)After determining the prescription, users can subscribe to recommended treatment methods on the Hims & Hers website.

4)After subscription, the medication will be delivered within 24 hours.

Although the medical services needed by different users are diverse, Hims has chosen the wisest customer acquisition strategy - prioritizing the medical services that users want the most: for men, they start with treatment for and hair loss; for women, they start with contraceptive services.

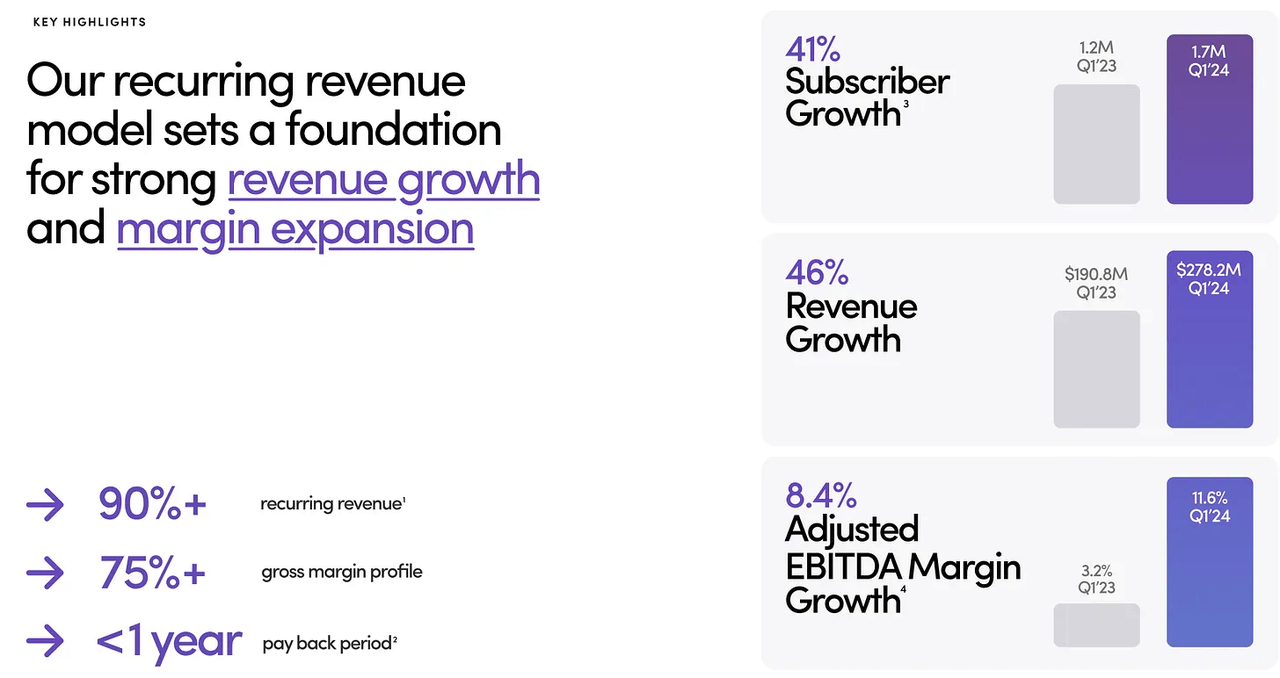

Given the chronic functional impairment of the aforementioned users, Hims has successfully created a subscription model from the beginning, and now more than 90% of its revenue is recurring. The superiority of recurring revenue lies in firstly, it can serve as many users as possible and attract more subscribers with the same set of standard services; secondly, it can try cross-selling and sell more products to the same subscriber; finally, it can flexibly recommend different product combinations, thereby increasing the profit margin of existing products.

Currently, Hims has three important competitive advantages:

1)Scale economy: Hims wants to cater to a wide audience, so it has to act as a low-cost supplier. As mentioned earlier, Hims' weight loss pills are 75% cheaper than those of Eli Lilly and Novo Nordisk. As it sells more GLP-1, its costs will be further reduced. This is a huge advantage.

2)Network Effect: Hims platform has more than 800 licensed drug providers. With the increase in the number of drug providers, it will be easier and faster for users to choose treatment plans, and more people will use the platform, thus attracting more drug providers and forming a virtuous cycle. Due to its wide range of suppliers and pharmacy partners, Hims can provide drugs within 24 hours after users consult and confirm treatment plans. For new entrants, it is not easy to provide similar services.

3)High market share: The telemedicine industry where Hims is located is essentially similar to e-commerce, with the possibility of winner-takes-all. The final market may be dominated by only one or two leading companies, rather than dozens or even hundreds of companies competing.

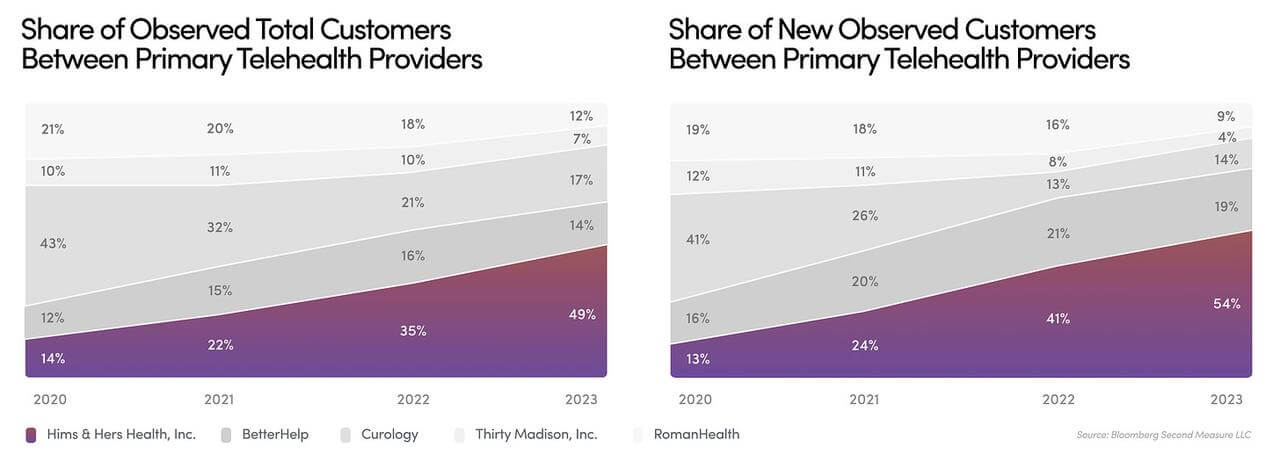

As shown in the above figure, Hims is currently the leader in the telemedicine industry, with a market share of 49% in 2023 and continuing to rise. In terms of market incremental share, its dominant position is even more obvious, accounting for 54% of all newcomers and still growing.

More importantly, it actually caught up later. As shown on the left side of the above figure, Curology was the leading company in the market in 2020 and 2021, while Hims took three years to catch up and finally surpassed in 2022, and completed the suppression in 2023. This means that Hims has found a good growth strategy and has efficient execution, capturing the market share of its competitors and ultimately becoming the industry leader.

2. Four reasons to be bullish on Hims in the long run

RockFlow's investment research team believes that investing in pharmaceuticals is a high-return opportunity brought by participating in new drug research and technological innovation. Pharmaceutical companies usually have great potential for growth, but also come with greater risks of failure. It is wise to consider biotechnology as one of the diversified choices, but it is difficult for non-professional investors to specifically select promising biotechnology stocks.

For the online medical platform Hims, it does not bear the risk of medical research and development failure, but can fully enjoy the benefits brought by the successful drug research and development. Therefore, Hims is relatively a more secure choice. This is the first reason to be optimistic about Hims.

The second reason is that Hims' current products involve hair loss, , anxiety and depression, weight loss, skin diseases, and some healthcare markets. These have initially covered the needs of daily consumers, but have not yet expanded to markets such as sleep, fertility, diabetes, and cholesterol. The addressable market contains opportunities worth billions of dollars, and the potential space is still huge.

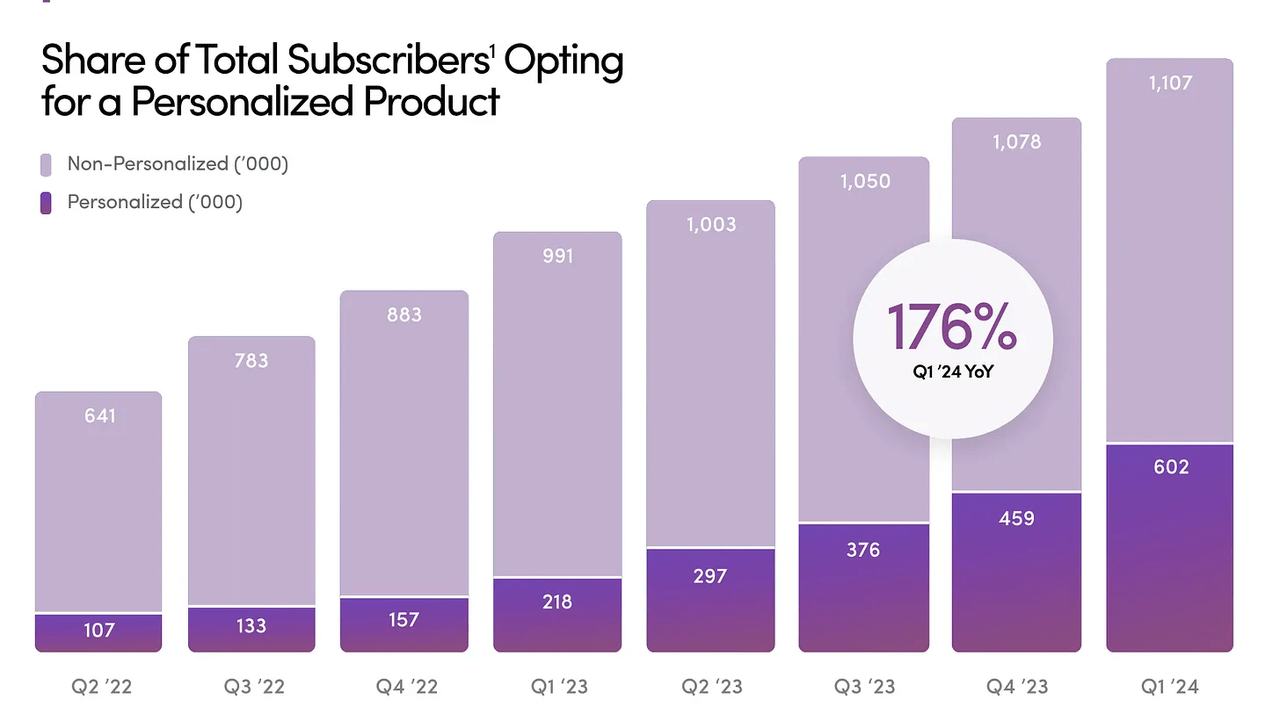

The third reason why we are optimistic about Hims, as mentioned earlier, is that online sales of pharmaceuticals will become a winner-takes-all market with e-commerce, and Hims is fully capable of winning this market. Its personalized options can also effectively retain customers. Once a customer subscribes to a set of plans and obtains good long-term therapeutic effects, it is difficult for them to give up this platform (especially for people with long-term chronic diseases who have high stickiness).

The last reason to be optimistic about Hims is its execution speed. Hims management has performed well in launching new products and quickly catering to customers. They started delivering GLP-1 one week after announcing it. This execution speed will continue to bring advantages to its future new product releases and broader regional expansion.

As mentioned at the beginning, in less than a year, the stock price of Hims has increased by more than 250%, mainly due to its impressive financial performance. According to financial report data, the company was only established in 2017 and achieved nearly $1 billion in revenue in just 7 years. The revenue in 2023 is more than 10 times that of 2019.

Not only is the revenue growth rate fast, but as a rising star, Hims has even achieved profitability. According to the latest quarterly financial report, its earnings per share for Quarter 1 in 2024 were $0.05, which was $0.04 higher than expected.

In addition, given that over 90% of its revenue is recurring, its future revenue is highly predictable. This makes it comparable to SaaS and even Streaming Media platforms, bringing stable revenue expectations to investors.

3. How does Hims respond to the recent turmoil?

Despite the above advantages, Hims is not perfect. After people's initial enthusiasm for the compound GLP-1 drug solution faded, Hims' stock price has fallen from a high of $25 in mid-June to around $20 in recent weeks.

In addition, a recent short-selling report by Hunterbrook Media has raised doubts about Hims. The report's doubts are mainly twofold:

One is the sustainability of GLP-1 drug sales and insufficient long-term contribution to performance. Short reports indicate that compound drugs cannot continue to be sold within 60 days after the FDA-approved drug shortage ends. However, in fact, Hims aims to achieve $100 million in sales by 2025, and GLP-1 drugs have never been considered in this estimate.

Hims' long-term focus does not rely on composite GLP-1 drugs. Hims will receive a short-term boost from these sales, but in the long run, Hims hopes to obtain truly approved GLP-1 drugs in the future and persuade existing customers to use them.

Another major challenge in the report is the claim that individual suppliers on the Hims platform are related to fraud and have suspicious historical behavior. This has since been clarified, and the hundreds of drug suppliers on the Hims platform are sufficient to provide sufficient and comprehensive services.

The RockFlow research team believes that Hims is worth long-term optimism. It focuses on personalized health solutions that other industry participants have not provided, and has many advantages. In the future, it may even use richer databases and AI to help develop and sell more personalized drugs to subscribers.

Hims plans to announce its Q2 2024 earnings on August 5th, with expected revenue of $302 million, a year-on-year increase of 45%; expected earnings per share of $0.05, a year-on-year increase of 250%. In addition, the recent appointment of the former COO of Novo Nordisk to the board of directors by Hims is also seen as a positive move by the market, adding credibility to the company's efforts to delve into the generic and compound drug markets.

Conclusion

RockFlow is optimistic about the business model and future development prospects of telemedicine company Hims. It believes that its three important advantages (scale economy, network effect, and high market share) will help it further gain more market share in the segmented market and ultimately achieve the goal of winner-takes-all. It does not bear the risk of failure in pharmaceutical research and development, but can fully enjoy the benefits brought by the successful drug research and development. Moreover, it can still involve a wide range of fields in the future, with execution speed far exceeding that of similar competitors, and is expected to bring returns that exceed the market in the long run.

Author Profile:

The RockFlow research team has a long-term focus on high-quality companies in the US stock market, emerging markets such as Latin America and Southeast Asia, and high potential industries such as encryption and biotechnology. The core members of the team come from top technology companies and financial institutions such as Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, CITIC Securities, etc. Most of them graduated from top universities such as Massachusetts Institute of Technology, University of California, Berkeley, Nanyang Technological Institute, Tsinghua University, and Fudan University.

Additionally, you can also find us on these platforms: