According to Bloomberg, while hedge funds were busy bailing from stocks at a record pace, Corporate America was furiously repurchasing shares, as the S&P 500 plunged into a bear market.

Goldman Sachs chief U.S. equity strategist David Kostin predicts actual buybacks this year will rise 12% to a record $1 trillion.

Buyback, on the one hand, can increase the company's stock price, and reassure investors on the other. Research has shown that 40% of S&P 500 returns over the past decade were driven by buybacks alone.

S&P Dow Jones Indices announced preliminary S&P 500 stock buybacks and share repurchases data for Q1 of 2022, with Apple (AAPL), Alphabet (GOOGL), Meta (NMETA), Microsoft (MSFT) and S&P Global (SPGI) making up the top five companies with the highest total buybacks of $58 billion in the first quarter. Apple was the largest, spending $23 billion alone.

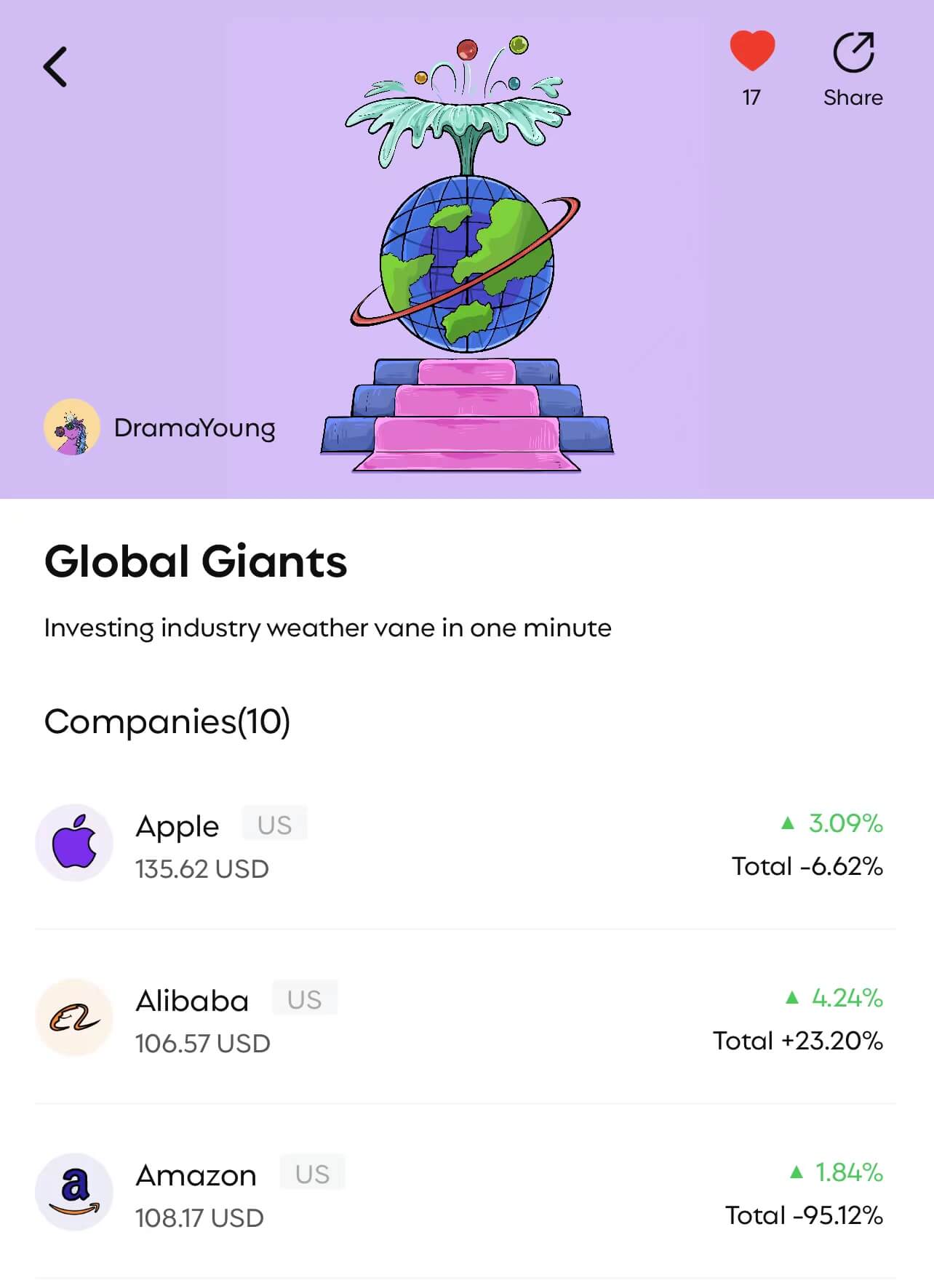

You can get more quality stock lists in RockFlow APP.