Trading exceeded expectations on the first day of listing! Will Ethereum ETF be a new hit in the US stock market?

Highlight:

Nine Ethereum spot ETFs were launched for trading on July 23rd. Referring to the nearly 50% return performance of Bitcoin spot ETFs in the past six months, Ethereum spot ETFs are quite worth looking forward to.

On the first day of listing, the cumulative trading volume of Ethereum spot ETF exceeded 1 billion USD. Its potential capital inflow is expected to reach 20% -30% of the same period as Bitcoin spot ETF, which is conducive to boosting the price performance of Ethereum in the second half of the year.

The participation of traditional financial giants in publishing and the regulatory approval of the US SEC have once again brought solid and important credit endorsement to the cryptocurrency industry. The institutionalization of the cryptocurrency market is becoming more and more perfect. Institutions such as pension funds, hedge funds, and investment banks will continue to enter the market. We still have confidence in the long-term performance of cryptocurrency ETFs.

Introduction

In January of this year, the launch of Bitcoin spot ETF marked the end of a decade of waiting. With the help of ETF, a simple, compliant, and highly accepted traditional US stock investment product, US stock investors can invest more widely in the largest cryptocurrency assets. The 13-F document from a few months ago showed that Bitcoin spot ETF has been widely accepted by US state mutual funds, major banks, top hedge funds, well-known asset management companies, Investment Advice companies, and other commercial companies.

Subsequently, market attention turned to another top cryptocurrency asset: Ethereum. Ethereum's market value is now $420 billion, and it was clear months ago that its ETF approval was only a matter of time, not a "yes or no" question. On July 23rd, nine Ethereum spot ETFs were finally approved and officially began trading.

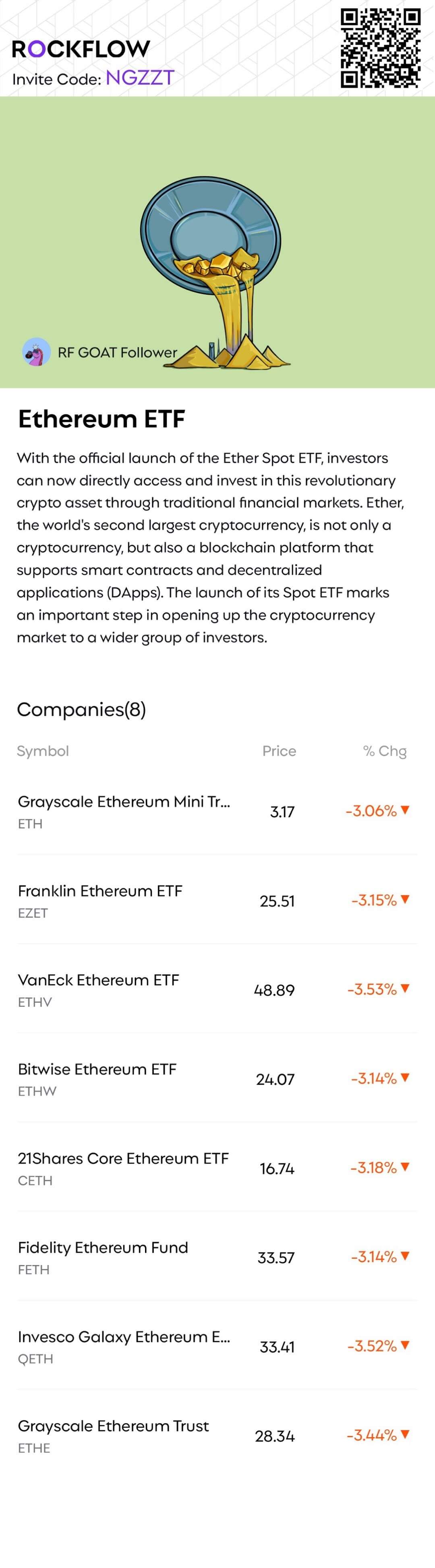

RockFlow integrates the Ethereum ETF collection list currently launched by different institutions. Welcome to scan the code to follow.

The RockFlow research team will delve into the publishing institutions, supply and demand dynamics, and future impact of Ethereum spot ETFs in this article, helping US stock investors interested in crypto investment better understand their investment value.

RockFlow will continue to track the progress of Bitcoin spot ETF, Ethereum spot ETF, and the latest trends in the cryptocurrency market. In addition, if you want to continue to learn about the listing details, post-listing development status, and potential impact of Bitcoin spot ETF, you can check out RockFlow's previous in-depth analysis articles:

- Will the spot ETF effect repeat itself in Ethereum after a nearly 70% surge in 2 months

- Bitcoin Spot ETF launched three months, a comprehensive analysis of its development status and future impact

- Bitcoin spot ETF is here, analyzing the strength and biggest beneficiaries of 11 publishing companies in one article

On the first day of listing, the results were brilliant

Nine Ethereum spot ETFs, which debuted on July 23rd, were published by traditional asset management giants such as BlackRock and Fidelity, as well as emerging crypto funds such as Grayscale and Bitwise. They will track the spot price of Ethereum. By being listed on exchanges such as the Chicago Board Options Exchange (CBOE), the New York Stock Exchange (NYSE), and NASDAQ, US stock investors can now hold this emerging top cryptocurrency asset through US stock brokers.

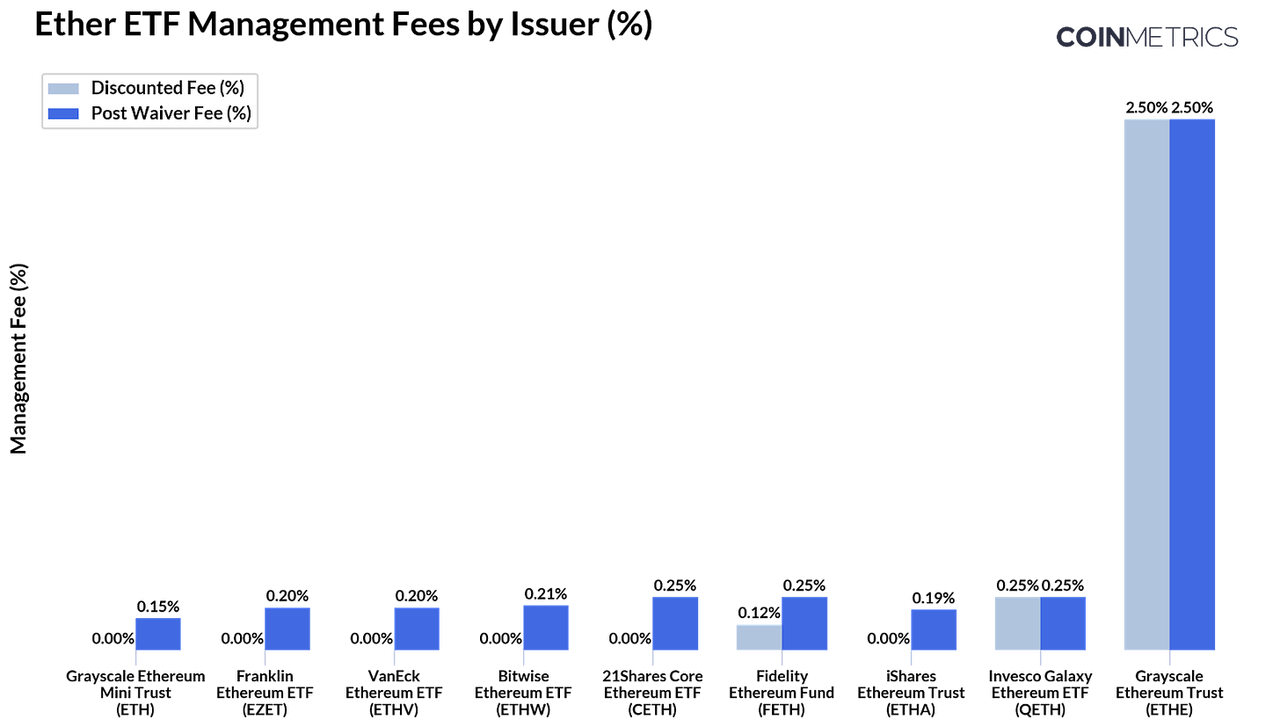

In order to compete for more market share, publishing institutions have chosen to compete for initial release, volume speed, and fee reduction (fee waiver). Currently, the management fees of various funds range from 0.15% for the newly launched Grayscale Ethereum Mini Trust (ETH) to 2.50% for Ethereum Trust (ETHE). Some institutions even choose to temporarily waive fees to attract higher AUM, just like when the Bitcoin spot ETF was first listed six months ago.

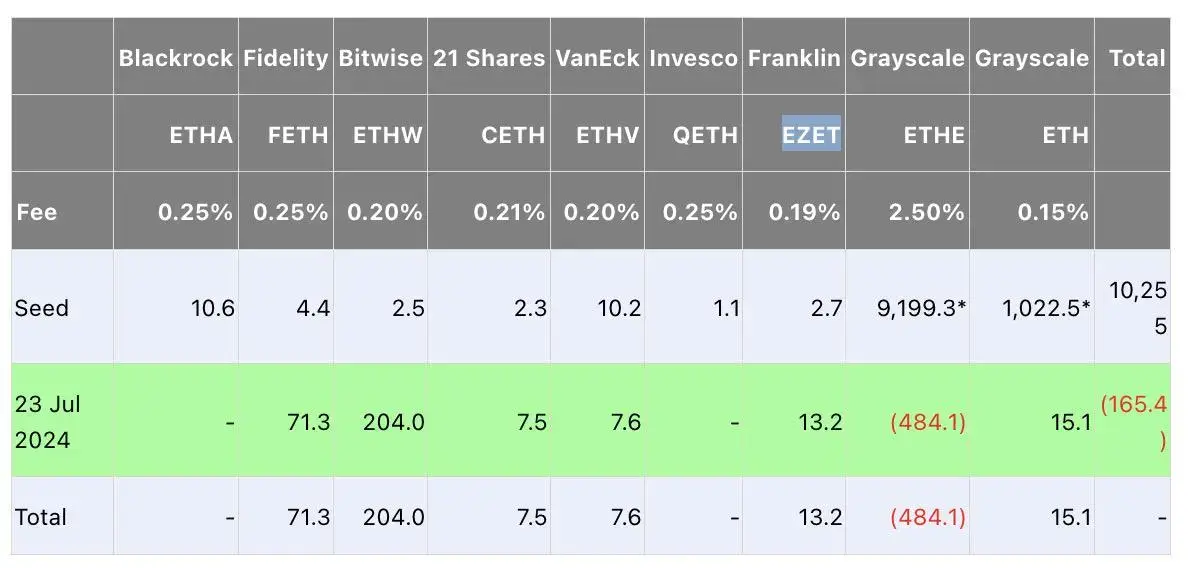

On the first day of listing, the cumulative trading volume of Ethereum spot ETF exceeded 1 billion USD, mainly from Canary Release ETHE, BlackRock ETHA, and Fidelity FETH. However, according to Farside Investors' data, the overall funds showed an outflow on the day of listing, mainly due to ETHE's net outflow of over 480 million USD.

Surprisingly, Bitwise's ETHW became the main force of "attracting money" with a net inflow of more than 200 million dollars, far exceeding the 71.30 million dollars of FETH and the 13.20 million dollars of Franklin EZET.

As a crypto-native asset management company without a strong traditional financial background, Bitwise stands out and chooses to focus on various aspects such as publishing time, transaction fees, and ecosystem support in order to quickly achieve greater scale.

As early as the launch of its Bitcoin spot ETF - BITB, Bitwise announced that it would donate 10% of BITB profits to three non-profit organizations that fund Bitcoin open source development. These organizations play a key role in improving Bitcoin's cyber security, scalability, and usability. Donations will be made at least once a year for the next 10 years to further support the health and development of the Bitcoin ecosystem. Similarly, this time it publishes ETHW, announcing that it will donate 10% of the fund profits to Ethereum open source developers for at least 10 years, every year. To ensure transparency, both BITB's Bitcoin address and ETHW's Ethereum address have been made public.

The donation behavior of being so close to the encryption community naturally aroused the favor of encryption enthusiasts, and encryption enthusiasts "returned the favor" and gave Bitwise a surprise on the first day of ETF trading.

Potential demand analysis of Ethereum Spot ETF

Based on the basic situation of Bitcoin and its development trend in the past six months, we can roughly conduct a forward-looking analysis of the potential demand for Ethereum spot ETF.

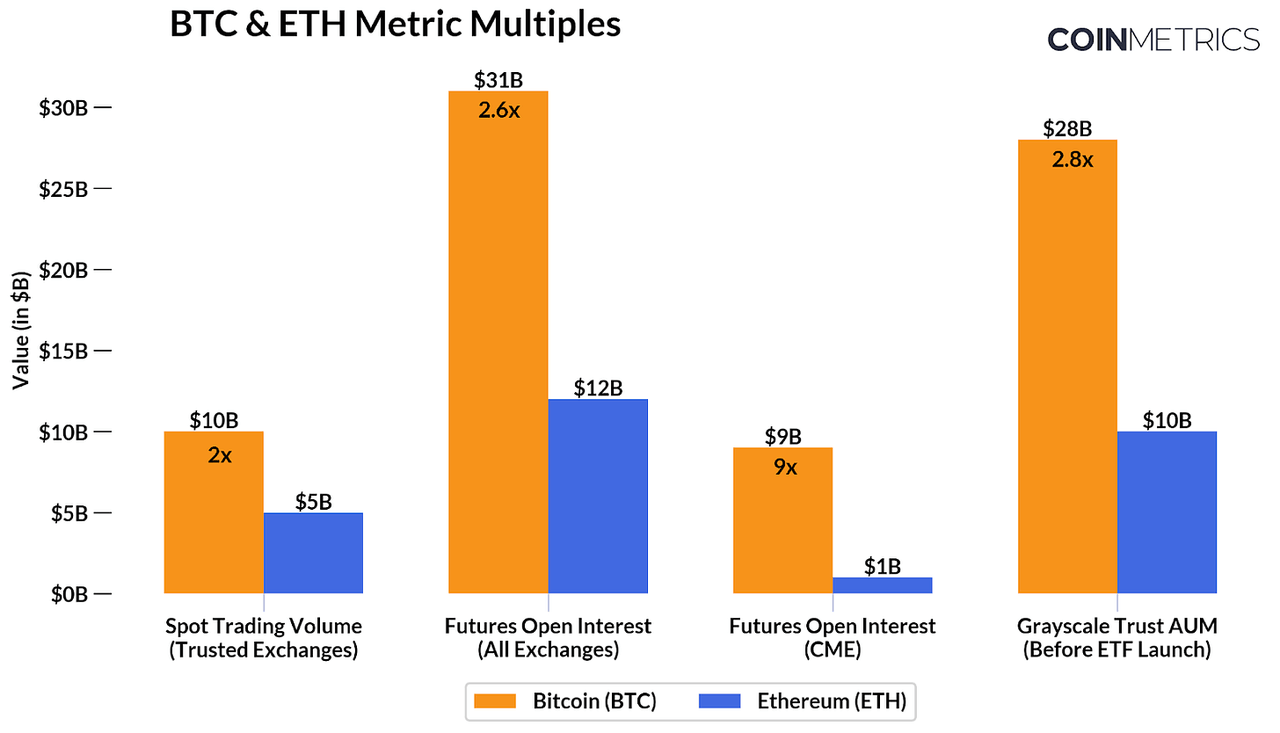

The market value of Ethereum is $420 billion, which is about one-third of Bitcoin's market value of $1.30 trillion. On average, the daily spot trading volume of Ethereum is half that of Bitcoin, and in the Future Market, Bitcoin's non-position squaring contracts are about 2.6 times higher than Ethereum on all exchanges and about 9 times higher on the Chicago Mercantile Exchange.

In addition, prior to the launch of the respective ETFs, the canary release fund Bitcoin Trust (GBTC) had about 2.8 times more Assets Under Management than its Ethereum Trust (ETHE).

Based on the above indicators, we can roughly assume that the potential capital inflow of Ethereum spot ETF is expected to reach 20% -30% of that of Bitcoin spot ETF during the same period.

Of course, given the current regulatory requirements for Ethereum spot ETFs that prevent them from including staking returns, this restriction may weaken investor demand in the short term.

In addition, an important factor that cannot be ignored when analyzing the inflow of funds into the Ethereum spot ETF is the significant impact brought by the Ethereum Trust (ETHE) under the Canary Release Fund.

The performance of the Bitcoin Trust (GBTC) of the Canary Release Fund in the past six months can be used as a reference. Before converting to a Bitcoin spot ETF, GBTC held about 620,000 bitcoins (about 3.1% of the Bitcoin supply), with a total asset management of about $30 billion. Later, converting to an ETF created opportunities for investors who previously purchased GBTC at a discount to exit or transfer to ETFs with lower management fees. Therefore, GBTC's Bitcoin holdings decreased by about 55% to 270,000 bitcoins, objectively putting downward pressure on the Bitcoin price.

The canary release fund's Ethereum Trust (ETHE) held about $10 billion in Asset Under Management before its launch, equivalent to about 3 million Ethereum (2.5% of the Ethereum supply). Although ETHE may experience similar outflows, there are two aspects to consider:

Firstly, with the approval of the ETF in May, the discount of ETHE's Net Asset Value quickly narrowed, giving investors enough time to exit at a price close to face value. Secondly, the Ethereum Mini Trust (ETH) charges a fee of only 0.15%, providing fee-sensitive investors with the option to transition to this low-cost product, and 10% of ETHE has been transferred as seed capital into the new mini-trust product.

Therefore, these factors are expected to greatly reduce the willingness of ETHE holders to sell, thereby reducing the possibility of ETF fund outflows.

How will the Ethereum Spot ETF affect the cryptocurrency market?

If in the next six months, the inflow of funds into the Ethereum spot ETF reaches 30% of that of the Bitcoin spot ETF during the same period, then at the current price, the inflow of 4 billion US dollars means that by the end of this year, 1% of the circulating ETH will be held by the Ethereum spot ETF. This is obviously beneficial to boost the price performance of Ethereum in the second half of the year.

Historical experience shows that the billions of dollars flowing into Bitcoin through ETFs have an important stimulating effect on the rise in Bitcoin prices in the first half of 2024. The market fluctuations during this period have allowed crypto ETF investors to respond calmly. Even during large price adjustments, funds did not panic, which is also a stable factor for new investors who are committed to long-term investment and plan to choose Ethereum spot ETFs.

Not to mention, the participation of traditional financial giant BlackRock in publishing and the regulatory approval of the US SEC have once again brought solid and important credit endorsements to the crypto industry.

Conclusion

RockFlow research team believes that while the market's initial focus may have been on the price performance of Ethereum spot ETFs, their true impact will gradually become apparent in the coming months. The mass listing of Ethereum spot ETFs marks a new key milestone in the expansion and maturity of the cryptocurrency asset market.

From Bitcoin spot ETF to Ethereum spot ETF, we can see that the institutionalization of the cryptocurrency market is becoming more perfect. By making cryptocurrency more suitable for institutional capital such as pension funds, hedge funds, and investment banks, the position of the cryptocurrency market in the financial mainstream is further established. And now may just be the beginning: some analysts say that the next step may be the listing of Solana ETF or funds representing multiple tokens.

About the Author

The RockFlow research team specializes in long-term analysis of high-quality companies in the US stock market, as well as emerging markets in Latin America and Southeast Asia, focusing on industries with high potential such as cryptocurrencies, biotechnology, and more. The core members of the team come from top technology companies and financial institutions including Facebook, Baidu, ByteDance, Huawei, Goldman Sachs, and CITIC Securities. Many of them have graduated from leading universities such as Massachusetts Institute of Technology (MIT), University of California, Berkeley, Nanyang Technological University, Tsinghua University, and Fudan University.

You can also find us on these platforms: