Highlight:

1)The original intention of Nubank's establishment was to disrupt traditional banks. In order to create a fully digital Financial Institution, Nubank successfully used technology to provide a more streamlined and humanized experience, reduce management costs, and bring better service to customers.

2)Nu stands out with its branchless model and lower service costs than any existing enterprise. These advantages give Nubank a higher profit ceiling and greater cross-selling potential, so it can also feedback more value to customers through better yields and lower loan rates, achieving positive growth flywheels.

3)Facing multiple risks in Emerging Markets, Nubank dynamically balances latent risks and growth contradictions, avoiding long-term risks while achieving goals. Compared to short-term indicators, they prioritize long-term value creation.

4)With the increasing homogenization of competition, Nubank is expanding into other segmented fields in order to gradually achieve its future goals - "Open Platform + Super App".

- https://help.rockflow.ai/blog/duolingo/

- https://help.rockflow.ai/blog/pinduoduo-plunges/

- https://help.rockflow.ai/blog/starbucks-midlife-crisis-and-Its/

Traditional banks in Brazil are known for their long queues, high fees, and cumbersome processes. In 2008, when David Vélez moved from Colombia to Brazil, it took him five months to open a bank account. This indirectly led him to choose to establish Nubank - an emerging financial platform that is fast and convenient to open an account, without offline branches, fees, or cumbersome procedures.

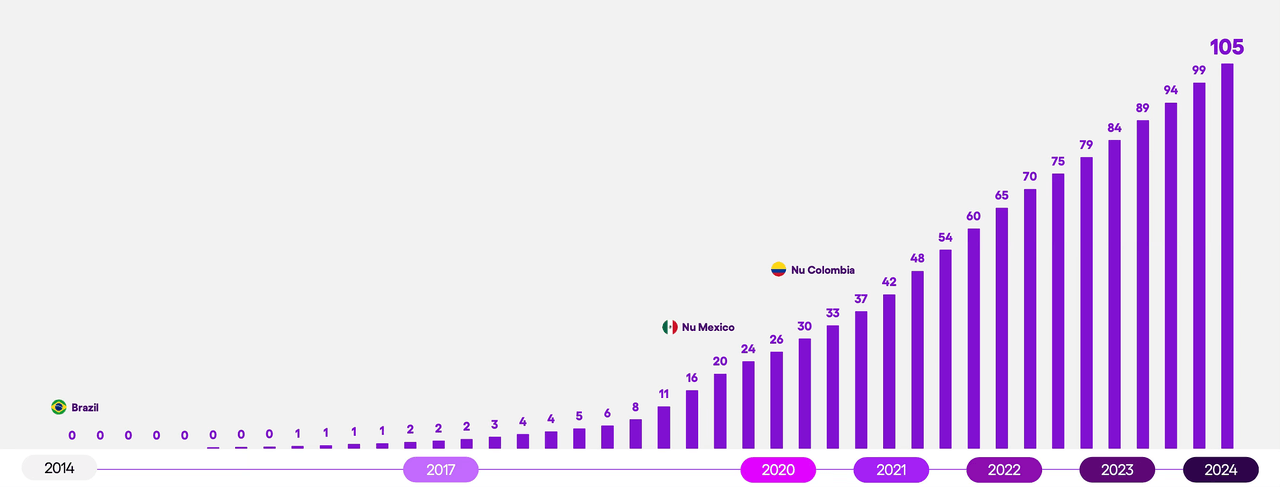

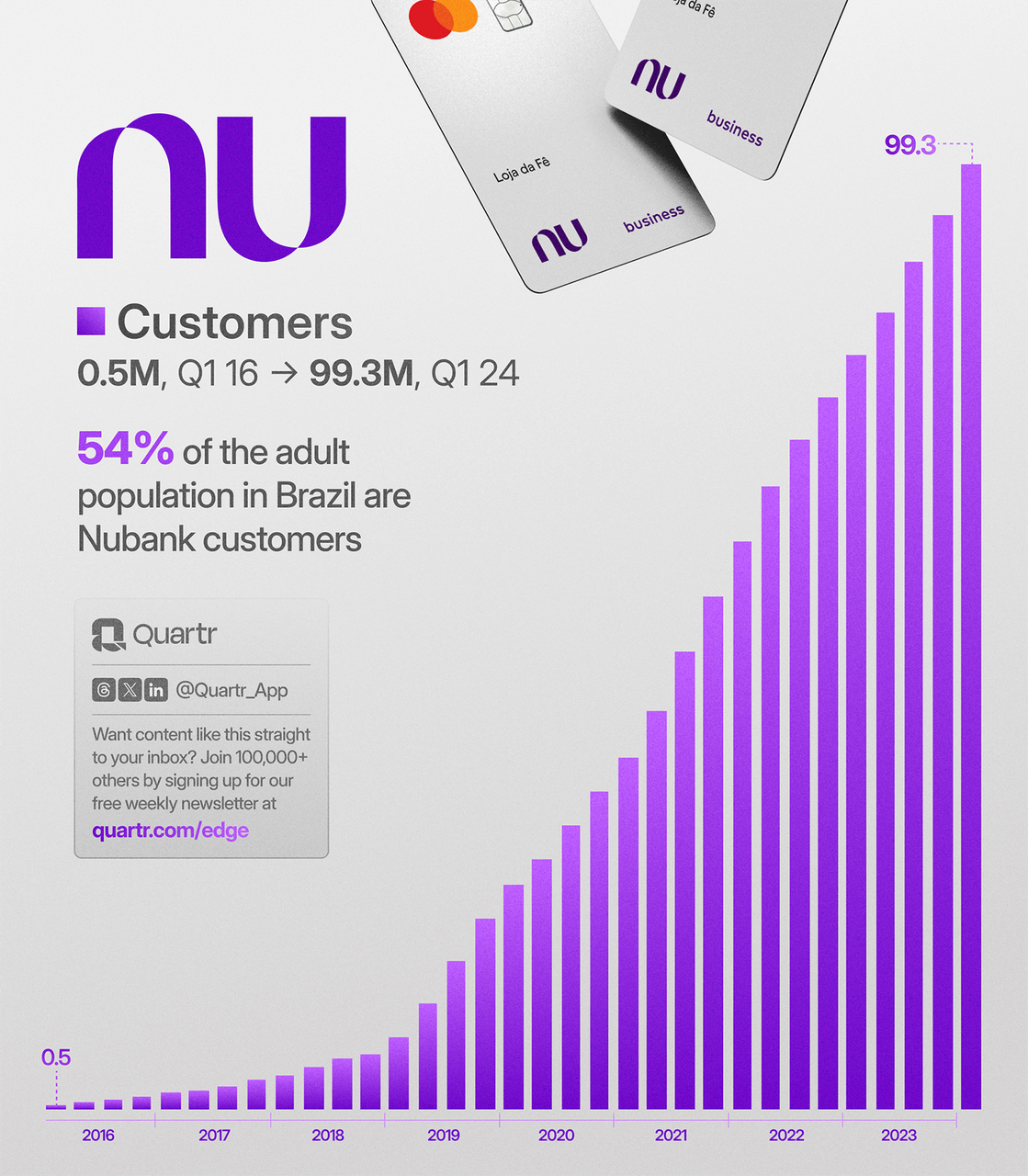

When Nubank was founded in 2013, only 68% of adults in Brazil had a bank account. By 2024, this proportion will reach 90%, largely due to Nubank. Initially aimed at eliminating bureaucratic inefficiencies and high fees, Nubank has grown into one of the largest companies in Latin America by market value, with more than 100 million customers.

Nubank annual user growth in millions

Nubank annual user growth in millions

Today's Nubank is not only an emerging technology company with complete digital financial solutions, but also has brought important changes to Latin America, a former technology barren land. With the support of giants such as Berkshire Hathaway, Tencent, and Sequoia, Nubank's journey has just begun. In this article, the RockFlow research team will explore in depth how this emerging company has developed from its inception to today, as well as its business prospects, risks, and investment value.

Born to subvert tradition and pursue complete digitization

As mentioned earlier, Nubank was founded with the intention of disrupting traditional banks. Founder David Vélez was responsible for early investment business in Brazil and other places at Sequoia Capital. During his time living in Brazil, he felt the complexity and inefficiency of the local banking system.

Afterwards, David Vélez teamed up with Cristina Junqueira, a former executive of Itaú Unibanco, and technology boss Edward Wible to establish Nubank. The team set out to build a fully digital Financial Institution, using technology to provide a more streamlined and user-friendly experience, reduce management costs, and bring better service to customers.

However, this journey has not been smooth sailing. At that time, Brazil's banking industry was dominated by a few large institutions, controlling about 80% of the domestic credit market. The oligopoly allowed them to operate at relatively high profit margins (Brazil's average loan interest rate was the highest in the world). In addition, regulatory barriers and potential investor suspicion were also significant obstacles.

Despite these challenges, Nubank's founders are determined to move forward. They firmly believe that Nubank can make banking services more convenient, and Latin America really needs such a company.

Nubank's three core markets - Brazil, Mexico, and Colombia - together account for 60% of Latin America's GDP. Its demographic characteristics and current financial industry situation are also very suitable for the company's early development.

- The proportion of the population with insufficient banking services in the local area is 40% -50%.

- Mexico and Colombia have no credit card rates of over 80%

- The middle class is growing rapidly, with people under 30 accounting for more than 40% of the total population

- The penetration rate of smartphones exceeds 90%.

- Regulatory openness

The inefficient market situation precisely breeds opportunities. Moreover, the competition in Latin America is much easier than in the US, which is one of the reasons why Nubank did not encounter strong competitors in the early days and grew so rapidly.

Since its inception, Nubank has experienced significant growth. By the second quarter of 2024, the user base exceeded the 100 million mark, making it the first digital banking platform outside of Asia to achieve this milestone.

In short, Nubank's development process can be mainly divided into three stages.

Phase 1 (2013-2017): Starting with credit card business and entering the long-tail market

In 2013, Nubank was founded in Brazil. "Nu" means "naked" in Portuguese, reflecting the original intention of founder David Vélez to establish a transparent and efficient digital financial platform to change the inefficient situation of Brazil's Financial Services industry. At that time, Brazil's Financial Services industry was highly monopolized, and Nubank successfully entered the long-tail market through digital credit card products, competing against the traditional financial industry.

Phase 2 (2017-2018): Launch savings accounts and debit card products, obtain consumer finance licenses, and lay the foundation for subsequent business

In 2017, the company launched Nubank Rewards, a credit card points product, to encourage users to use credit cards more for payment. In the same year, the digital account NuConta was launched, allowing users to transfer and pay for free.

In 2018, the company upgraded NuConta to launch the Nubank Debit Card product, which allows users to directly swipe their card to consume NuConta balances without completing a credit check. This further strengthens Nubank's user entry point position and enables Nubank to accelerate growth by serving a wider range of people.

In the same year, Nubank obtained a license as a consumer finance company in Brazil. In the early days, Nubank, as a payment institution in Brazil, could directly publish credit cards and prepaid cards, and mainly obtained credit card loan funds through cooperation with local banks. After obtaining the consumer finance license, Nubank further expanded its sources of loan funds and expanded its range of credit products.

Phase 3 (2019-present): Gradually evolving into a one-stop financial platform and continuously promoting overseas expansion

In October 2018, Tencent completed its investment in Nubank with the aim of empowering Nubank to build a one-stop financial services platform. In 2019, the company launched a personal credit product. In 2020, we collaborated with Anda Insurance to launch the insurance platform NuLife. In 2021, the company successfully acquired Easynvest, a leading direct-to-consumer investment platform in Brazil, and launched the investment platform NuInvest based on this.

So far, Nubank's business has covered five major sectors: payment, savings, investment, credit, and insurance. In addition to enriching its product matrix, Nubank has also set its sights on Brazil. In Mexico and Colombia, where the financial industry background is similar to Brazil and the credit card penetration rate is relatively lower, Nubank once again uses credit cards as an entry point to successfully enter the local market and achieve regional expansion in an orderly manner.

What makes Nubank's business model strong?

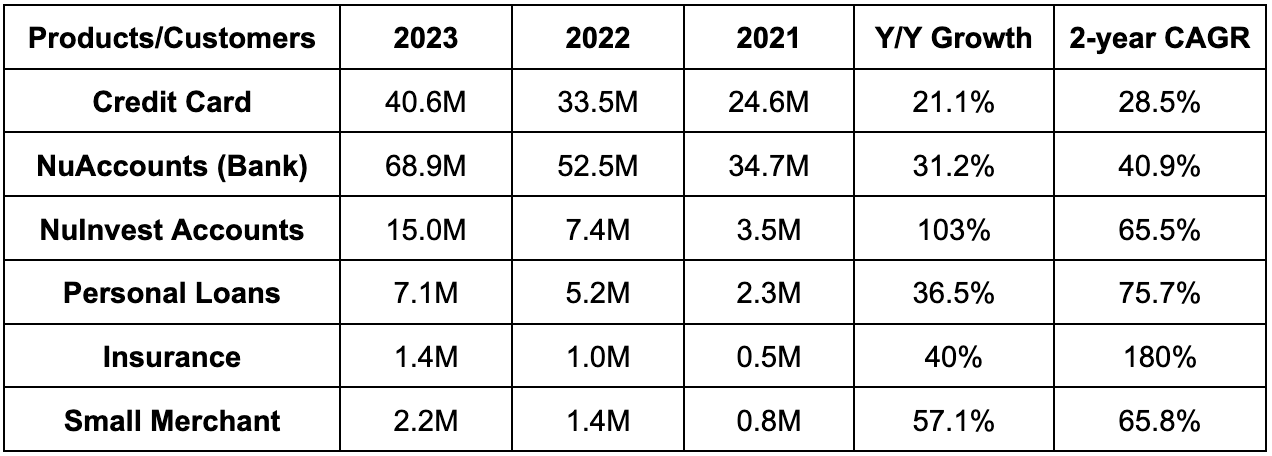

Nubank generates revenue in three main ways: 1) charging fees for credit/debit card transactions; 2) charging interest on consumer credit services; 3) charging commissions and service fees for investment and wealth management, insurance brokerage, and other subscription services.

Its core products are credit cards, zero-fee and commission bank accounts, and personal loans. In addition, it also provides investment and financial services for Latin Americans. Through NuInvest, Latin American investors can enter markets such as the stock market, bond market, real estate, and ETFs at a very low cost. It also provides insurance products in a light asset manner.

Against the backdrop of Brazil's central bank promoting the development of the fintech industry and promoting competition in the financial industry, Nubank can obtain user funds and issue loans at low cost only based on payment licenses and consumer finance licenses, without holding banking licenses and bearing corresponding regulatory compliance costs. The loan funds come directly from deposits in consumer savings accounts, which further reduces the cost of funds.

In hindsight, Nubank's competitive advantage is also due to its early entry into the market, scale effect, modern technology infrastructure, and Network Effect. As the first digital-native bank in Latin America, Nubank has occupied a considerable market share, which enables it to share costs with a large customer base. Nubank attaches great importance to the Data-driven strategy, which not only enhances customer experience and loyalty, but also achieves excellent underwriting capabilities, optimized credit lines, and lower delinquency rates, ultimately consolidating its market leadership and profitability.

In addition, from a macro perspective, both Brazil and Mexico are highly attractive (as is Colombia). The population is young and growing, and both governments have promoted financial reforms favorable to Nubank. Both countries have very high interest rates and very low inflation rates. This leaves huge room for accelerating Nu's lending and other businesses.

Nu provides 24/7 Client Server. Thanks to cross-selling of multiple products such as credit cards, bank accounts, investment accounts, personal credit, and insurance, it has achieved super high growth rates in all product categories in the past few years.

Nu stands out with its branchless business model and lower service costs than any existing enterprise. Its customer acquisition cost is lower, and its risk cost is also lower. These advantages give Nubank a higher profit ceiling and greater cross-selling potential, so it can also feedback more value to customers through better yields and lower loan interest rates, thus achieving positive growth flywheels.

How does Nubank balance short-term and long-term goals when facing business risks?

In recent years, Nubank has completely changed Brazil's financial landscape. With its customer-centric approach and innovative banking solutions, Nubank has won the loyalty and love of tens of millions of customers. Nubank actively attracts customers and expands its loan business, resulting in an increasing proportion of Interest-Bearing Assets in its product category, such as credit card receivables and unsecured personal loans.

However, this also brings problems. Taking Quarter 1 of 2024 as an example, Nubank's Non-Performing Loan delinquency rate was 8.2%, while the industry average delinquency rate was only 7.2%. This means that behind the rapid development of Nu, there are increasingly severe challenges: Non-Performing Loans are accumulating. This trend is in sharp contrast to the performance of traditional banks (which are gradually reducing their Non-Performing Loan rates during the same period).

In addition to credit risk, operating in emerging markets such as Brazil, Mexico, and Colombia, Nubank also faces economic instability, high capital costs, and currency exchange rate fluctuations, all of which can affect its profitability and operational stability.

So, how does Nubank view and resolve these risks? How to persuade investors to approve of their handling? We need to delve into the reasons for Nubank's Non-Performing Loan accumulation and its unique strategy under the indicators.

Nubank's main target audience includes young people who are underserved by traditional banks. This group usually has lower income levels and poor credit records, and they find Nubank's products very attractive. The differentiation strategy allows Nubank to quickly expand its customer base, but it also means that the proportion of customers with less stable financial backgrounds in the customer base is higher.

The hidden danger of Nubank's rapid growth is precisely that focusing on underserved groups will bring higher risks. Traditional banks can use diversified investment portfolios and conservative loan issuance to reduce Non-Performing Loans, while Nubank focuses on expanding credit channels, leading to a higher proportion of loans to higher-risk customer groups.

During the Q4 2023 earnings conference call, Nu Chief Operations Officer and President Youssef Lahrech clearly outlined their strategy.

When we layout credit business, our goal is not to minimize Non-Performing Loans. Our goal is to maximize the Net Present Value of credit business under elastic constraints, thereby increasing the Net Present Value of corresponding customer income.

This sentence emphasizes Nu's complex approach to risk management, which does not fail to consider the cumulative risks of Non-Performing Loans. The risks brought by the rise of Non-Performing Loans are actually the result of Nu's active choice. Compared with short-term indicators, they prioritize long-term value creation.

At the same time, Nu has implemented a more complex credit risk management approach in its credit business. This approach is based on three key pillars: Data-driven decision-making; continuous improvement models; and proactive threat and risk assessment. Nu uses Data-driven decision-making to determine credit risk and customize scoring results, thereby achieving personalized evaluations of customer performance. These factors work together to maintain strong provision levels while expanding its loan portfolio at a rapid pace.

Nu's Q2 2024 financial report shows remarkable growth in revenue, profitability, and customer base in Latin America. At the same time, the early loan delinquency rate of 15-90 days has also shown a significant downward trend.

Nubank's Desired Future - Super App

Due to the rapid development of Brazil's fintech industry in recent years, with more fintech companies emerging, the local market is also facing more intense competition. Different financial platforms provide users with similar Financial Services functions, and the competition tends to be homogeneous, which is forcing Nubank to optimize service quality and User Experience, and seek differentiated marginal advantages.

On the other hand, traditional banks have also entered Nu's target market by adopting digital transformation to cope with the impact of digital finance. Some traditional banks continue to promote the digitalization of internal business, while others reach Non-Major markets through digital means. For example, Caixa Economica Federal successfully opened 35 million accounts by helping the government distribute epidemic subsidies to "unbanked" people.

In addition, it is worth noting that Nubank may face stricter industry regulations, which may increase its compliance and operating costs (such as improving capital adequacy ratios), or slow down its business layout process.

Facing the uncertain situation, Nubank has already set its future goal direction - "Open Platform + Super App". Similar to Nubank, most other top overseas digital financial platforms have also begun to develop towards "Super App".

PayPal announces "Super App" strategy, aiming to integrate more financial and other services. After Square completed the acquisition of Afterpay in 2022, its Cash App initially formed a super application ecosystem. Affirm announced that it will provide more Financial Services and shopping recommendation functions in the future, transforming from a single BNPL service provider to a "Super App". Grab, the leading ride-hailing and food delivery platform in South East Asia, is also evolving from mobility services to financial services.

Like other top players, Nubank has also begun to expand into other segmented fields in order to obtain more sources of income, enhance growth potential, and strengthen ecological barriers. Its next growth strategy includes:

Geographical expansion (current markets: Brazil, Mexico, Colombia, future addressable markets: Argentina, Peru, Chile)

Product diversification (latest launches: personal loans, investment products, insurance, expected business: small and medium-sized enterprise banking, life insurance, customer wealth management, etc.)

Technological innovation (enhanced threat and risk assessment, personalized AI and Machine Learning exploration, open banking initiatives, etc.)

Obviously, Nu is also actively embracing competition and striving to eventually evolve into a "Super App" for users.

Conclusion

RockFlow's research team believes that Nubank's growth from a start-up company to a financial giant fully reflects the potential of fintech to change the industry. With its innovative approach, commitment to customer satisfaction, and focus on financial inclusiveness, Nubank is not just a bank, but also a catalyst for change in the financial industry. We believe that Nubank is still a high-quality company with considerable investment value, and its journey of continuously creating value for users is far from over.

Author Profile:

The RockFlow research team has a long-term focus on high-quality companies in the US stock market, emerging markets such as Latin America and Southeast Asia, and high potential industries such as encryption and biotechnology. The core members of the team come from top technology companies and financial institutions such as Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, CITIC Securities, etc. Most of them graduated from top universities such as Massachusetts Institute of Technology, University of California, Berkeley, Nanyang Technological Institute, Tsinghua University, and Fudan University.

Additionally, you can also find us on these platforms: